Receiving a letter or a phone call from a debt collector can be an incredibly stressful experience. It often leaves you feeling confused, overwhelmed, and unsure of your next steps. Before you panic, or even consider making a payment, it’s crucial to understand that you have specific rights designed to protect you in these situations.

One of the most powerful tools at your disposal is the right to validate the debt. This isn’t just about delaying a payment; it’s about ensuring that the debt is legitimate, accurate, and truly yours. Understanding this process and how to properly initiate it can be a game-changer, giving you control and clarity when dealing with collection agencies.

What Exactly Is Debt Validation And Why Does It Matter So Much?

Debt validation is your legal right to demand proof from a debt collector that the debt they claim you owe is legitimate. Think of it as asking for the collector’s homework – you’re essentially saying, “Prove that I owe this, prove it’s the correct amount, and prove you have the right to collect it.” This isn’t just a polite request; it’s a fundamental consumer protection enshrined in law.

The reason this matters so profoundly is multifaceted. Firstly, it protects you from potential errors. Debt collection accounts are often bought and sold multiple times, and with each transfer, there’s a risk of inaccurate information or even outright fraud. You might be asked to pay a debt you’ve already settled, a debt that isn’t yours, or an amount that’s incorrect due to fees or miscalculations. Validating the debt puts the onus on the collector to present clear, verifiable evidence.

Secondly, it’s a powerful defensive move against aggressive collection tactics. Under the Fair Debt Collection Practices Act (FDCPA), once you send a validation request, the collector must cease all collection activities, including phone calls and letters, until they provide the requested information. This gives you much-needed breathing room and prevents further harassment while you await proof.

Finally, it ensures that if you do end up paying, you’re paying the right entity the correct amount for a debt you genuinely owe. Without validation, you could unknowingly pay a scammer, an agency that doesn’t legally own the debt, or an amount that includes unlawful charges. This simple step serves as your personal audit of their claims.

Key Information You Should Request

- The original creditor’s name.

- The exact amount of the debt, including a detailed breakdown of the principal, interest, and any fees.

- The original account number.

- Proof that you are the person who owes the debt (e.g., a copy of the original agreement).

- Proof that the collector has the legal right to collect this debt from you.

- The age of the debt to determine if it’s past the statute of limitations in your state.

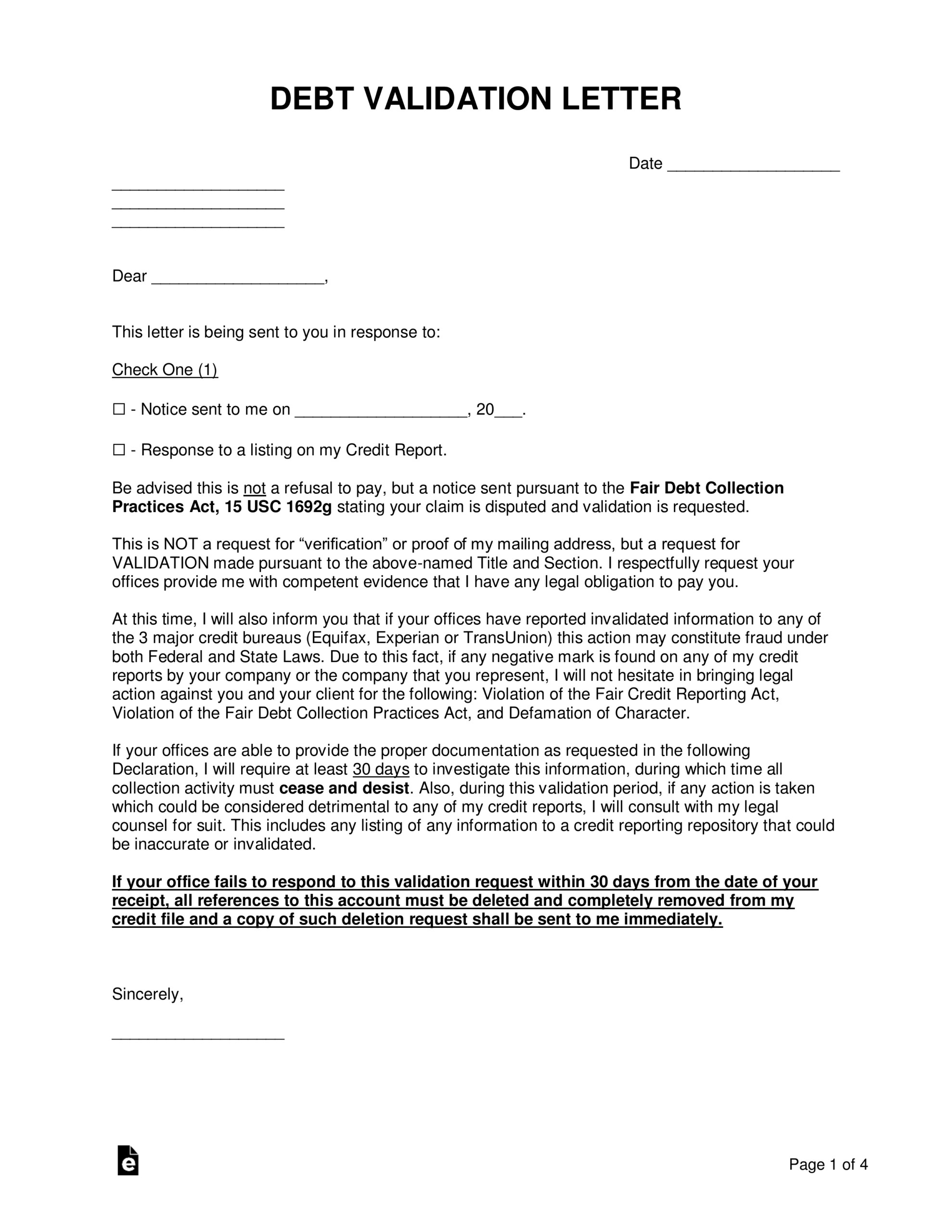

Crafting Your Own Validation Of Debt Letter Template

When you decide to send a debt validation letter, clarity and professionalism are key. You’re not accusing them of anything; you’re simply exercising your legal right to information. Your letter should be concise, polite but firm, and clearly state that you are disputing the debt and requesting validation. It’s important to avoid any language that could be interpreted as an admission that you owe the debt.

The letter should specifically request all the information listed above, leaving no room for ambiguity. Remember, the burden of proof is on the debt collector, not on you. You’re asking them to provide substantial evidence, not just a statement saying you owe money. A well-written letter can often make the difference between continued harassment and a resolution.

This is precisely where using a robust validation of debt letter template becomes incredibly beneficial. Instead of starting from scratch and potentially missing crucial legal language or specific requests, a template provides a proven structure. It ensures that all the necessary legal points are covered and that your request adheres to the FDCPA guidelines, making it harder for the debt collector to ignore or sidestep your demand. It saves you time, reduces stress, and increases the effectiveness of your communication.

Once your letter is prepared, the method of sending it is just as important as its content. Always send your validation letter via certified mail with a return receipt requested. This provides you with irrefutable proof that the letter was sent and received, and when. Keep a copy of everything: your sent letter, the certified mail receipt, and the return receipt. Documentation is your best friend in any debt dispute.

Protecting yourself from erroneous or fraudulent debt collection is not just a right, but a smart financial practice. By understanding the power of debt validation and knowing how to properly request it, you equip yourself with the tools to navigate these challenging situations with confidence and control.

Taking proactive steps to verify any debt collection claim is a crucial part of managing your financial well-being. It empowers you to stand firm, demand accountability, and ensure that any financial obligation you eventually address is legitimate and accurately presented.