Buying a home is often one of the biggest and most exciting milestones in life. The journey, however, comes with its share of challenges, and one of the most significant hurdles for many aspiring homeowners is saving up for the down payment. It’s an obstacle that can seem daunting, but thankfully, family often steps in to lend a helping hand, turning what seems like an impossible dream into a tangible reality. This generous support from loved ones can make all the difference in achieving homeownership.

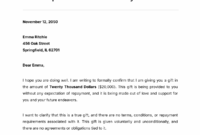

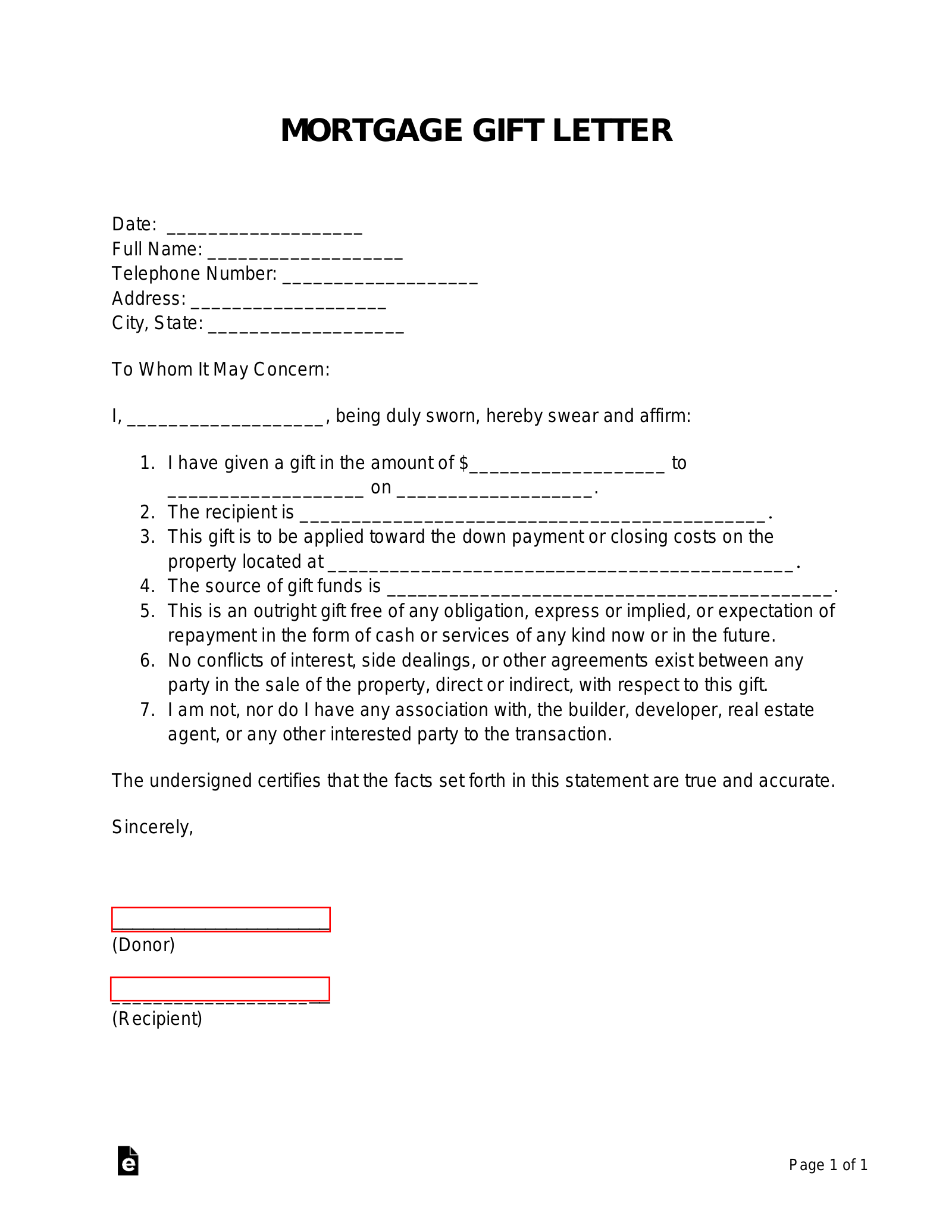

When financial gifts are involved in a home purchase, especially for a down payment, lenders require proper documentation to ensure everything is above board. This is where a gift letter comes into play. It’s a crucial document that clarifies the funds are indeed a gift and not a loan that needs to be repaid, which could impact your debt-to-income ratio. Understanding the ins and outs of this letter and having a reliable gift letter template for down payment ready can streamline your mortgage application process significantly.

Understanding the Importance of a Down Payment Gift Letter

When you’re applying for a mortgage, lenders are primarily concerned with your ability to repay the loan. They scrutinize every aspect of your financial situation, from your income and credit score to the source of your funds for the down payment and closing costs. If a significant portion of your down payment comes from a gift, the lender needs assurance that these funds are not secretly a loan. A gift letter serves as this official declaration, stating unequivocally that the money has been given freely, with no expectation of repayment. Without this letter, gifted funds might be viewed as an unrecorded debt, potentially jeopardizing your mortgage approval.

Imagine you’ve received a substantial amount from your parents to help with your home purchase. While this is wonderful news for you, your mortgage lender sees a large deposit in your bank account that isn’t from your regular income. They need to understand its origin to assess your true financial standing. They want to ensure that once you own the home, you won’t be burdened by an additional repayment obligation to your family, which could strain your finances and increase the risk of you defaulting on your mortgage. This document provides the transparency they need to feel confident in your financial stability.

Furthermore, a gift letter protects all parties involved. For the donor, it clarifies that they are not entering into a lending agreement. For the recipient, it solidifies the fact that these funds are a gift, not a debt. And for the lender, it provides a clear, legally sound record for their underwriting process, confirming that your debt-to-income ratio accurately reflects your obligations without any hidden liabilities. It’s a simple, yet powerful, piece of documentation that ensures a smooth transaction.

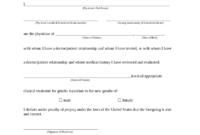

What information is typically needed to make this letter effective and acceptable to lenders? It’s more than just a casual note; it needs specific details to meet legal and financial requirements. Providing accurate and complete information is paramount to avoid delays in your mortgage application.

Key Information to Include in Your Gift Letter

- Gifter’s Full Name, Address, and Contact Information: This identifies the generous individual or couple providing the funds.

- Relationship to the Borrower: Clearly state how the gifter is related to you (e.g., parent, grandparent, sibling).

- The Exact Amount of the Gift: Specify the precise sum of money being gifted.

- Date the Gift Was Provided: The date when the funds were transferred or made available.

- A Clear Statement of No Repayment: Crucially, the letter must explicitly state that the funds are a true gift and that no repayment, explicit or implied, is expected from the borrower.

- Borrower’s Full Name and Address: Identifies the recipient of the gift.

- Property Address (if known): While not always mandatory at the initial stage, including the address of the property being purchased can be helpful.

- Gifter’s Signature and Date: The legal sign-off from the person giving the gift.

- Borrower’s Signature and Date (Often Required): In many cases, the lender will also want the borrower to sign, acknowledging receipt and understanding.

Navigating the Gift Letter Process and Common Scenarios

Getting the timing right for your gift and the accompanying letter is quite important. Lenders typically prefer to see gifted funds “seasoned” in your bank account for at least 60 days before you apply for a mortgage. This means the money should be in your account and appear on two consecutive bank statements, demonstrating it’s not a sudden, unexplained deposit. However, if the gift is received closer to your application date or even during the process, the gift letter becomes even more critical. It clarifies the source of the recent deposit, preventing it from raising red flags with the underwriter. Always consult with your loan officer about the best timing for receiving gift funds and submitting the letter.

Gift funds can come from various sources, but lenders usually have specific rules about who can be a donor. Typically, immediate family members such as parents, grandparents, and siblings are acceptable donors. In some cases, other relatives like aunts, uncles, or even close friends may be permitted, but this varies by loan program and lender guidelines. For example, an FHA loan generally allows gifts from relatives, while conventional loans might be more flexible with non-relatives if there’s a documented familial relationship. Always confirm eligible donors with your mortgage lender to avoid any surprises later in the process.

Be aware of what lenders call “large deposits.” Any deposit into your bank account that isn’t part of your regular income and is unusually large will draw scrutiny. If you deposit gift funds without a corresponding gift letter, the lender will require documentation to explain the source. This is why having your gift letter prepared and ready, ideally before the funds are even transferred, is a smart move. It preempts questions and keeps your mortgage application moving smoothly without unnecessary delays. It’s far easier to provide the letter upfront than to scramble for it when the underwriter requests clarification.

It’s also worth a quick mention that while the gift helps you, the tax implications generally fall on the donor, not the recipient. In the United States, if a gift exceeds the annual exclusion amount set by the IRS (which changes periodically), the donor may need to file a gift tax return. This is generally for informational purposes and rarely results in actual taxes owed unless the donor has exhausted their lifetime gift tax exemption. As the homebuyer, you typically don’t incur income tax on gifted funds for a down payment. However, it’s always wise for the donor to consult a tax professional regarding significant gifts. For you, the focus remains on ensuring the financial gift is properly documented for your mortgage.

Ultimately, having a clear and comprehensive gift letter template for down payment ready to go can save you a lot of stress and time. It’s a foundational document that facilitates one of the most heartwarming forms of financial assistance for homeownership. Preparing this ahead of time ensures that the generosity of your loved ones translates seamlessly into the realization of your dream home.

Navigating the financial requirements of buying a home can feel like a complex maze, but with the right tools and information, it becomes a much clearer path. A gift letter is a perfect example of a simple document that plays a pivotal role in smoothing out one of the most common financial hurdles for homebuyers. It transforms a generous act of family support into an official, lender-approved contribution, ensuring your homeownership journey continues without a hitch.

By understanding its purpose and ensuring all necessary details are included, you equip yourself for a seamless mortgage application process. This attention to detail allows you to focus on the exciting parts of buying a home, like choosing paint colors and planning your move, rather than getting bogged down in paperwork. With your financial ducks in a row, thanks to a well-prepared gift letter, you’re one significant step closer to unlocking the door to your very own home.