Tax deductible receipt template, The Federal Trade Commission is proposing new guidelines for business chances sellers and in this new set of proposed rules among the new stipulations will be that company opportunities sellers must present their client or a receipt. What’s the Federal Trade Commission requiring this? There have been cases of fraud where the buyer never got receipt and so could not prove that obsolete been torn off. Meanwhile, there wasn’t any record of this trade in any way, no copy of these signed agreements in many cases and no way to get the buyer’s money back. Sounds pretty shady to be. And this is the reason or instead this is among the reasons why the FTC is also among many other new suggested changes requiring that business chances sellers provide receipts to their customers.

Though most receipts contain the identical information, it would be best to review a number of receipt sample resources prior to introducing your format of choice. It’s important that you look around. If you’re going to get a free template from the Internet, you have the ability to add your business name, logo and the reception number to every receipt generated electronically. Many customers choose to manage their payments, online. Your office staff therefore must keep up to date with all these transfers. Bank statements need to be checked each day and obligations made deducted from the clients’ accounts.

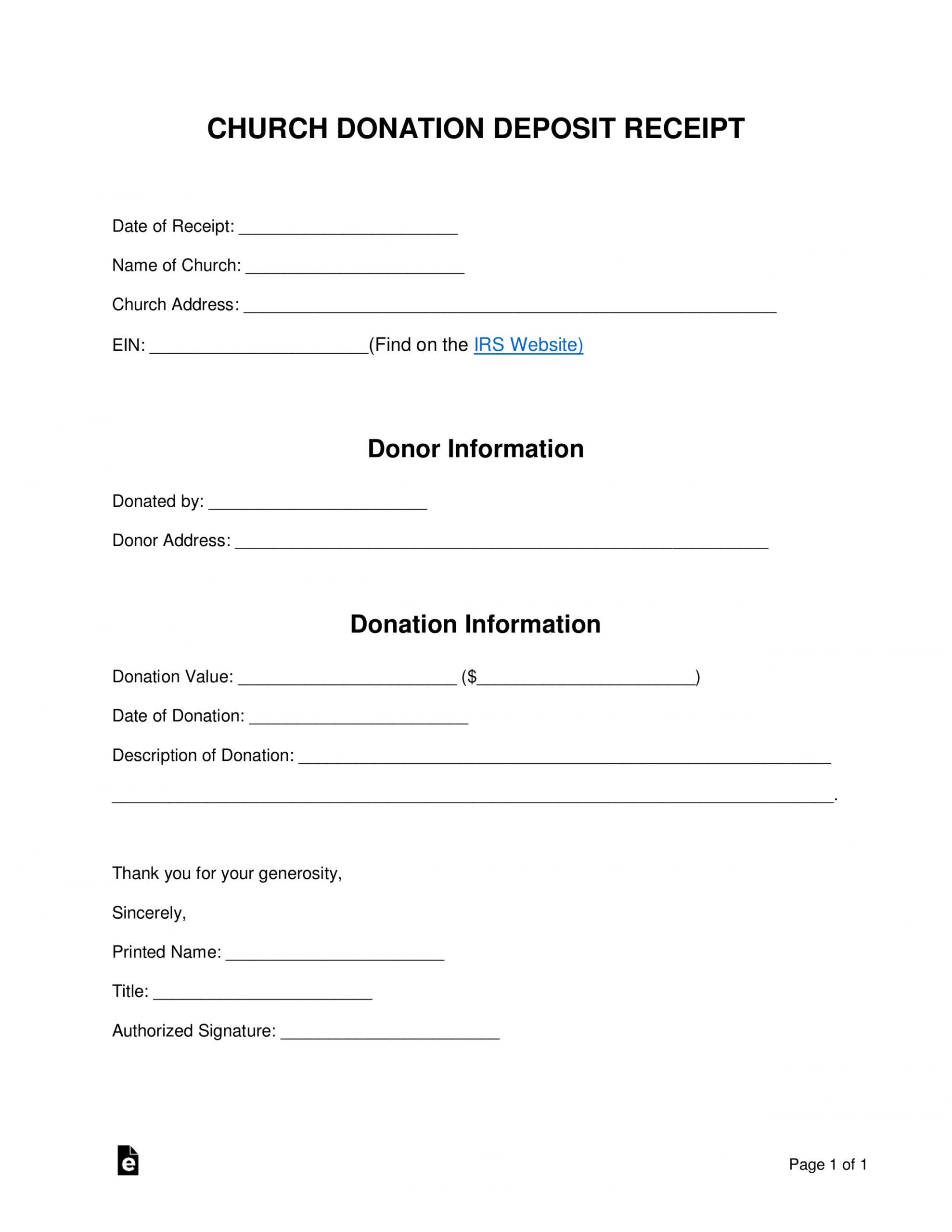

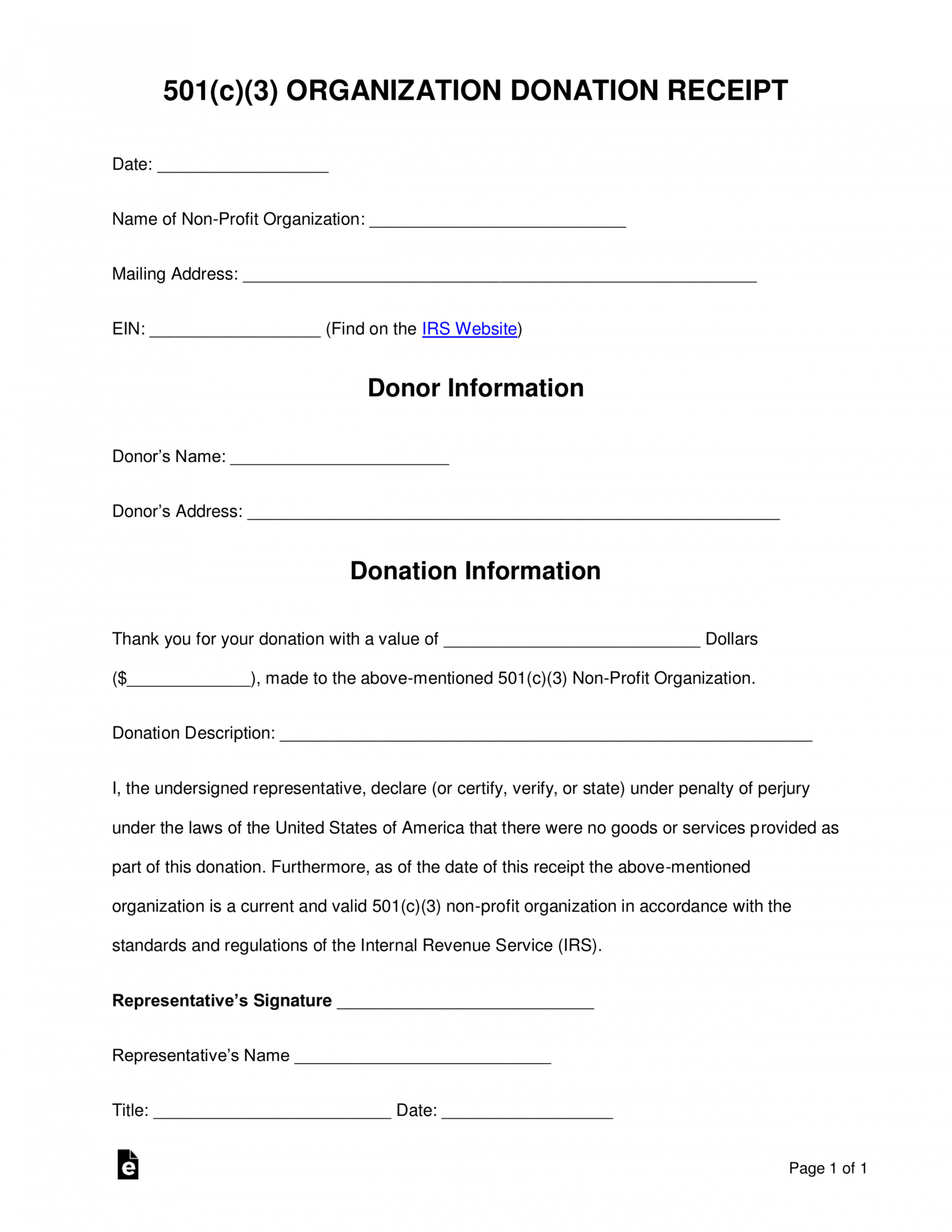

An acknowledgment of payment receipt is a written admiration the cash, property or anything of value has been obtained in addition to this receipt also creates a record and evidence of this transaction. These documents also play an important part to avoid any disputes or misunderstanding concerning the detail of this transaction. Generally this record may be used for any type of payment that is obtained from the customers, suppliers, clients and business partners. These receipts are also very crucial when the market analysts prepare a business program that intends to enhance the sales as well as profit.

Fundamentally these receipts assist the company owner to keep tabs on their business transactions together with customers or clients details. Thus it is a simpler way for any company account to conduct their audit of the business profits, losses and other essential info. Here are some essential actions that will lead you how to write an acknowledgement reception effectively in addition to professionally such as first use your business letterhead to communicate an expert, identify the basic objective of this document, address the document to the proper person or business, be sincere, timely acknowledgement, be polite, proofreading, be concise and choose an official final for your document.

Generally this reception not only enable the company owner on flip side it also aids the customers and acts as a legal document to encourage tax claims and firm evidence of payment. The acknowledgement reception considered one of the most crucial documents since they’re serves as an evidence you’ve done some business trade with other celebration at a particular time and date. You might even state here additional info that relates to the transaction that resulted in such a payment. This receipt say how much is the total quantity of payment you have received.