Navigating the complexities of business transactions and insurance agreements often involves a lot of paperwork and specific declarations. One such document that frequently comes up, particularly in the realms of mergers and acquisitions or when securing certain types of insurance policies, is what’s known as a no known loss letter. This isn’t just another form to fill out; it’s a crucial declaration that can significantly impact liabilities and coverage.

Understanding what this letter entails, why it’s requested, and how to properly draft one is vital for anyone involved in these high-stakes situations. It acts as a solemn promise, affirming that you are not aware of any existing issues or potential claims that would fall under the scope of a new policy or agreement. Getting it right ensures transparency and protects all parties involved from unforeseen complications.

What Exactly is a No Known Loss Letter and Why Do You Need One?

A no known loss letter is essentially a formal statement where the signatory declares that they are unaware of any events, circumstances, or specific situations that could reasonably lead to a loss or claim under a new or renewed insurance policy, or that might constitute a breach of representations and warranties in a business transaction. Think of it as a clean bill of health regarding potential liabilities. It’s often requested by insurers before they issue a policy, especially for specialized coverage like Directors and Officers (D&O) liability, Errors and Omissions (E&O), or Cyber insurance. The core purpose is to prevent individuals or companies from obtaining coverage for a loss that they already knew about or had reason to anticipate.

Without such a declaration, an insurer could face claims for pre-existing issues, which goes against the fundamental principle of insurance protecting against future, uncertain risks. In the context of mergers and acquisitions, the buyer might request this letter from the seller to ensure there are no undisclosed liabilities or ongoing issues that could result in future claims against the acquired entity. It serves as a layer of due diligence, providing assurance that the financial representations are accurate and that the buyer isn’t inheriting a ticking time bomb.

The importance of this document cannot be overstated. Signing a no known loss letter truthfully and accurately is critical. Providing an inaccurate or misleading declaration can lead to severe consequences, including the invalidation of the insurance policy, denial of claims, or even legal action for misrepresentation. It’s a testament to the integrity of the information being provided and a cornerstone for establishing trust in significant financial and legal agreements.

Key Scenarios Where a No Known Loss Letter is Essential

This type of letter isn’t universally required for all insurance policies or transactions. However, there are specific situations where you will almost certainly encounter a request for one:

- Obtaining Specialty Insurance Policies: Particularly for D&O, E&O, or Cyber liability insurance, where the risks are often tied to actions or knowledge of individuals within the company.

- Mergers and Acquisitions (M&A): As part of the due diligence process, buyers will often seek assurances that the target company has no undisclosed liabilities or ongoing issues that could lead to claims post-acquisition.

- Warranty and Indemnity (W&I) Insurance: When W&I policies are used in M&A deals to cover breaches of warranties, insurers will require a no known loss declaration from the seller.

- Significant Policy Renewals: For certain complex or high-value policies, insurers may request an updated no known loss declaration upon renewal to confirm that the risk profile hasn’t changed due to new, undisclosed information.

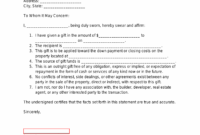

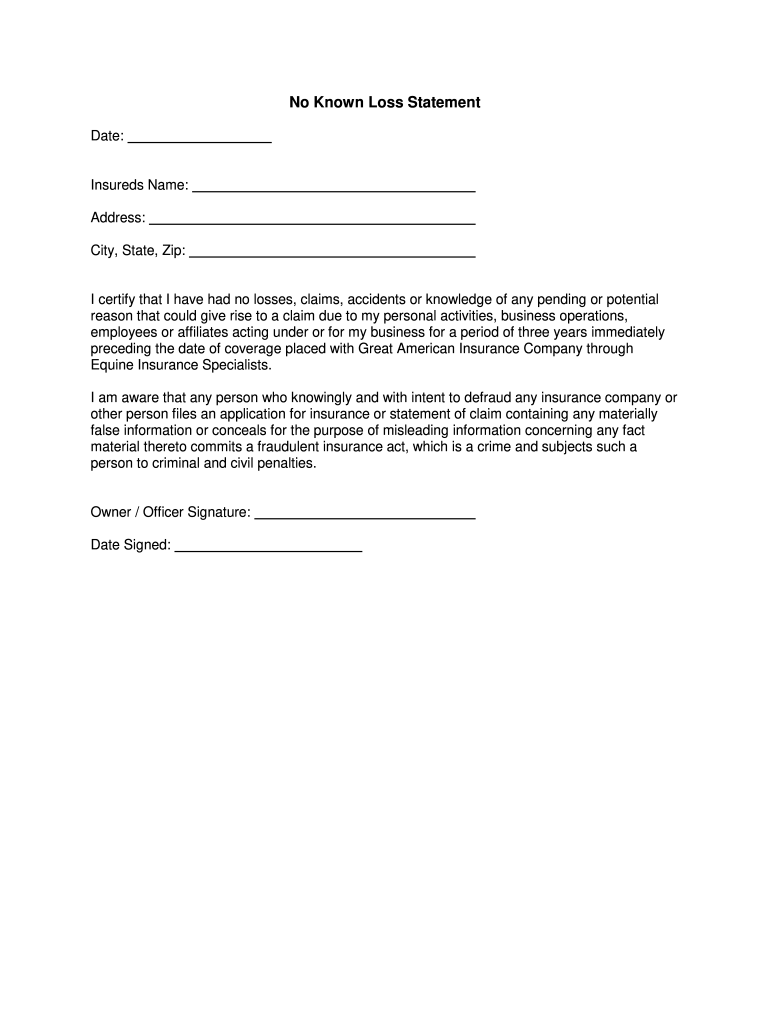

Building Your Own No Known Loss Letter Template: Essential Components

Creating an effective no known loss letter template requires careful attention to detail and clarity. While each situation might call for unique phrasing, there are fundamental elements that should always be present to ensure the letter serves its intended purpose. It’s not just about stating "no known loss"; it’s about providing context, specificity, and a clear understanding of the declaration’s implications.

Firstly, the letter needs to be properly addressed, clearly identifying both the sender (the party making the declaration) and the recipient (the insurer, buyer, or other relevant party). This includes full names, titles, and addresses. The date of the letter is also crucial, as it establishes the point in time to which the declaration applies. This timeline is vital, as any loss becoming known after the letter is signed but before the policy inception or transaction close might need to be disclosed.

Next, the core of the letter is the unequivocal statement of "no known loss." This statement should be direct and unambiguous. It should specify what the declaration pertains to—for example, "in connection with the proposed [Insurance Policy Type/Transaction Name] dated [Date]"—to avoid any confusion about the scope of the declaration. It’s important to clarify that "no known loss" means no knowledge of facts, circumstances, or events that could reasonably be expected to give rise to a claim or loss under the specified policy or agreement.

Beyond the core statement, it’s often prudent to include a clause acknowledging the signatory’s understanding of the importance and implications of the letter. This might include an affirmation that the signatory has conducted reasonable inquiry and due diligence to ascertain the truthfulness of the declaration. Remember, the goal is to make a truthful representation, and implying that diligent effort was made strengthens the letter’s credibility. Finally, the letter must be signed by an authorized individual, clearly stating their name and title.

- Date: When the declaration is made.

- Recipient Details: Clear identification of the party receiving the letter.

- Sender Details: Full identification of the individual or entity making the declaration.

- Specific Reference: Clearly link the letter to the specific policy or transaction.

- Unequivocal Statement: A clear and direct declaration of no known losses.

- Scope Definition: Specify what "no known loss" covers (e.g., facts, circumstances, events).

- Acknowledgment of Due Diligence: A clause confirming a reasonable inquiry was made.

- Authorized Signature: Signature, printed name, and title of the authorized signatory.

Preparing and signing such a letter is a significant responsibility, underlining the need for accuracy and honesty. It is always a good practice to seek legal counsel when drafting or reviewing a no known loss letter template to ensure it meets all legal requirements and accurately reflects your situation. This proactive approach helps mitigate risks and fosters confidence in the underlying agreements.

A properly executed no known loss letter is far more than a formality; it is a foundational element for establishing trust and managing risk in complex financial and insurance landscapes. Taking the time to understand its purpose, draft it meticulously, and ensure its accuracy can save a great deal of trouble and potential liability down the line, safeguarding your interests and maintaining the integrity of your agreements.