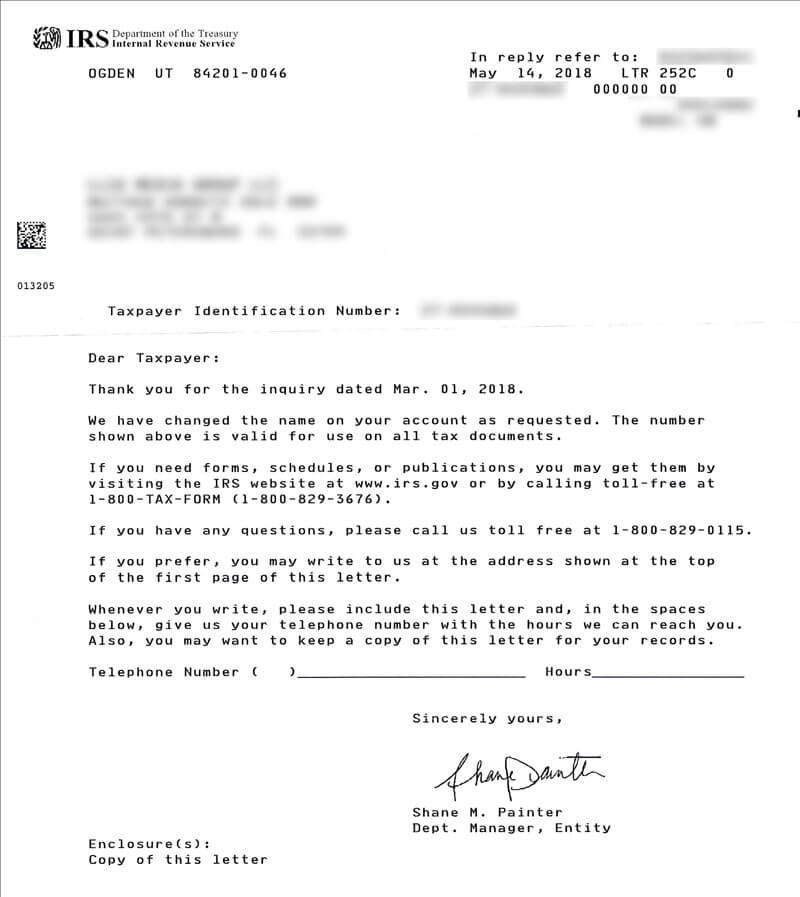

Changing your business name is a significant step, whether it is for rebranding, a merger, or simply reflecting a new direction. While exciting, this change comes with administrative tasks that are crucial for maintaining compliance and smooth operations. One of the most important notifications you will need to make is to the Internal Revenue Service, ensuring your federal tax records reflect your business’s current identity.

Navigating the various government agencies can sometimes feel overwhelming, but informing the IRS about your business name change does not have to be a complicated ordeal. With a clear understanding of what information they require and how to present it, you can handle this step efficiently. Having a reliable structure for your communication, like an irs business name change letter template, can significantly simplify the process, giving you peace of mind that all necessary details are covered.

Understanding Why the IRS Needs to Know About Your Business Name Change

When your business undergoes a name change, it is not just a matter of updating your stationery or website. The Internal Revenue Service maintains an extensive database of all entities that pay taxes or have an Employer Identification Number (EIN). This information is critical for accurate tax filings, processing refunds, sending official correspondence, and generally linking your financial activities to the correct legal entity. Failing to notify them can lead to a host of headaches, from delayed tax processing to missed communications.

Imagine trying to file your annual tax return with a new business name, but the IRS still has your old one on file. This mismatch can trigger alerts, cause your filing to be flagged, or even lead to your return being rejected, creating unnecessary delays and potential penalties. The IRS relies on consistent and up-to-date information to correctly identify your business and ensure it complies with federal tax laws. Your EIN, which acts like your business’s Social Security number, is permanently tied to your business structure and name, making it essential to keep that link current.

Different business structures have varying requirements and implications when it comes to name changes, though the IRS notification remains a constant. Understanding these nuances can help you prepare your documentation effectively.

Different Business Structures and Name Changes

- Sole Proprietorship: If you operate as a sole proprietorship and only change your business name (not your legal name or structure), you typically notify the IRS by simply using your new name on your tax returns. If you have an EIN, you should still inform the IRS in writing.

- Partnership: A partnership changing its name generally needs to update its partnership agreement. For federal tax purposes, the IRS should be informed in writing, especially if the change impacts how the business is identified.

- Corporation: Corporations must first file an amendment with their state of incorporation to officially change their name. Once the state approves the change, the IRS then needs to be notified in writing.

- Limited Liability Company (LLC): Similar to corporations, an LLC must amend its articles of organization with the state where it is registered. After state approval, a formal notification to the IRS in writing is a crucial next step.

Regardless of your business structure, while state-level name changes are the primary legal step, informing the IRS is a vital follow-up to ensure your federal tax records are perfectly aligned with your business’s new identity. This proactive approach helps avoid future complications and ensures a smooth operational flow.

Crafting Your Effective IRS Business Name Change Letter

When it comes to writing your official notification to the IRS, clarity, conciseness, and accuracy are paramount. This letter serves as a formal declaration of your business’s updated identity, and it needs to provide all the necessary information for the IRS to update its records without requiring further clarification. Think of it as a professional memo, straightforward and to the point, leaving no room for misinterpretation. It’s not just an announcement; it’s a critical administrative update.

To ensure your letter is comprehensive and effective, there are several key pieces of information you must include. Missing even one detail could lead to delays or further inquiries from the IRS, which is precisely what you want to avoid. A well-structured letter will make the process smoother for both you and the agency.

Here is a list of essential information to include in your letter:

- Your previous full legal business name.

- Your new full legal business name.

- Your Employer Identification Number (EIN).

- Your full business address (including street, city, state, and ZIP code).

- The effective date of the name change.

- A brief, clear statement explaining the reason for the name change (e.g., “for rebranding purposes,” “due to a merger,” “as per state amendment”).

- Your signature, along with your printed name and title within the business.

- A copy of the state-filed amendment or certificate of name change, if applicable, as supporting documentation.

Regarding formatting, it is best to use a standard business letter format. Ensure your letter is dated and addressed correctly to the IRS department responsible for entity changes, which is typically the IRS center where you file your business taxes. While a conversational tone is fine for this article, your letter to the IRS should maintain a professional and factual tone. Attaching supporting documents, such as a copy of your state-filed articles of amendment, adds credibility and helps expedite the process, verifying the legality of your name change.

Having a robust irs business name change letter template at your disposal can be incredibly helpful. It ensures that you do not overlook any crucial details, guides you through the necessary information, and gives you a professional starting point. This systematic approach can save you valuable time and reduce the chances of errors, making what could be a confusing task into a simple, checklist-driven process.

Notifying the IRS about your business name change is a fundamental step to keep your federal tax records accurate and avoid any potential issues down the line. By understanding the importance of this notification and carefully preparing your letter with all the required details, you can ensure a seamless transition for your business’s identity with the federal government. Taking the time to craft a precise and complete letter means your business can continue its operations with full compliance, allowing you to focus on your growth and success.