Finding an error on your credit report can feel like a punch to the gut. It’s frustrating to see inaccurate information affecting your financial standing, potentially blocking you from loans, credit cards, or even housing opportunities. You might feel overwhelmed, wondering where to even begin to fix such a problem. But take a deep breath; you’re not powerless in this situation.

Thankfully, there’s a clear path to addressing these inaccuracies. Learning how to properly dispute these items with credit bureaus is a crucial step towards maintaining a healthy credit profile. A well-crafted removal credit dispute letter template is an indispensable tool in your arsenal, providing a structured and professional way to communicate your concerns and demand correction.

Understanding Your Rights and the Dispute Process

When you spot an error on your credit report, it’s natural to feel a mix of frustration and urgency. These inaccuracies, whether they are incorrect balances, accounts that aren’t yours, or items that should have been removed years ago, can significantly drag down your credit score. A lower score can translate into higher interest rates, or even outright denial for essential financial products. That’s why understanding your rights and the correct dispute process is so incredibly important for your financial well-being.

The good news is that federal law is on your side. The Fair Credit Reporting Act FCRA grants you specific rights regarding the accuracy and privacy of the information in your credit report. This act mandates that credit bureaus and information providers must correct or delete inaccurate, incomplete, or unverifiable information. Knowing this empowers you to take action, and a dispute letter is your formal way of triggering this legal obligation.

Before you even put pen to paper, it is wise to gather all your supporting evidence. This might include bank statements, canceled checks, court documents, police reports for identity theft, or any communication you’ve had with creditors. The more evidence you can provide to back up your claim, the stronger your dispute will be. This preparation stage is vital for a successful outcome and will give your dispute letter the weight it needs.

Ultimately, the goal is clear communication. You want to present your case concisely and persuasively to the credit bureaus. They receive thousands of disputes, so making yours easy to understand and supported by facts will significantly increase its chances of a swift and favorable resolution. Remember, you are advocating for yourself and your financial future.

Key Elements of an Effective Dispute Letter

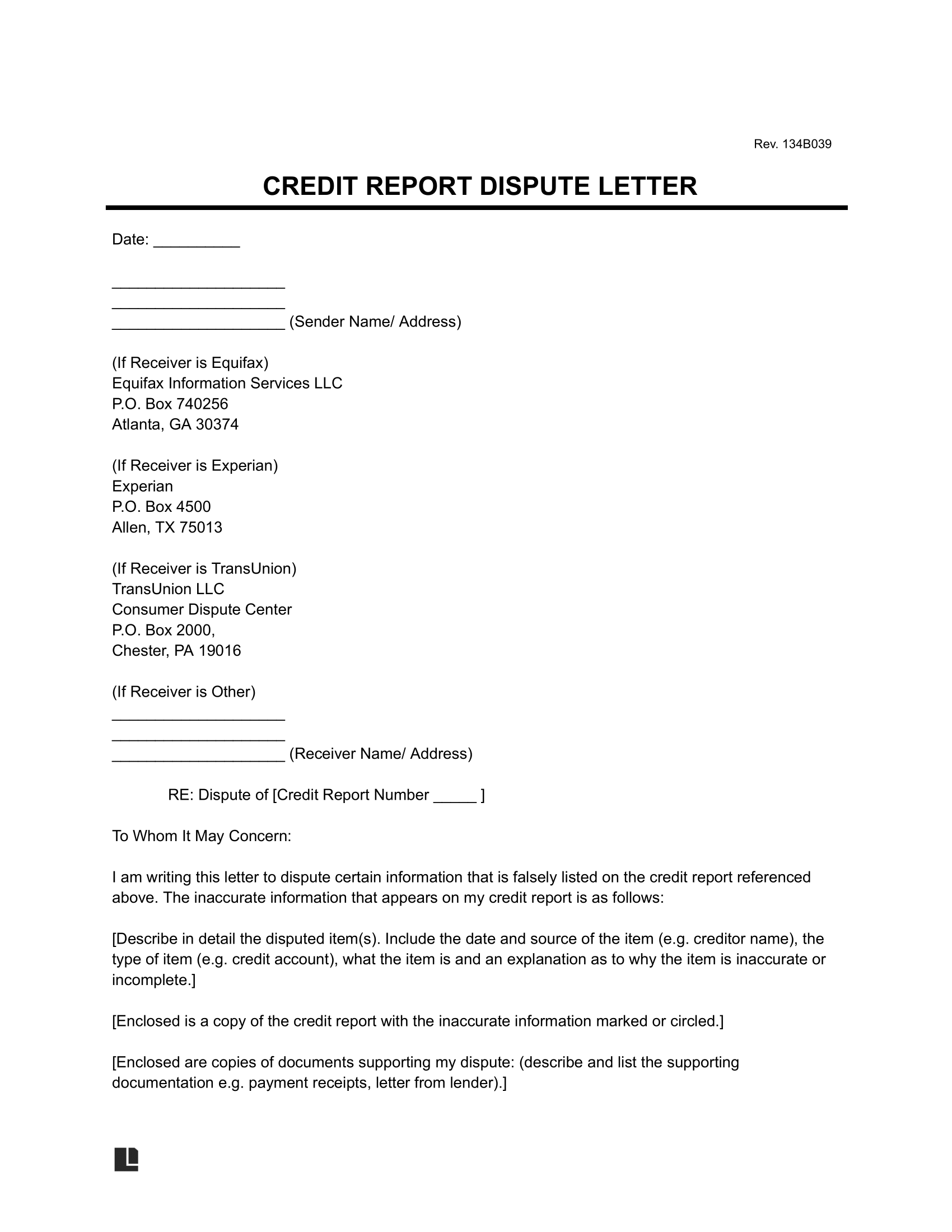

- Your complete personal information including your full name current address and date of birth

- The specific account number and creditor name associated with the inaccurate item

- A clear and concise statement explaining why you are disputing the item

- The specific reason for the dispute such as “not my account” “paid in full” or “incorrect balance”

- The action you are requesting from the credit bureau for example “remove this account” or “correct the balance”

- Copies of all supporting documents that validate your claim do not send originals

- Your signature and the date

Crafting Your Powerful Dispute Letter

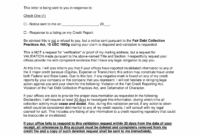

When it comes to putting your concerns into writing, a well-structured removal credit dispute letter template is your best friend. This isn’t just a casual note; it’s a formal legal document that initiates a process with significant implications for your financial health. The tone should be firm and factual, devoid of emotional language, focusing solely on the discrepancies and the desired outcome. Remember, clarity and professionalism are key to ensuring your dispute is taken seriously and processed efficiently by the credit bureaus.

Your letter should always start with your own contact information, followed by the date, and then the contact information for the credit bureau you are sending it to. This sets the formal tone immediately. Within the body of the letter, you’ll clearly identify the specific account in question, using the account number and the creditor’s name exactly as it appears on your credit report. This precision prevents any confusion about which item you are disputing.

Next, articulate precisely why you are disputing the entry. Are you claiming identity theft? Is the balance incorrect? Was the account paid off but still showing an outstanding balance? Be specific and refer to the supporting documents you are enclosing. For instance, if you paid an old debt, you’d mention enclosing a copy of the cancelled check or payment receipt. The more detail you provide, backed by evidence, the stronger your argument becomes.

Always include a clear request for action. State that you demand the inaccurate information be removed or corrected. Finally, sign the letter and keep a copy for your records, along with copies of all enclosed documents. Sending your letter via certified mail with a return receipt requested is highly recommended. This provides you with proof that the letter was sent and received, which is crucial for tracking your dispute and ensuring the credit bureau adheres to their legal obligations.

- Your full legal name and current address

- The full name and address of the credit bureau you are contacting

- The date the letter is being written

- A clear statement indicating this is a dispute letter

- The specific account name and number you are disputing

- A detailed explanation of why you believe the information is inaccurate

- A request for the inaccurate information to be investigated and removed or corrected

- A list of all enclosed supporting documents

- Your signature

Taking control of your credit report by addressing inaccuracies is one of the most proactive steps you can take for your financial future. It might seem like a daunting task at first, but with the right approach and a clear understanding of the process, you can effectively challenge incorrect entries and clear your credit profile. This dedication to accuracy will serve you well, opening doors to better financial opportunities down the road.

Remember, persistence often pays off. Even if your initial dispute is denied, you have the right to re-dispute or escalate the issue. Maintaining diligent records, following up regularly, and understanding your rights under the FCRA will empower you to navigate this process successfully, ultimately leading to a healthier, more accurate credit report that truly reflects your financial responsibility.