Navigating the world of financial applications when you’re self-employed can sometimes feel like a puzzle with missing pieces. Unlike traditional employees who receive regular pay stubs and W-2 forms, independent contractors, freelancers, and small business owners often lack these standard documents to verify their earnings. This can pose a significant challenge when applying for a mortgage, renting an apartment, securing a loan, or even simply registering for certain services that require proof of a stable income.

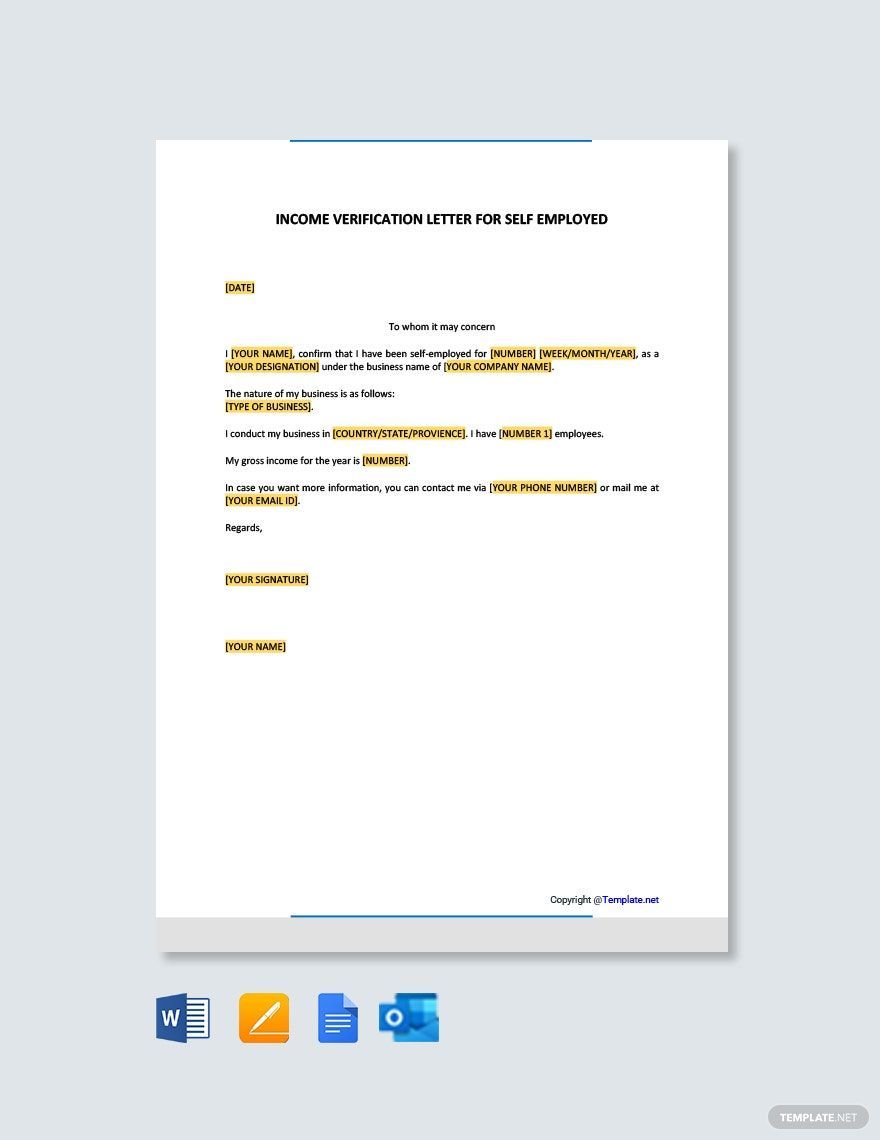

Fortunately, there’s an effective way to bridge this gap: a well-crafted proof of income letter. This document serves as a formal declaration of your earnings, providing a clear and concise summary of your financial situation. While it’s a self-attested document, its credibility can be significantly enhanced when it follows a professional format and is backed by supporting documentation. Understanding how to create such a letter, and perhaps even utilizing a robust self employed proof of income letter template, is an invaluable skill for any independent professional.

Why You Need This Letter and What to Include

For the self-employed, a proof of income letter isn’t just a formality; it’s often a necessity for accessing critical services and opportunities. Imagine trying to rent a new apartment. A landlord needs assurance you can consistently pay the rent. Or perhaps you’re applying for a car loan; lenders want to see a reliable income stream. Even for things like applying for government benefits, child care assistance, or certain immigration processes, demonstrating your financial capacity is paramount. Since you don’t have an employer to vouch for you, this letter steps in to fill that vital role.

The core function of this letter is to provide a formal, written statement of your income, typically over a specified period. It should be clear, factual, and professional. While it originates from you, the self-employed individual, its purpose is to be presented to a third party. Therefore, it needs to be easily understandable and presentable. Think of it as your personal financial statement, condensed into a formal letter format, ready to be reviewed by the recipient.

Key Elements of an Effective Letter

To ensure your proof of income letter is taken seriously and serves its purpose effectively, it must include several key pieces of information. Omitting any of these could lead to delays or questions, undermining the letter’s credibility. It’s about being comprehensive without being overly verbose.

Here’s a breakdown of what you should definitely include:

- Your full legal name and current contact information (address, phone number, email).

- The date the letter is written.

- The recipient’s name and contact information (if you know it, otherwise a general salutation like “To Whom It May Concern”).

- A clear and concise subject line, such as “Proof of Income for [Your Name]”.

- A statement of your business details, including your business name (if applicable), type of business, and your Social Security Number (SSN) or Employer Identification Number (EIN).

- A clear declaration of your income, specifying the total amount earned over a particular period (e.g., “I earned $X from [Start Date] to [End Date]”).

- A list of the supporting documents you are including with the letter (e.g., tax returns, bank statements, invoices).

- Your professional closing, followed by your physical signature and your typed name.

- Consider including a statement that you attest to the accuracy of the information provided under penalty of perjury, which adds a layer of legal seriousness.

Beyond these core elements, the tone should be confident and professional. Remember, this letter is a reflection of your business acumen and financial responsibility. Accuracy is non-negotiable; always double-check all figures and dates.

Crafting Your Letter: Tips for Credibility and Professionalism

When you’re creating a proof of income letter, whether from scratch or using a self employed proof of income letter template, presentation and substance go hand-in-hand. A professionally formatted letter on clean paper, perhaps even using a business letterhead, immediately conveys a sense of seriousness and reliability. Even if your business is just you working from home, presenting a polished document shows you take your financial obligations and representations seriously. Avoid casual language or any expressions that might diminish the formal nature of the communication.

Crucially, a proof of income letter rarely stands alone. Its power is significantly amplified when it’s backed by concrete, verifiable documentation. Think of the letter as an executive summary, and the supporting documents as the detailed report. These could include copies of your most recent federal tax returns (specifically Schedule C for sole proprietors), bank statements showing consistent deposits from clients, copies of signed client contracts, a selection of paid invoices, or even profit and loss statements generated by accounting software. The more transparent and verifiable your claims are, the stronger your proof becomes.

The writing style should be direct and unambiguous. Get straight to the point, state the facts clearly, and avoid any unnecessary fluff. The reader, whether a loan officer or a landlord, is looking for specific information, not a narrative. Use simple, clear language and professional terminology where appropriate. If you’ve been in business for a while, mentioning your years of experience can subtly bolster confidence in your stability, but always keep it brief and relevant.

For situations requiring a higher level of scrutiny, such as significant loans or complex legal matters, consider having your letter notarized. A notary public verifies your identity and witnesses your signature, adding an extra layer of official confirmation to your document. While not always necessary, notarization can significantly enhance the credibility of your self employed proof of income letter template, especially when dealing with institutions that demand stringent verification. Taking these extra steps demonstrates your commitment to providing accurate and reliable financial information.

Ultimately, mastering the creation of a strong proof of income letter empowers you as a self-employed individual. It transforms a potential hurdle into a clear path forward, enabling you to confidently pursue financial goals and opportunities without the traditional employer-provided paperwork. By presenting a clear, well-supported document, you effectively communicate your financial stability and professionalism to any institution or individual requiring such assurances.