Receiving an insurance denial can be incredibly frustrating and, let’s be honest, quite stressful. You’ve paid your premiums, expected coverage, and suddenly find yourself facing an unexpected bill or a service you desperately need being withheld. It’s a common scenario that leaves many feeling helpless, but it’s crucial to remember that a denial isn’t always the final answer. You have the right to appeal, and often, a well-crafted letter is your most powerful tool in reversing that decision.

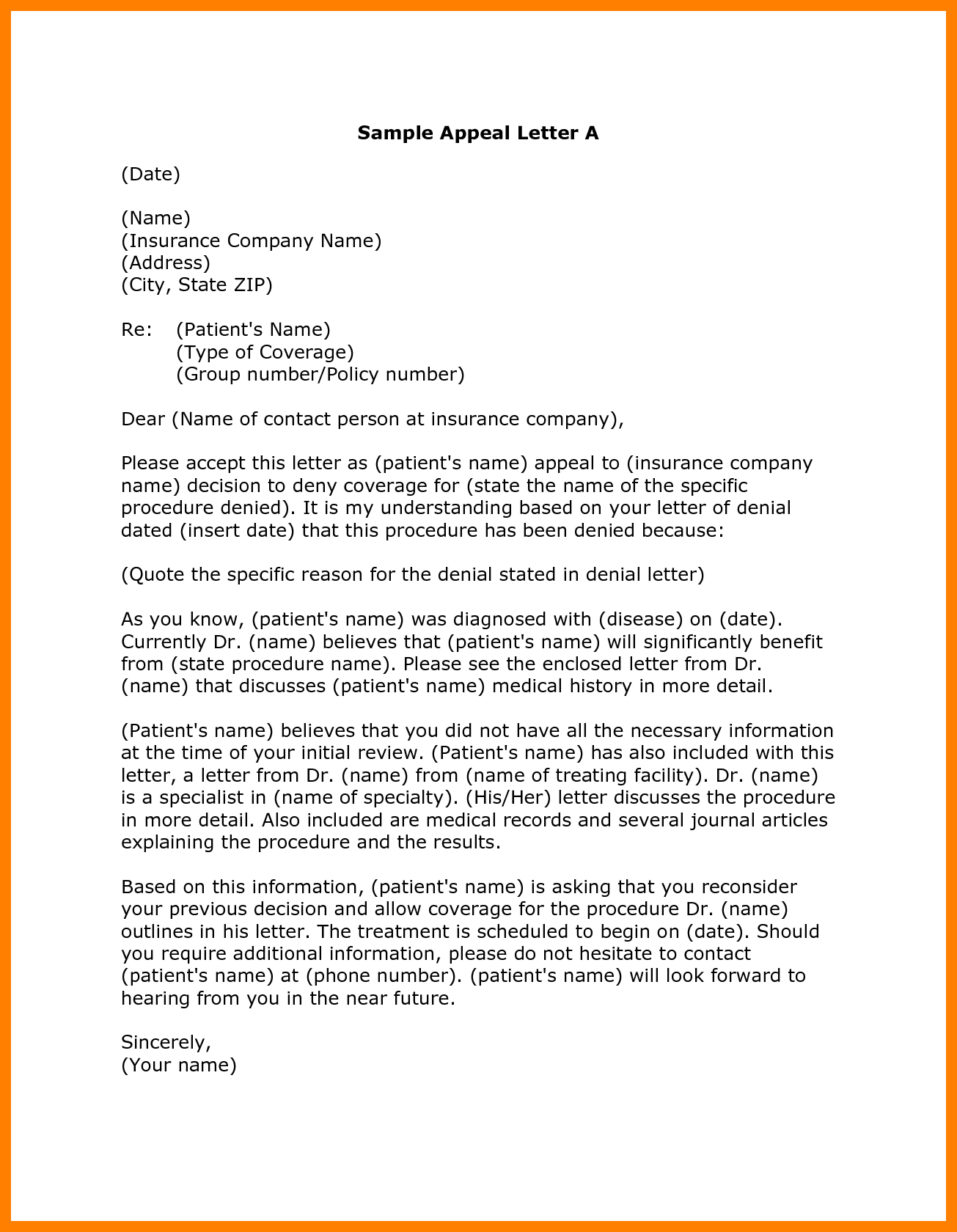

Navigating the complexities of insurance policies and their appeal processes can feel daunting, but it doesn’t have to be. With the right guidance and a clear understanding of what makes an appeal effective, you can significantly increase your chances of success. That’s precisely where an effective insurance denial appeal letter template comes in handy, providing a structured approach to present your case clearly and persuasively to your insurance provider.

Understanding Your Insurance Denial and Why an Appeal Matters

When your insurance claim is denied, it can feel like a brick wall. However, understanding the ‘why’ behind the denial is the first crucial step in dismantling that wall. Insurance companies deny claims for a myriad of reasons, some of which are easily correctable. Common reasons include missing information on the claim, a service deemed "not medically necessary" by their criteria, prior authorization issues, or simply an administrative error. Sometimes, it’s a simple coding mistake, or perhaps the provider submitted the claim incorrectly. Your denial letter should always state the reason for the denial, and it’s essential to read this document very carefully.

An appeal is your formal request to have your insurer reconsider their decision. It’s not just about complaining; it’s about presenting new information, clarifying existing details, or demonstrating why their initial decision was incorrect according to your policy terms or medical necessity. Many people give up after the first denial, but statistics show that a significant percentage of appeals are successful, especially when the policyholder is persistent and well-prepared. Don’t leave money on the table or forgo necessary treatment simply because of an initial "no."

Before you even start writing, gather all relevant documents. This includes your denial letter, your insurance policy (especially the section on appeals and covered benefits), medical records related to the claim, bills, and any correspondence you’ve had with your insurer or healthcare provider. Organizing these materials beforehand will streamline the writing process and ensure you have all the facts at your fingertips. Your appeal needs to be well-supported by evidence, not just emotional pleas.

Taking the time to understand the denial and preparing your documents thoroughly sets the stage for a compelling appeal. This initial effort will pay dividends, making your letter more persuasive and efficient. Remember, the goal is to provide the insurance company with every reason to reverse their decision, leaving no room for ambiguity or doubt.

Key Components of an Effective Appeal Letter

For your appeal letter to be successful, it needs to be clear, concise, and comprehensive. Think of it as a formal business communication designed to clearly state your case. Here are the essential components you should include:

- Your Policyholder Information: Full name, address, phone number, email, and most importantly, your policy or group number.

- Claim Information: The specific claim number, date of service, and the name of the service or treatment that was denied.

- Clear Statement of Appeal: Explicitly state that you are appealing the denial of the specific claim.

- Reason for Denial: Reference the reason provided in your denial letter.

- Your Argument for Reversal: Explain clearly and factually why you believe the denial should be overturned. This is where you introduce new information, correct errors, or argue medical necessity based on your policy.

- Supporting Documentation: List all attachments you are including (medical records, doctor’s letters, explanations of benefits, etc.).

- Call to Action: Request a specific resolution, such as payment for the service or a review by a different medical professional.

- Professional Closing: A formal closing with your signature.

Crafting Your Appeal Letter: Tips for Success

Once you’ve understood the denial and gathered your documents, the next step is to put pen to paper, or fingers to keyboard. Your tone in the letter should always remain professional and factual, even if you’re feeling incredibly frustrated. Avoid emotional language, threats, or accusations. Stick to the facts, reference your policy, and explain why their decision is inconsistent with the terms of your coverage or your medical needs. A calm, well-reasoned argument is far more effective than an angry one.

Be as specific as possible. When you reference a specific date, claim number, or section of your policy, it helps the reviewer quickly locate the relevant information. If your doctor has provided a letter of medical necessity, ensure it clearly outlines why the denied service is crucial for your health. Sometimes, a simple omission of a specific diagnostic code can lead to a denial, and your doctor’s input can resolve this. Don’t assume the insurance company knows all the details; it’s your job to present them clearly.

Always make copies of everything you send, including your appeal letter and all supporting documents. It’s also highly recommended to send your appeal letter via certified mail with a return receipt requested. This provides undeniable proof that your letter was sent and received, and when it was received. This can be critical if there are deadlines for appeals, which there almost certainly will be. Missing a deadline could result in your appeal being automatically denied, regardless of its merit.

Remember, the goal is to provide a comprehensive package that makes it easy for the insurance company to say "yes" to your appeal. An effective insurance denial appeal letter template helps you organize your thoughts and ensure all critical information is included. Don’t be afraid to follow up after a reasonable amount of time. Persistence is often key to successfully navigating the insurance appeal process.

Facing an insurance denial can feel like a setback, but it’s important to view it as a challenge you can overcome. By taking a structured, informed approach to your appeal, you empower yourself to advocate for the care you need and deserve. With careful preparation and a clear, factual letter, you significantly improve your chances of turning that initial "no" into a "yes."