Stepping into the exciting world of homeownership can feel like a big adventure, full of possibilities and a few essential steps. One of the most crucial early milestones you’ll encounter is securing a mortgage pre approval letter. This document isn’t just a piece of paper; it’s your golden ticket that tells sellers you’re a serious buyer, ready and able to make an offer. It essentially signals to everyone involved that a lender has reviewed your financial situation and provisionally agreed to lend you a specific amount.

Think of it as having your financial ducks in a row before you even start house hunting seriously. Without it, some real estate agents might hesitate to show you properties, and sellers might not take your offers as seriously, especially in a competitive market. Having this letter in hand empowers you to move quickly when you find the perfect home, giving you a distinct advantage over other potential buyers who haven’t taken this important step.

What Exactly Is a Mortgage Pre Approval Letter?

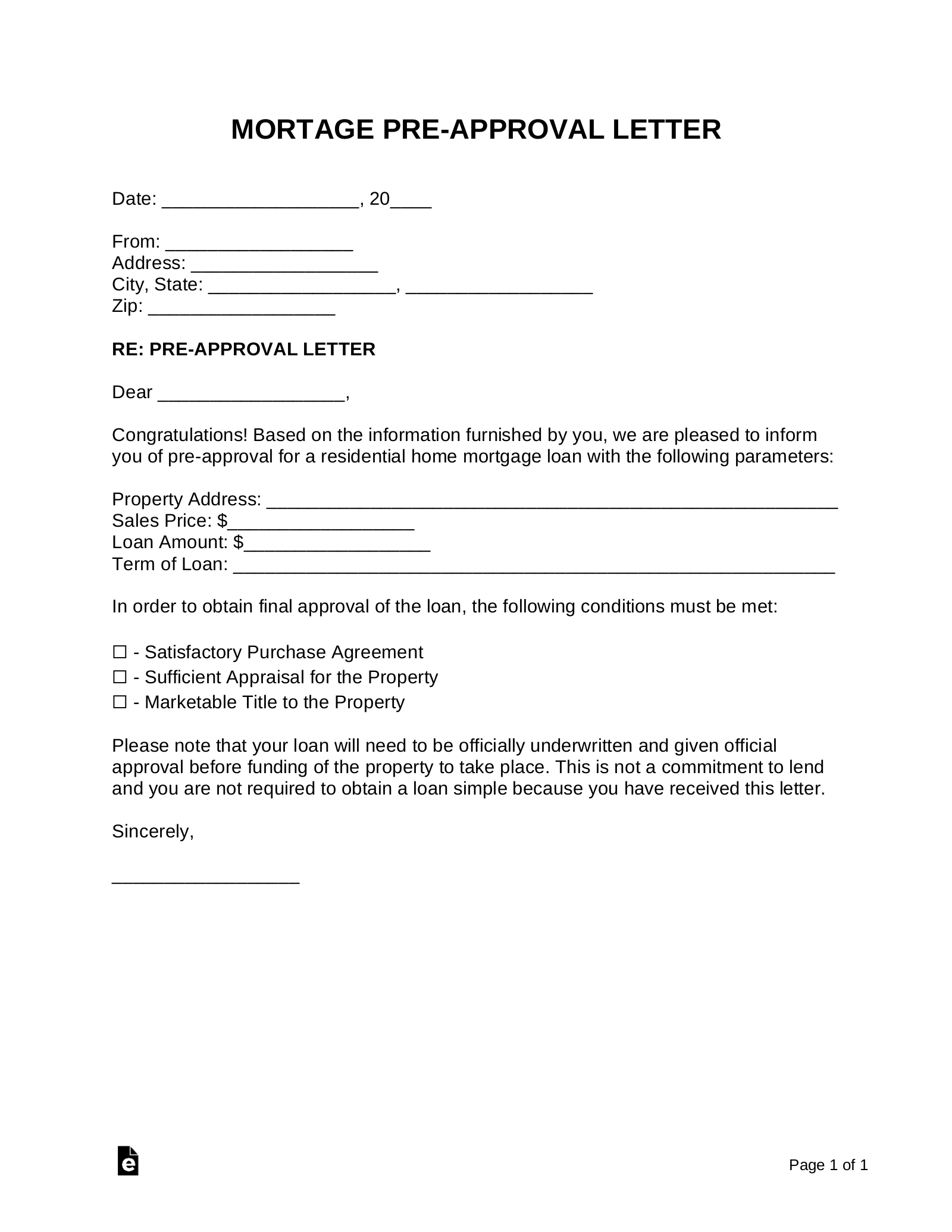

A mortgage pre approval letter is a formal document from a lender indicating that you meet their criteria for a loan up to a certain amount. It’s based on a thorough review of your credit history, income, assets, and liabilities. Unlike a mere pre-qualification, which is often a quick, informal estimate, pre approval involves a deeper dive into your financial health, often including a hard credit pull. This means the lender has verified your information and is confident in your ability to repay the loan, subject to a final property appraisal and a few other conditions.

This letter doesn’t just confirm your borrowing power; it also typically specifies the type of loan you’re approved for, the interest rate you might expect, and the estimated monthly payments. Having this clear picture of your financial capacity helps you set realistic expectations for your home search and ensures you’re looking at properties within your budget. It removes a significant amount of guesswork and emotional stress from the house-hunting process.

One of the greatest benefits of having a pre approval letter is the speed at which you can act. When you find a home you love, you can present an offer backed by a credible financial commitment. This can be particularly appealing to sellers who want to close quickly and with minimal fuss. They see your offer as less risky because a major hurdle, your financing, has already been largely cleared. Understanding what goes into a professional mortgage pre approval letter template can significantly streamline your journey.

Essential Elements You’ll Find

- Your name and the lender’s name.

- The maximum loan amount you’re approved for.

- The loan program (e.g., FHA, Conventional, VA).

- The interest rate you’re provisionally offered.

- The expiration date of the pre approval.

- Any conditions that still need to be met (e.g., property appraisal, final income verification).

Knowing these details upfront means you’re not just guessing; you have concrete figures to work with. It’s a powerful negotiating tool that speaks volumes about your readiness to buy.

Navigating the Path to Your Mortgage Pre Approval

Obtaining your mortgage pre approval is a straightforward process, though it does require gathering some financial documents. The first step involves contacting a reputable mortgage lender or broker. They will guide you through the application, asking for details about your income, employment history, debts, and assets. This is the stage where they assess your creditworthiness and your capacity to handle a mortgage payment. Don’t be shy about asking questions; a good lender will take the time to explain everything clearly.

You’ll need to provide documentation such as recent pay stubs, W-2 forms from the last two years, bank statements, and tax returns. If you’re self-employed, you might need to provide more extensive financial records. The lender uses this information to verify the figures you’ve provided and to ensure that you meet their lending guidelines. This thorough review is what makes the pre approval letter so valuable and respected by sellers and real estate agents.

Once your financial information has been reviewed and approved, the lender will issue your mortgage pre approval letter. This document usually has an expiration date, often 60 to 90 days, because your financial situation can change. If your pre approval expires before you find a home, you’ll simply need to update your financial information with your lender to get a renewed letter. It’s a good practice to keep your lender informed of any significant changes in your employment or financial status during your home search.

The beauty of having a robust mortgage pre approval letter template is that it allows you to approach your home search with confidence and clarity. You know exactly what you can afford, which helps you focus your efforts on suitable properties. Moreover, it significantly strengthens your position when making an offer, as it demonstrates to sellers that you are a serious and qualified buyer, making your offer more appealing than others that lack this crucial backing. This readiness can make all the difference in a competitive market, allowing you to seize opportunities as they arise.

Having your mortgage pre approval letter in hand transforms your home buying journey from a hopeful dream into a tangible plan. It equips you with the confidence to tour homes, make informed decisions, and present offers that truly stand out. This foundational step not only streamlines the purchasing process but also puts you in a stronger negotiating position, ensuring that when you find that perfect place, you’re fully prepared to make it yours.

So, as you embark on this exciting chapter of finding your dream home, remember the power of being prepared. Taking the time to secure your pre approval letter isn’t just about getting a document; it’s about setting yourself up for success, ensuring a smoother, less stressful path to unlocking the door to your new life.