Ever been in a situation where a payment you expected didn’t go through, or perhaps a check you wrote bounced? It can be an incredibly frustrating and often embarrassing experience for everyone involved. When a check or an electronic payment fails due to non sufficient funds (NSF), it means there wasn’t enough money in the account to cover the transaction. This isn’t just a minor inconvenience; it can lead to fees, strained relationships, and even legal complications if not handled properly.

In such scenarios, clear and formal communication becomes absolutely essential. Whether you’re a business trying to collect a payment, an individual informing someone their payment was returned, or even a bank notifying a customer, a well-drafted letter is the professional way to proceed. This is where having a reliable non sufficient funds letter template can be a real lifesaver, simplifying a potentially awkward and complex situation into a manageable task.

Why Sending an NSF Letter is Crucial

Sending an NSF letter isn’t just a formality; it’s a critical step in managing bounced payments effectively. For businesses, it serves as a formal demand for payment, establishing a clear record of the attempted transaction and the deficiency. This documentation can be invaluable for accounting purposes, for follow-up actions, and even for legal proceedings if the matter escalates. It shows diligence on your part in attempting to resolve the issue amicably before resorting to more drastic measures. For individuals, it provides a polite yet firm way to inform someone about their returned payment, minimizing misunderstandings while still setting clear expectations for resolution.

Moreover, these letters often serve as a notification of additional fees incurred due to the NSF event. Banks typically charge fees for bounced checks, and businesses are often permitted to pass on these charges to the payer. An NSF letter explicitly states these charges, ensuring the payer is fully aware of their total obligation. It’s also an opportunity to provide instructions on how to rectify the situation, offering various payment methods and setting a clear deadline for the funds to be received. Without such a letter, there’s a higher chance of confusion, delayed payment, or even a complete lack of response, leaving you in limbo.

The act of sending a formal letter also underscores the seriousness of the situation without being overly aggressive. It’s a professional courtesy that provides the recipient with official notice, allowing them to take appropriate action. This approach can help preserve business relationships by demonstrating your commitment to fair practice, even in challenging financial situations. It’s about being firm but also providing a clear path forward.

Ultimately, a detailed NSF letter contributes to maintaining transparent financial records for all parties involved. It’s a timestamped account of the event and the communication surrounding it. This transparency is key for compliance, audit trails, and avoiding future disputes. It helps ensure that everyone is on the same page regarding the financial discrepancy and the steps required to resolve it.

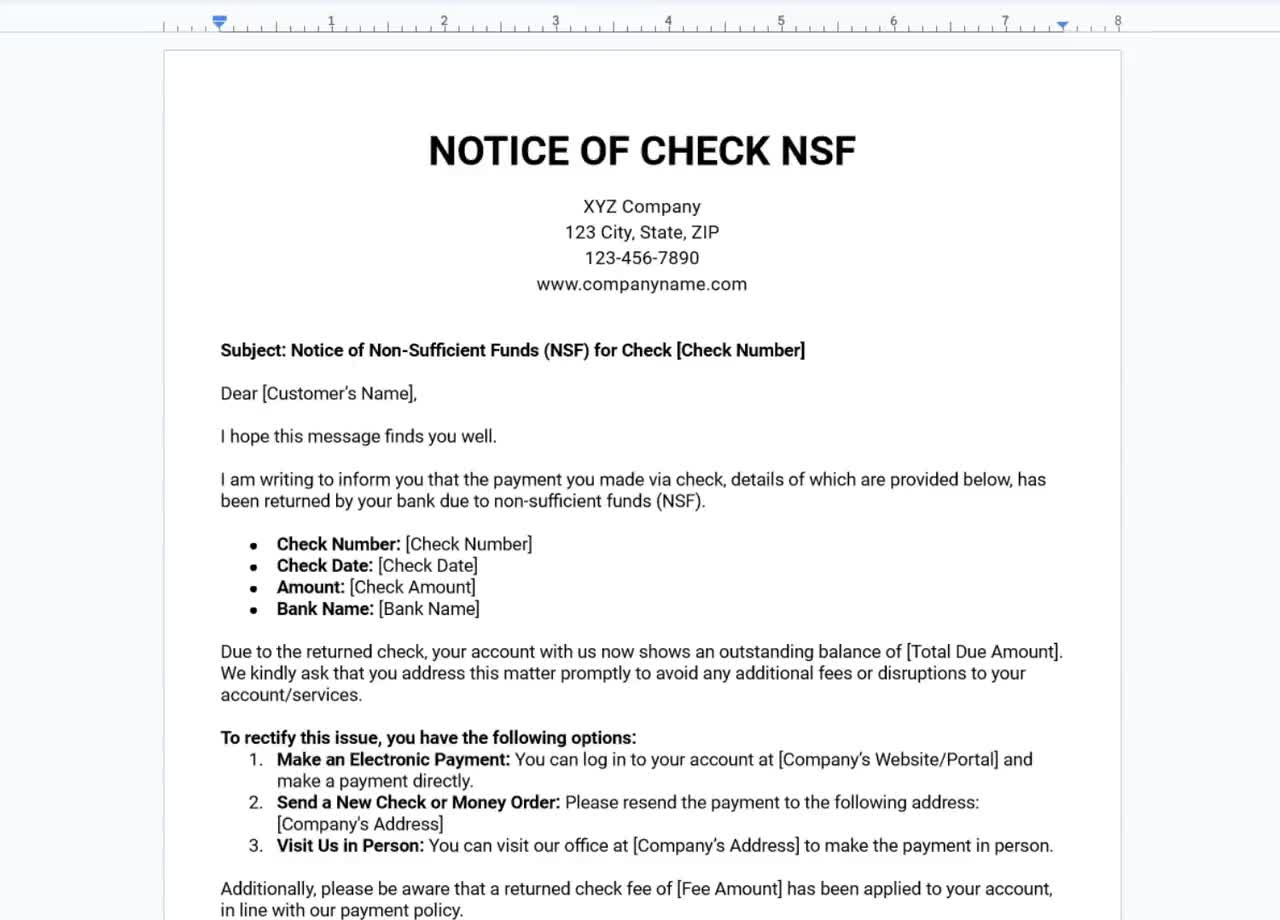

Key Elements to Include in Your Non Sufficient Funds Letter

- Sender’s and Recipient’s Information: Clearly state who is sending the letter and who it is addressed to, including full names and addresses.

- Date of the Letter: Essential for record-keeping and establishing a timeline.

- Clear Reference to the Bounced Transaction: Specify the type of payment (check, direct debit), the check number (if applicable), the original amount, and the date it was issued or attempted.

- Reason for the NSF: Briefly state that the payment was returned due to non sufficient funds.

- Specific Request for Payment: Clearly state the total amount now due, which includes the original amount plus any NSF fees or late charges. Provide a new due date.

- Payment Methods: Offer clear instructions on how the payment can be made (e.g., bank transfer, money order, cashier’s check).

- Consequences of Non-Payment: Briefly outline what will happen if the payment is not received by the new deadline, such as further fees, legal action, or cessation of services.

- Professional Closing: End with a polite yet firm closing, such as “Sincerely” or “Regards,” followed by your name and contact information.

Steps to Customize Your Non Sufficient Funds Letter Template

Once you have a solid non sufficient funds letter template, the next step is to customize it to fit your specific situation. This involves more than just filling in the blanks; it requires careful consideration of the details surrounding the bounced payment and the relationship you have with the recipient. Start by gathering all the pertinent information: the exact amount of the original transaction, the date it occurred, any reference numbers (like a check number or invoice number), and the specific NSF fees you are legally entitled to collect. Having these facts at your fingertips ensures your letter is accurate and leaves no room for doubt or dispute.

Next, adapt the tone of the letter. While an NSF letter is inherently formal, you can adjust its severity based on your relationship with the payer. For a first-time bounced check from a long-standing client, you might opt for a slightly more understanding tone, perhaps offering a bit of flexibility with the new payment deadline. However, for a repeat offender or a new client with a history of payment issues, a firmer, more direct approach would be appropriate. Remember, the goal is to secure payment while maintaining professionalism, so choose your words carefully to convey firmness without aggression.

Beyond the content, consider the logistics of sending the letter. While email is quick and convenient, for significant amounts or critical situations, sending the letter via certified mail with a return receipt requested is highly recommended. This provides undeniable proof that the letter was sent and received, which can be crucial if legal action becomes necessary down the line. Always keep a copy of the sent letter, along with any proof of mailing, in your records. This creates a complete audit trail of your efforts to collect the outstanding funds.

Finally, always proofread your customized letter meticulously before sending it. Typos, grammatical errors, or incorrect figures can undermine the professionalism of your communication and potentially weaken your position. Ensure all dates, amounts, and contact details are accurate. A clear, error-free letter reflects positively on you or your organization and reinforces the seriousness of the matter. Taking these extra steps ensures your non sufficient funds letter template effectively serves its purpose in resolving financial discrepancies.

Dealing with non sufficient funds can be a challenging situation, but clear and professional communication is your most powerful tool for resolution. A well-crafted letter effectively communicates the issue, outlines the steps for rectification, and protects your interests, all while maintaining a respectful dialogue. It transforms an awkward financial problem into a structured process for recovery.

By utilizing a reliable non sufficient funds letter template and customizing it with care, you can streamline the process of addressing bounced payments. This allows you to focus on managing your finances more effectively and ensures that financial discrepancies are handled with the clarity and professionalism they require, leading to swifter and more amicable resolutions.