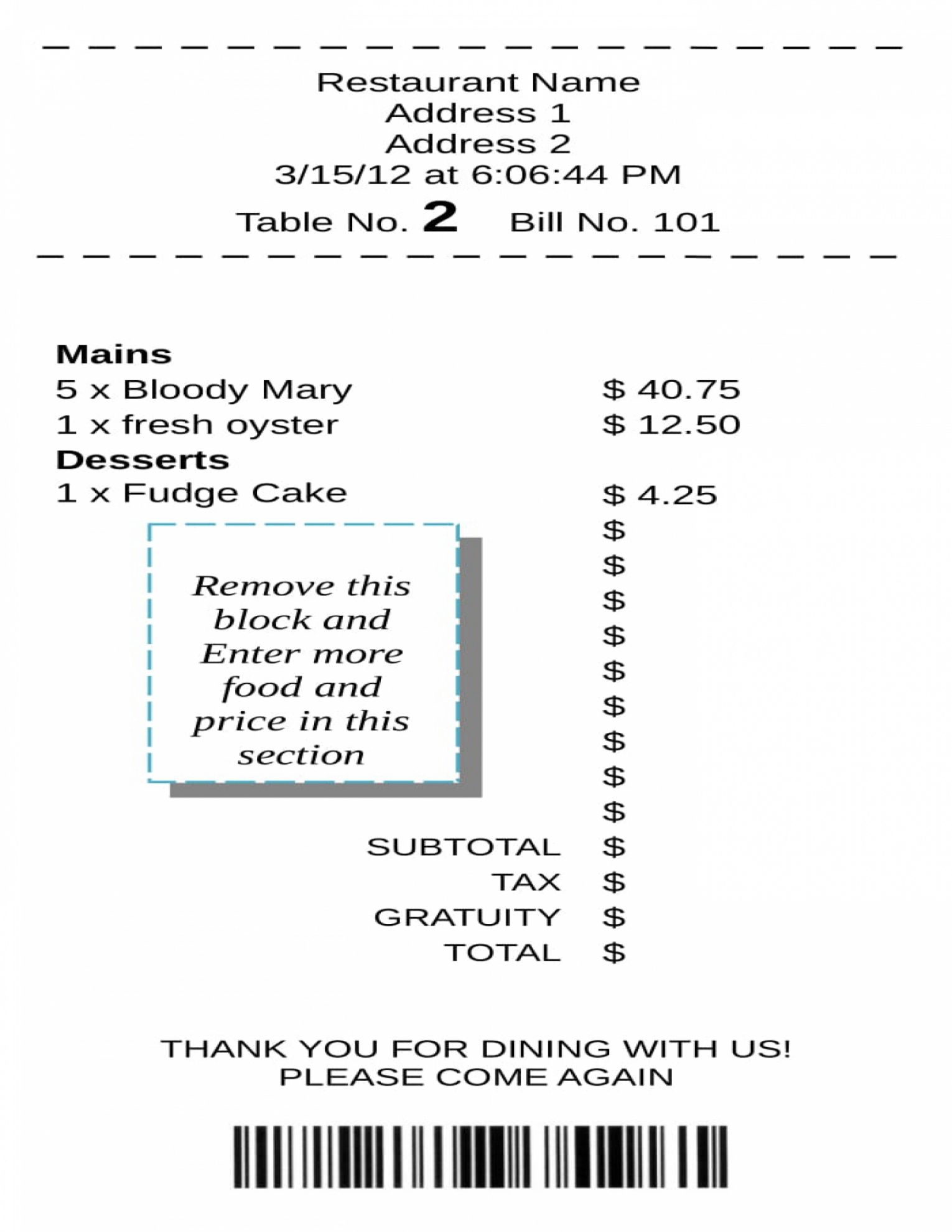

Itemized restaurant receipt template, The Federal Trade Commission is proposing new rules for business opportunities sellers and in this fresh set of rules that are proposed one of the newest stipulations are that business opportunities sellers must present their customer or a reception. Why is the Federal Trade Commission requiring this? There have been cases of fraud where the buyer never got receipt and so couldn’t prove that obsolete been torn off. Meanwhile, there was no record of this transaction in any way, no copy of these signed agreements in many cases and no way to have the purchaser’s money back. Sounds pretty sketchy to be. And this is why or instead this is among the reasons why the FTC is also among a number of other new proposed changes requiring that business opportunities sellers provide receipts to their customers.

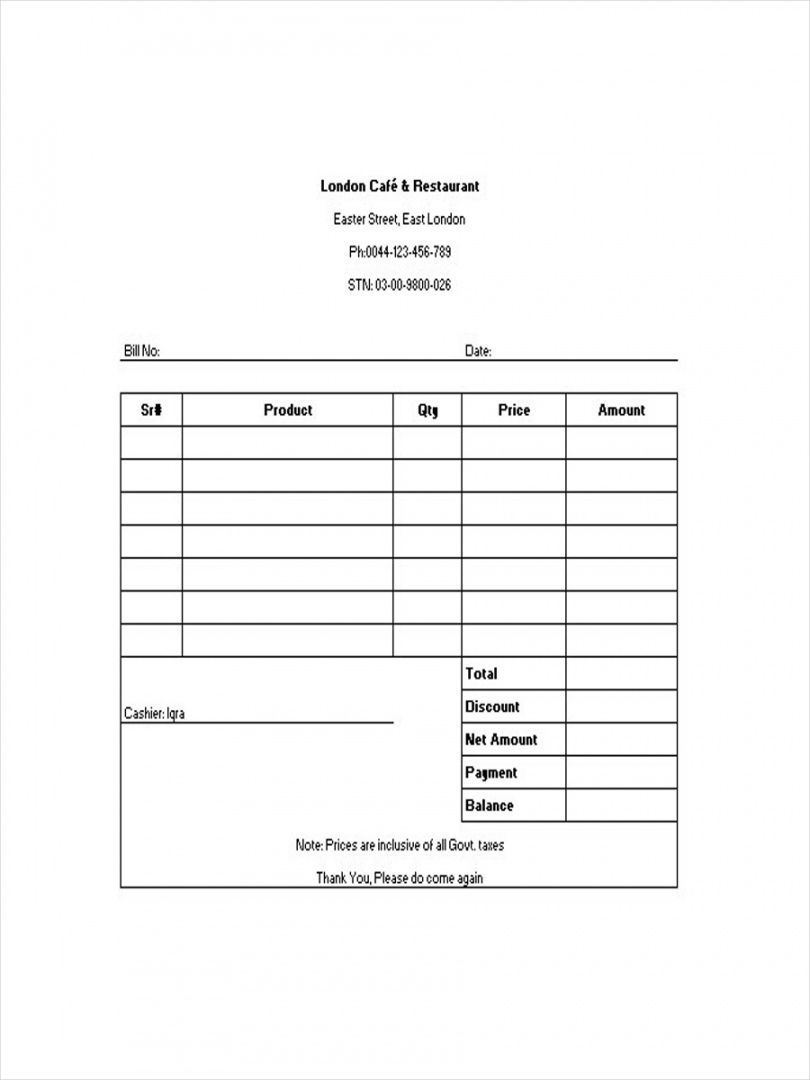

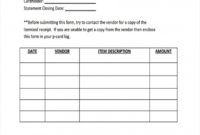

Although most receipts include the same information, it would be best to review quite a few receipt sample resources prior to introducing your format of choice. It is important that you look around. If you’re going to get a free template from the Internet, you have the ability to add your business name, emblem and the reception number to each receipt generated electronically. Many customers choose to control their payments, online. Your office staff therefore needs to keep current with these transfers. Bank statements need to be checked daily and payments made deducted from the clients’ accounts.

An acknowledgment of payment receipt is a written admiration the money, property or anything of worth was received in addition to this receipt additionally generates a record and evidence of this transaction. These records also play an important part to avoid any disputes or misunderstanding about the detail of this transaction. Generally this record may be used for any kind of payment that is received from the customers, providers, customers and business partners. These receipts are also very crucial when the market analysts prepare a business program that intends to enhance the sales in addition to profit.

If your business is audited, you may again, need to have a copy of your receipts. You should keep the receipts in a secure place and make certain that they’re organized so you can actually refer back to previous trades! Plus, how are you going to adjust your company habits or make a gain if you don’t know where your money is going, or that you are making? If You’re new to the business world, you might not realize that There Are Lots of different types of receipts.

These receipts can serve as a hard proof of a payment which in turn deprive the possibility of the company owner to make legal claims concerning nonpayment. This record also enables the consumer if if they need a refund for damaged products. These documents explain all necessary information and convey them into short yet detailed paragraph as well as ensure that all your ideas are conveyed flawlessly. Some fundamental benefits of keeping these receipts such as they communicate information in a professional manner, expand markets, and maintain the secrecy, building in a fantastic will, assist in maintain records, lowest cost, stop from conflicts and conclude trades in an organized way.