Navigating the complexities of property ownership and financial obligations can sometimes feel like a maze, especially when a lien enters the picture. A lien is essentially a legal claim or a right against assets, typically used as collateral to satisfy a debt. It provides a creditor with an interest in your property until the debt is paid. While liens serve an important purpose in securing financial transactions, their removal is just as crucial, allowing property to be bought, sold, or refinanced without encumbrance.

This is where understanding the power of a document like a release of lien letter becomes incredibly important. Whether you’re a contractor who has just received final payment, a homeowner who has settled an outstanding debt, or a lender clearing a title, knowing how to properly execute this document can save you significant time and potential legal headaches. Having a reliable release of lien letter template at your fingertips can make this process straightforward and efficient, ensuring all necessary details are covered.

Understanding the Lien Release Process and Its Importance

A lien release is the formal document that acknowledges a specific debt has been satisfied and, consequently, the legal claim on a property is removed. It acts as official proof that the lienholder no longer has any financial interest in the property related to that particular debt. This step is absolutely critical because until a lien is formally released, it remains a cloud on the property’s title, potentially preventing its sale or transfer of ownership. For both parties involved, getting a lien released promptly is a sign of a completed transaction and clear financial standing.

For the party who initially placed the lien, usually the lienholder, issuing a release confirms they have received their due payment and are fulfilling their legal obligation to remove the claim. For the property owner, it provides peace of mind and full, unencumbered ownership. Imagine trying to sell your house only to find an old, forgotten lien still attached to the title. Without a proper release, that sale could be significantly delayed or even fall through entirely.

Key Elements of an Effective Lien Release Letter

Creating a comprehensive and legally sound release of lien letter is paramount. While the exact requirements can vary by jurisdiction and the type of lien, certain fundamental pieces of information are universally important. A well-structured release of lien letter template will guide you to include all these necessary components, minimizing the risk of errors or omissions.

Here are some critical details that should always be present:

- Full legal names and addresses of both the lien claimant (the party releasing the lien) and the property owner.

- A clear and accurate legal description of the property subject to the lien, often including its address and parcel number.

- Specific identification of the original lien, including its filing date, document number, and the office where it was recorded (e.g., county recorder’s office).

- A precise statement indicating that the debt has been fully or partially satisfied and that the lien is thereby released.

- The effective date of the release, which is when the release becomes legally binding.

- The signature of the lien claimant, often requiring notarization to attest to its authenticity.

Ensuring every detail is accurate and complete is not just good practice; it’s often a legal requirement. Mistakes can lead to delays or even the invalidation of the release, forcing you to go through the process all over again.

Navigating Different Types of Lien Releases

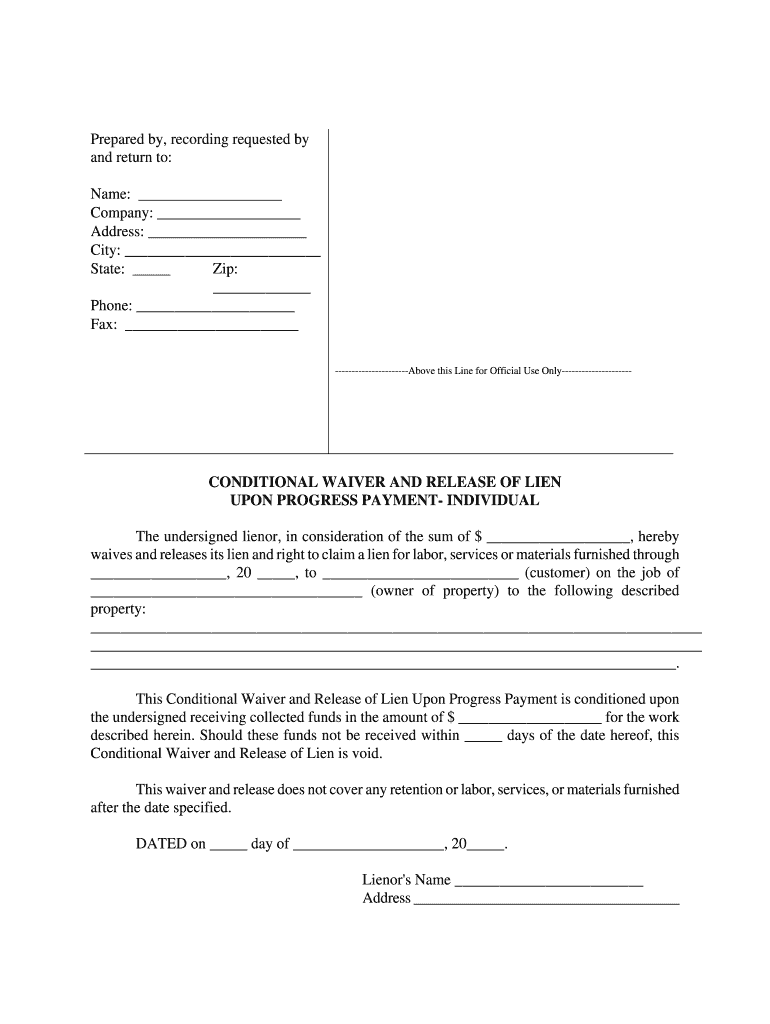

It’s important to recognize that not all lien releases are identical. The type of release you need will depend on the nature of the original lien and the specifics of your payment arrangement. Understanding these distinctions is crucial to ensure you’re using the correct document and avoiding future complications. For instance, in the construction industry, lien waivers are particularly common and come in various forms, each serving a distinct purpose in the payment process.

One key distinction is between a “full” and a “partial” release. A full release of lien indicates that the entire debt has been paid and the lien is completely removed from the property. This is what most people typically think of when they talk about a lien release. A partial release, on the other hand, means only a portion of the debt has been satisfied, or that the lien is being released from a specific part of a larger project or property, but the underlying debt or claim might still exist for other parts.

Further complicating matters are “conditional” and “unconditional” releases. A conditional release becomes effective only upon the occurrence of a certain event, most commonly the actual receipt of payment. For example, a “conditional lien release upon progress payment” means the lien is released only if and when the specified payment clears. An unconditional release, however, is effective immediately upon signing, regardless of whether payment has actually been received. This type of release carries more risk for the lien claimant, as they are giving up their lien rights upfront.

Choosing the appropriate type of release is paramount. Using an unconditional release when payment hasn’t cleared, for example, could leave a contractor without recourse if a check bounces. Conversely, as a property owner, you want to ensure the release you receive fully protects your interests and clears your title as intended. Always review the language carefully and understand what rights are being waived. When in doubt, consulting with a legal professional can provide invaluable guidance to navigate these nuances effectively.

The importance of a properly executed lien release cannot be overstated. It is the final step in clearing a financial obligation and ensuring a clean slate for property ownership. Diligence in obtaining and filing this document correctly safeguards your interests and avoids potential legal tangles down the road. Remember, clarity and accuracy in these matters are your best allies.