Understanding the importance of financial documentation can save you a lot of future headaches. When you finally pay off a debt, especially one that has been challenging, it brings an immense sense of relief. However, that feeling of accomplishment should also be accompanied by a proactive step: ensuring you have official confirmation that the debt is indeed settled and closed. This is where a formal letter, often called a paid in full letter, becomes an indispensable tool in your financial toolkit.

Having this official documentation serves as proof of your payment and can prevent discrepancies from appearing on your credit report or issues with collection agencies down the line. It offers peace of mind and solidifies your financial standing. While writing such a letter might seem daunting, it doesn’t have to be. With the right guidance and a well-structured paid in full letter template, you can easily create a professional and effective document to protect your interests.

Why You Need This Essential Documentation

Imagine you’ve diligently paid off a loan or cleared an old debt, only to find it still lingering on your credit report months later, or worse, receive a collection notice for the same amount. Unfortunately, administrative errors happen, and sometimes, old debts are even sold to new collection agencies without proper updates. A paid in full letter acts as your primary line of defense against such frustrating and potentially damaging scenarios. It provides irrefutable evidence that your financial obligation has been completely satisfied.

This official correspondence isn’t just about preventing errors; it’s about safeguarding your credit score and financial reputation. An inaccurate outstanding debt can severely impact your ability to secure new loans, rent an apartment, or even get certain jobs. By having a clear, concise letter confirming your payment, you empower yourself with the documentation needed to dispute any false claims swiftly and effectively, ensuring your credit report accurately reflects your financial responsibility.

Furthermore, a well-drafted letter requesting confirmation can solidify the terms of a settlement, particularly if you’ve paid a reduced amount to satisfy a larger debt. It ensures both parties are on the same page regarding the finality of the payment. This foresight protects you from any misunderstandings or further collection attempts that might arise from an incomplete or unacknowledged agreement. It’s an investment in your future financial stability.

By taking the initiative to send a paid in full letter, you demonstrate diligence and a proactive approach to managing your finances. This simple yet powerful step can save you countless hours of stress and effort later on, allowing you to focus on your financial goals with confidence, knowing your past debts are properly resolved and documented.

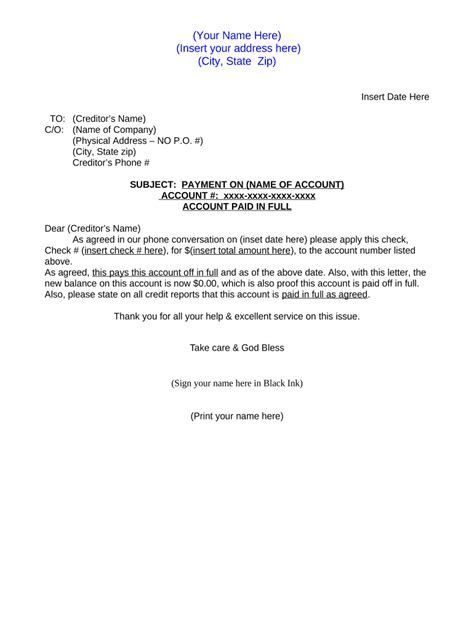

Key Elements to Include

- Your full name and current address

- The creditor or collection agency’s name and address

- Your account number related to the debt

- The original amount of the debt, if applicable

- The amount you paid and the date of payment

- A clear statement that the debt is paid in full and you request confirmation

- A request for the account to be reported as “paid in full” to all credit bureaus

- Your signature and the date the letter is sent

Crafting Your Effective Paid In Full Letter Template

The idea of drafting a formal letter to a financial institution or collection agency might seem intimidating, but a well-designed template simplifies the process immensely. Using a paid in full letter template ensures that all crucial information is included, that the language is professional and legally sound, and that you don’t overlook any vital details that could undermine the letter’s effectiveness. It’s about saving time and stress while still producing a document that stands up to scrutiny.

When you start with a template, your main task becomes filling in the blanks with your specific information. This includes your personal details, the exact account number, the date and amount of your payment, and the name and address of the entity you’re sending it to. Remember to be precise with these details; any inaccuracies could delay the process or lead to confusion. A good template acts as a checklist, guiding you through each necessary piece of information effortlessly.

Beyond just filling in the blanks, it’s also important to understand the tone and purpose of the letter. It should be polite but firm, clearly stating your request for confirmation that the debt is fully satisfied and that your credit report will be updated accordingly. The goal is to obtain official documentation from the creditor or collection agency acknowledging the full payment and confirming that no further amounts are owed. This mutual understanding is crucial for your financial peace of mind.

Once you’ve customized your paid in full letter template, remember to print a copy for your records and send the original via certified mail with a return receipt requested. This provides you with proof that the letter was sent and received, along with the date of delivery. This extra step is vital in case of any future disputes, offering you documented evidence of your proactive communication.

- Fill in all specific account details accurately.

- Ensure the payment amount and date are correct.

- Request an official confirmation letter from the creditor.

- Ask for credit bureaus to be updated with “paid in full” status.

- Keep a copy of the signed letter for your records.

- Send the letter via certified mail with a return receipt.

Taking control of your financial documentation is a powerful way to protect yourself and ensure your efforts to manage debt are properly recorded. This proactive approach not only provides immediate confirmation but also establishes a clear record for any future reference or dispute resolution.

By carefully preparing and sending this critical piece of correspondence, you empower yourself with an official safeguard against potential errors or misunderstandings. It’s a simple yet highly effective strategy to secure your financial future and enjoy the true freedom that comes with a debt settled and properly acknowledged.