Receiving calls and letters from debt collectors can be incredibly stressful and even overwhelming. It often feels like you’re caught in a challenging situation with little power, especially when you’re unsure about the legitimacy of a debt or your rights. However, taking a proactive approach and understanding how to communicate effectively can make a significant difference in managing these interactions and protecting your financial well-being.

One of the most powerful tools at your disposal is a well-crafted letter. Instead of ignoring the calls or engaging in potentially confusing phone conversations, putting your concerns and requests in writing provides a clear, documented record of your communication. This article will guide you through the process, helping you feel more confident and prepared when dealing with collection agencies, particularly by leveraging a solid letter template to send to debt collectors.

Understanding Your Rights: Why a Validation Letter is Essential

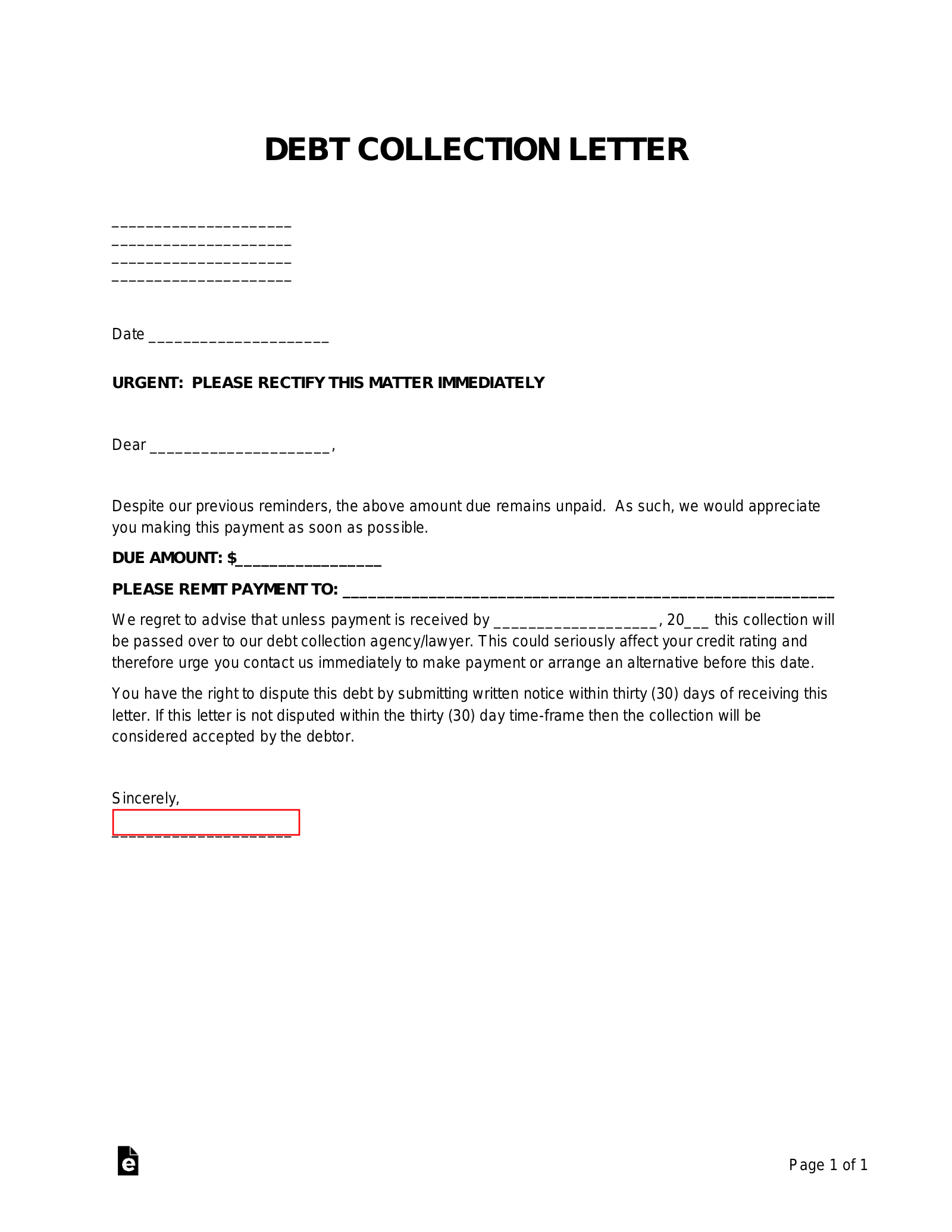

When a debt collector contacts you about an outstanding balance, your first step should often be to request validation of the debt. This isn’t about denying you owe money; it’s about ensuring that the debt is legitimate, that the collector has the legal right to collect it, and that all the details are accurate. Under the Fair Debt Collection Practices Act FDCPA, you have specific rights, and one of the most important is the right to request validation within 30 days of receiving the first communication from the collector. Sending a debt validation letter essentially puts a pause on their collection activities until they can provide satisfactory proof.

This pause is crucial because it gives you time to breathe and conduct your own research without the pressure of constant calls. It helps prevent cases of mistaken identity, old debts that are past the statute of limitations, or situations where the collector is pursuing an amount that isn’t entirely correct. Without proper validation, a collector cannot legally continue their efforts or report the debt to credit bureaus. This makes a debt validation letter template to send to debt collectors an indispensable tool for anyone facing collection attempts.

Sending this letter forces the debt collector to provide specific information. They need to show that you actually owe the debt, that they are legally authorized to collect it, and that the amount is accurate. If they can’t provide this, or if the information is inconsistent, their ability to pursue the debt becomes severely hampered. This empowers you to challenge inaccurate claims and protect your credit history from erroneous entries.

Key Information to Include in Your Validation Request

- Your full name and address.

- The debt collector’s name and address.

- A clear statement that you are disputing the debt and requesting validation.

- The account number or reference number provided by the debt collector.

- A request for specific documents, such as:

- Proof that you owe the debt (e.g., original contract, loan agreement).

- Proof that the debt collector is authorized to collect the debt.

- The original creditor’s name and address.

- An itemized breakdown of the amount owed.

- A statement that all collection activities must cease until validation is provided.

- The date you are sending the letter.

Beyond Validation: Other Essential Letters You Might Need

While a debt validation letter is often your first line of defense, there are other types of letters you might need to send to debt collectors depending on your situation. Each serves a distinct purpose and helps you maintain control over the communication process, providing clear instructions and boundaries. Understanding these options can further empower you to manage your debt responsibly and strategically.

For instance, if a debt collector is harassing you with excessive calls or contacting you at inconvenient times or places, a “Cease and Desist” letter can be very effective. This letter formally requests that the debt collector stops all communication with you, except to notify you that they are stopping collection efforts or that they intend to file a lawsuit. They are legally obligated to honor this request. While it won’t make the debt disappear, it will stop the unwanted contact and give you peace of mind.

Another useful letter is a “Pay-for-Delete” letter. If you have an older collection account that’s negatively impacting your credit score, you might negotiate with the collector to pay a portion of the debt in exchange for them removing the negative entry from your credit report. This requires careful negotiation and a very specific letter to ensure both parties understand the terms before any payment is made. It’s crucial that the agreement to remove the entry is in writing before you send any money.

Finally, you might consider a “Debt Settlement Offer” letter. If you acknowledge the debt and wish to resolve it, but cannot pay the full amount, you can offer a lump-sum payment for less than the total. This letter clearly outlines your offer, the payment terms, and requests that the remaining balance be considered paid in full once your offer is accepted. Having a structured letter ensures that all terms are documented, protecting you from future claims on the same debt. Using a structured letter template to send to debt collectors for these different scenarios ensures clarity and professionalism, helping you navigate these often-tricky waters effectively.

Taking charge of your communication with debt collectors through well-structured letters is a powerful step towards regaining control over your financial situation. Each letter you send creates a documented record, protecting your rights and ensuring clarity in every interaction. Remember, you have rights, and using these tools can make a significant difference in how your debt is managed and ultimately resolved.

Empowering yourself with knowledge and effective communication strategies will not only alleviate the stress associated with debt collection but also lay the groundwork for a more stable financial future. Don’t let the fear of dealing with collectors deter you from asserting your rights and seeking a fair resolution.