Giving or receiving the gift of a vehicle can be an incredibly exciting and generous gesture. Whether it’s a first car for a new driver, an upgrade for a family member, or a thoughtful present for a friend, the joy of such an event is often immense. However, beyond the celebratory moment, there’s an essential administrative step that often goes overlooked: documenting the transfer of ownership correctly.

This is where a formal document, often referred to as a gift letter, becomes indispensable. It’s not just a polite note; it’s a crucial piece of paperwork that clarifies the transfer of ownership without a financial transaction. Without it, you might run into unexpected hurdles with your local Department of Motor Vehicles (DMV) or face unnecessary tax implications. Understanding how to prepare and use a proper gift letter template for vehicle transfers can save you a lot of time and potential headaches down the road.

Why You Need a Vehicle Gift Letter and What It Includes

Transferring vehicle ownership, even between family members or close friends, requires official documentation. This is primarily to satisfy state and federal regulations regarding vehicle registration, title transfer, and sales tax. When a vehicle is gifted, no money changes hands, which means there isn’t a traditional bill of sale to prove the transaction. This is precisely why a gift letter is needed – it serves as that official declaration, stating clearly that the vehicle was given as a gift and not purchased.

One of the biggest advantages of using a gift letter is its role in sales tax exemption. In many states, if a vehicle is truly gifted, the recipient might be exempt from paying sales tax on its value. Without a formal gift letter, the DMV might assume a sale took place and require you to pay sales tax based on the vehicle’s market value, which can be a significant unexpected expense. Furthermore, a gift letter protects the giver by clearly documenting that they are no longer the owner, thus removing any future liability related to the vehicle.

Beyond sales tax, a gift letter is vital for the smooth transfer of the vehicle title and subsequent registration in the recipient’s name. It provides a legal record that the transfer was legitimate and completed with the full consent of the original owner. This formal documentation ensures that all parties comply with state laws, making the entire process transparent and legally sound. It also helps to prevent any disputes or misunderstandings about the vehicle’s ownership in the future.

Ultimately, whether you are the giver or the recipient, having a properly executed vehicle gift letter is about peace of mind and adhering to legal requirements. It transforms a personal act of generosity into a fully recognized legal transaction, ensuring a seamless transition of ownership and avoiding any costly surprises.

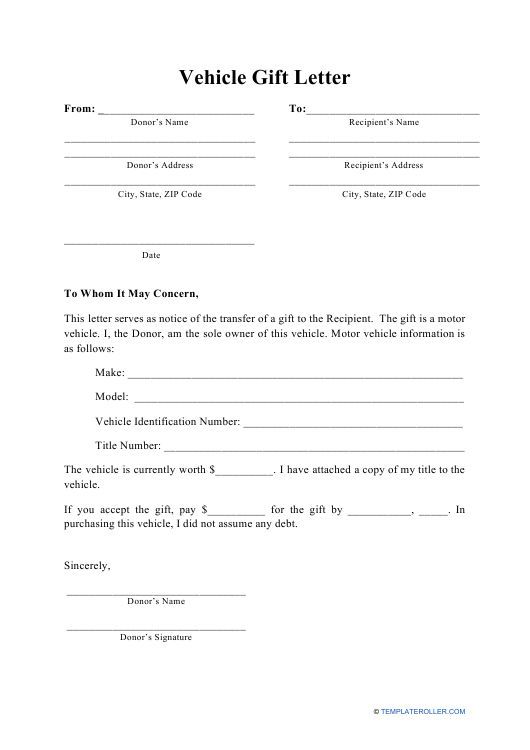

Key Information to Include in Your Gift Letter

- Giver’s Information: Full legal name, current address, and contact number of the person giving the vehicle.

- Recipient’s Information: Full legal name, current address, and contact number of the person receiving the vehicle.

- Vehicle Details: The complete make, model, year, and Vehicle Identification Number (VIN) of the gifted car. It’s also wise to include the current odometer reading.

- Statement of Gift: A clear and unambiguous statement that the vehicle is being transferred as a gift, with no monetary exchange taking place. For example, “I, [Giver’s Name], hereby declare that I am gifting the vehicle described below to [Recipient’s Name].”

- Date of Transfer: The specific date on which the vehicle ownership is officially being transferred.

- Signatures: The signature of the giver (and often the recipient), along with the printed names and dates of signing.

- Notary Public Acknowledgment: Depending on your state’s requirements, the letter may need to be notarized to be legally binding. Check with your local DMV.

Crafting Your Gift Letter: Tips and Best Practices

When preparing your gift letter, clarity and accuracy are paramount. The language should be straightforward, avoiding any ambiguity that could lead to questions from the DMV or other authorities. Ensure all names, addresses, and vehicle details are spelled correctly and match those on existing documents like the vehicle title. Any discrepancies could cause delays or require additional paperwork to correct. Taking the time to double-check every piece of information before signing is a crucial step that can prevent future complications.

Beyond the content of the letter itself, it’s important to understand the broader context of gifting a vehicle. Each state has its own specific requirements regarding gift letters, title transfers, and sales tax exemptions. Before you even start drafting your letter, it’s highly recommended to contact your state’s Department of Motor Vehicles (DMV) or equivalent agency. They can provide precise guidance on what documents are needed, whether notarization is required, and any specific wording that must be included in your gift letter to qualify for tax exemptions.

Remember that a gift letter is just one piece of the puzzle. You will also need the original vehicle title, properly signed over by the giver, and potentially other forms depending on your state. These could include an odometer disclosure statement, a lien release (if applicable), or a power of attorney if someone is acting on behalf of the giver or receiver. Having all these documents prepared simultaneously will streamline the transfer process significantly.

Once your gift letter is complete and all other necessary documents are assembled, make sure to keep multiple copies. The original should go with the title transfer paperwork to the DMV, but both the giver and the receiver should retain copies for their records. This provides a backup in case of any issues and serves as proof of the transaction for tax purposes or future inquiries. A well-prepared gift letter template for vehicle transfers, combined with diligent preparation, ensures a stress-free experience for everyone involved.

Gifting a vehicle is a wonderful gesture, and with a little preparation, the administrative side can be just as smooth as the joy of the giving itself. By understanding the importance of a formal gift letter and including all the necessary details, you ensure a clear and legal transfer of ownership. This attention to detail protects both parties from potential legal and financial complications.

Taking the time to craft a precise and comprehensive vehicle gift letter, along with gathering all supporting documents, will pay dividends in peace of mind. It transforms a thoughtful present into a fully compliant legal transaction, allowing the recipient to enjoy their new vehicle without any lingering worries about paperwork or unexpected fees.