Receipt for cash payment template, The Federal Trade Commission is proposing new rules for business opportunities sellers and inside this fresh set of rules that are proposed among the newest stipulations will be that company chances sellers must give their customer or a reception. Why is the Federal Trade Commission requiring this? There have been cases of fraud in which the buyer never got receipt and so could not prove that dated been ripped off. Meanwhile, there was no record of this transaction at all, no copy of the signed agreements in many cases and no way to have the purchaser’s money back. Sounds pretty sketchy to be. And that’s the reason or instead this is one of the reasons why the FTC is also among many other new proposed changes requiring that company chances sellers give receipts to their customers.

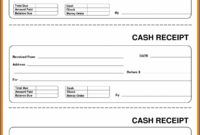

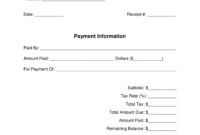

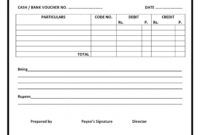

Though most receipts contain the identical info, it would be best to review a number of receipt sample sources before introducing your format of choice. It is important that you look around. If you’re going to download a free template from the Internet, you have the ability to add your business name, logo and the receipt number to each reception created electronically. Many clients choose to control their obligations, online. Your office staff therefore needs to keep up to date with all these transfers. Bank statements need to be checked each day and payments made deducted from the customers’ accounts.

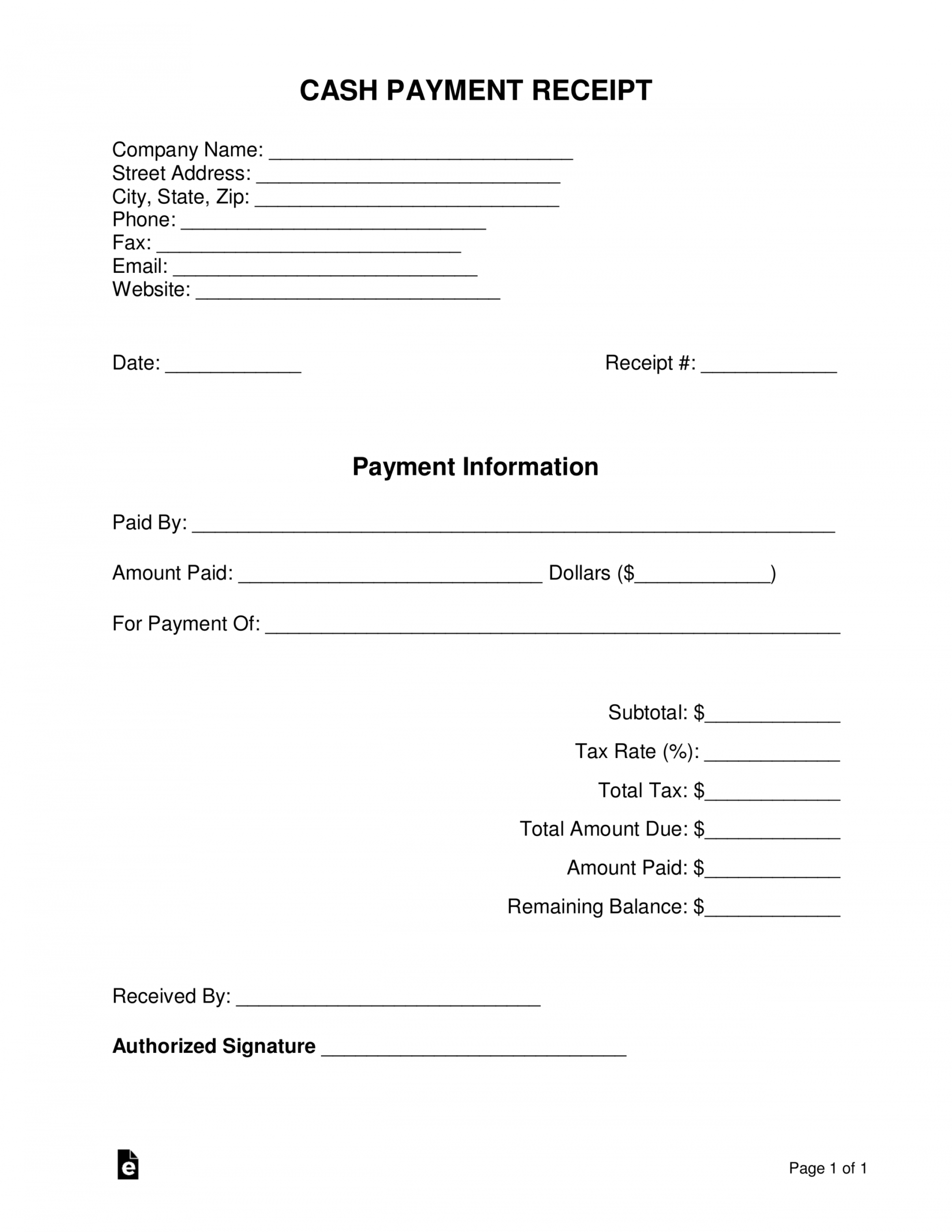

An acknowledgment of payment receipt is a written appreciation the cash, property or anything of worth has been obtained in addition to this receipt also creates a record and proof of the trade. These documents also play an essential role to avoid any disputes or misunderstanding concerning the detail of this transaction. Generally this record can be used for any type of payment that’s received from the clients, suppliers, customers and business partners. These receipts are also very crucial once the market analysts prepare a company program that intends to boost the earnings as well as profit.

Basically these receipts help the company owner to keep tabs on the business transactions along customers or clients details. Therefore it is an easier way for any business account to run their audit of their company profits, losses and other essential information. Below are some basic steps that will lead you how to compose an acknowledgement reception effectively in addition to professionally such as use your business letterhead to communicate a professional, identify the fundamental objective of this document, address the file to the proper person or organization, be truthful, timely acknowledgement, be considerate, proofreading, be succinct and select a formal closing for your document.

If you handle a rather few of receipts, storing them in paper form by month could be sufficient. You can store them along with your hanging reference documents, or perhaps a larger accordion file that’s split by month. Information from a smaller number of receipts may rather easily be input into your financial management program, and finding a receipt should be fast if it is filed appropriately. If you manage a relatively large number of receipts, you can reduce time and energy by automating your storage, retrieval and input of receipt information.