When you reach the exciting point of paying off your mortgage loan, whether you are selling your home, refinancing, or simply making your final payment, there is one crucial document you will need: a mortgage payoff letter. This essential piece of paper provides the exact amount required to fully satisfy your loan on a specific date, ensuring a smooth and legally sound transaction. Without it, you might inadvertently pay too little or too much, leading to complications down the line.

Understanding this document and knowing how to obtain it is key to a hassle-free closing or final payment process. It serves as an official statement from your lender, detailing every penny owed, including principal, interest, and any associated fees, up to a precise future date. This article will guide you through what a mortgage loan payoff letter template entails and how it plays a vital role in finalizing your financial commitment.

Understanding Your Mortgage Payoff Letter

A mortgage payoff letter is far more than just a routine statement; it is a binding document from your lender that specifies the precise amount needed to completely close out your loan. Unlike your monthly statements, which only show your balance as of a past date, a payoff letter calculates all outstanding amounts, including daily interest, up to a future “good through” date. This precision is critical because mortgage interest accrues daily, meaning the exact amount owed changes constantly.

Receiving this letter ensures that you or your closing agent can wire or send the correct funds, leaving no lingering debt or overpayment. This protects you from potential collection issues or the need to chase down a refund from your lender. It is the official confirmation that once the stated amount is received by the specified date, your loan obligations are fully satisfied, and the lien on your property can be released.

The accuracy of this document is paramount. It clears the way for the lender to formally release their lien on your property, a process that is recorded with your local county and ensures you have clear title. Without this release, even if you have paid off the loan, the property records would still show the lender as having an interest in your home, which could complicate future sales or refinancing efforts.

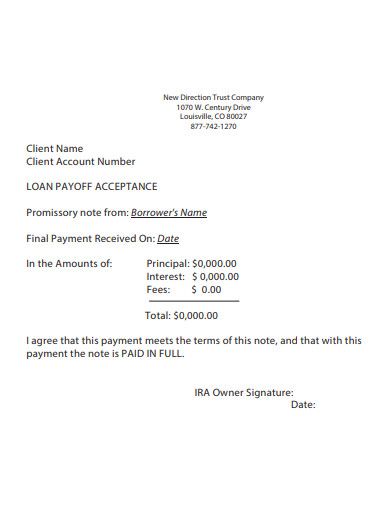

Essential Elements of a Payoff Letter

- Payoff Amount: This is the total sum required to fully satisfy the loan, including all principal, interest, and any fees, calculated up to the good-through date.

- Per Diem Interest: This shows the amount of interest that accrues daily. It is crucial for calculating the precise payoff amount if the payment is made on a date different from the good-through date.

- Good-Through Date: This is the specific date until which the provided payoff amount is valid. If payment is made after this date, the amount will need to be re-calculated due to additional accrued interest.

- Instructions for Remittance: Detailed information on how to send the payment, including wire transfer instructions, mailing addresses, and any specific account numbers or reference codes required.

- Account Number: Your specific mortgage loan account number for proper identification.

- Borrower Information: Your name and property address, confirming the letter applies to your specific loan.

- Lender Contact: Information for reaching the lender if there are questions or discrepancies.

It is important to meticulously review each of these components to ensure everything aligns with your understanding of your loan balance and terms. Any discrepancies should be addressed with your lender immediately.

Obtaining and Using Your Payoff Letter Effectively

Requesting your mortgage payoff letter is usually a straightforward process. Most lenders offer several ways to request this document, including through their online portal, a phone call to customer service, or by sending a written request. When you make your request, be prepared to provide your loan account number and a desired “good through” date. This date should be chosen carefully, usually a few business days after your expected closing or payment date, to allow for processing and unexpected delays.

Once requested, lenders typically provide the payoff letter within a few business days, though some may take up to a week. It is always wise to request it well in advance of when you need it, especially if you have a time-sensitive closing. Upon receiving the letter, carefully compare the details with your own records. Check the loan amount, per diem interest, and especially the good-through date. If you are selling your home, your closing agent or title company will handle the request and review the mortgage loan payoff letter template on your behalf.

Common Scenarios for Using a Payoff Letter

- Selling Your Home: The payoff amount is deducted from the sale proceeds, and the lien is released, transferring clear title to the new buyer.

- Refinancing: The new lender uses the payoff letter to send funds directly to your current lender, satisfying the old loan and establishing the new one.

- Paying Off the Loan in Full: If you are making the final payment yourself, the letter ensures you send the correct amount, leading to the official release of the lien.

- Estate Settlement: In cases of a borrower’s passing, the estate needs this document to settle the mortgage debt.

After the payment has been sent and processed according to the instructions in the letter, it is a good practice to follow up with your lender to confirm that the loan has been fully satisfied and that the lien release process has begun. The lender will then usually send you a confirmation letter and ensure the lien is removed from public records, officially concluding your mortgage journey.

Navigating the final stages of your mortgage can feel complex, but having the right documentation simplifies the process immensely. A precise mortgage payoff letter is the cornerstone of a clean and complete transaction, ensuring that your property is free and clear. By understanding its components and knowing how to obtain and review it, you empower yourself to confidently close this significant chapter of your financial life.