Receiving a collection notice can be an incredibly stressful experience, often bringing with it a wave of anxiety and uncertainty about what to do next. It is easy to feel overwhelmed, especially when unfamiliar names or amounts appear on statements you did not expect. However, it is crucial to remember that you have rights designed to protect consumers from unfair or inaccurate collection practices, and the first step in exercising those rights often involves a formal response.

Taking control of the situation starts with clear communication. Instead of ignoring the notice, which can lead to further complications, a well-crafted dispute letter can be your most powerful tool. This letter formally questions the validity of the debt, stops collection activity while the debt is verified, and protects your credit report from potentially incorrect information. Understanding how to construct such a letter, or better yet, having access to a reliable dispute letter template for collection, can make all the difference.

The Indispensable Role of a Formal Dispute

When a collection agency contacts you regarding an alleged debt, whether by mail or phone, your immediate response should be to verify the debt’s authenticity. This is not just a suggestion; it is a right granted to you under the Fair Debt Collection Practices Act FDCPA. Sending a formal dispute letter within 30 days of receiving the initial communication from the debt collector is vital. This action puts the onus on the collection agency to provide proof that you owe the debt, and that the amount is accurate. Without such proof, they cannot continue collection efforts or report the debt to credit bureaus.

A well-composed dispute letter serves multiple purposes. It officially notifies the collector that you are questioning the debt, which, by law, compels them to cease all collection activity until they have validated the debt. This includes stopping phone calls and letters. Furthermore, it safeguards your credit rating. If the debt turns out to be inaccurate or unvalidated, you have a documented record of your dispute, which can be essential if it later appears on your credit report. It is your way of saying, “Prove it,” before any further action can be taken.

Many different scenarios might prompt you to dispute a debt. Perhaps you are a victim of identity theft, and the debt is not yours at all. Maybe you have already paid the debt, and there has been a clerical error. It could be that the amount is incorrect, or the debt is simply too old to be legally collected, known as being past the statute of limitations. Whatever the reason, having a clear and concise way to state your case is paramount to protecting your financial well-being.

Your dispute letter is more than just a complaint; it is a formal legal document. It needs to be precise, polite yet firm, and contain specific information to be effective. A vague letter might not trigger the collection agency’s obligation to validate the debt, leaving you vulnerable to continued collection efforts.

Critical Information to Include in Your Dispute Letter

- Your full name and current address.

- The account number or reference number provided by the collection agency.

- The name of the original creditor.

- A clear statement that you dispute the debt and are requesting validation.

- A request for specific information, such as the original creditor’s name, the original account number, the amount of the original debt, and any records demonstrating you owe the debt.

- A statement clarifying that this is not a promise to pay the debt.

Effectively Using a Dispute Letter Template For Collection

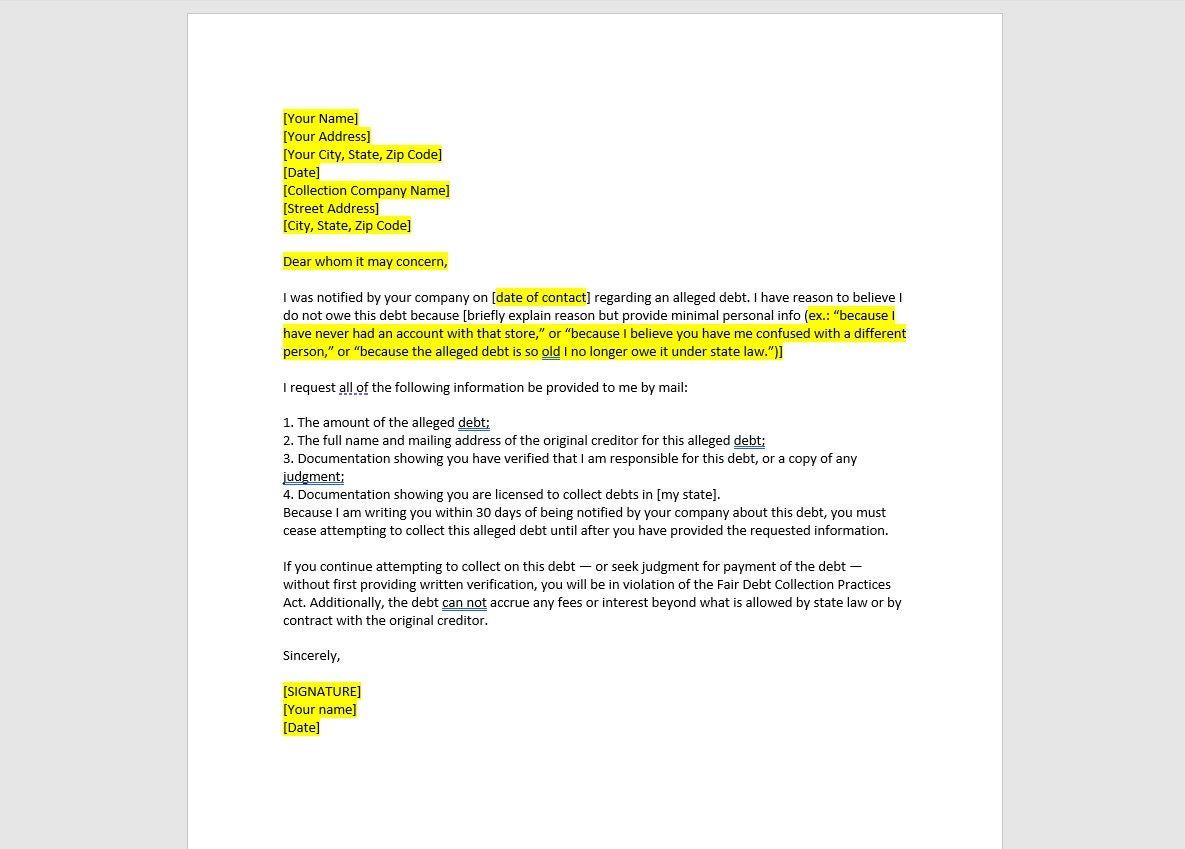

Utilizing a dispute letter template for collection can greatly simplify this often-complex process, ensuring you include all necessary legal language and information without missing crucial details. These templates provide a structured framework, allowing you to fill in your specific details while maintaining a professional and assertive tone. The goal is to clearly articulate your dispute and demand validation, leaving no room for misinterpretation by the collection agency. It is important to remember that while a template offers convenience, you should always review and customize it to fit the unique circumstances of your situation.

Once your dispute letter is drafted, the method of sending it is just as important as its content. Always send your letter via certified mail with a return receipt requested. This provides you with irrefutable proof that the collection agency received your letter and on what date. This proof is invaluable if the agency fails to respond or continues collection efforts without validating the debt, giving you a strong position should you need to take further action or report them to regulatory bodies. Without this documentation, it can be your word against theirs, which is a position you want to avoid.

After sending the letter, the collection agency has a legal obligation to respond to your request for validation within a reasonable timeframe. During this period, they are prohibited from contacting you further about the debt or reporting it to credit bureaus. If they fail to provide sufficient validation, or if the debt is indeed proven to be invalid, they must cease all collection activities and remove any negative entries from your credit report. If they provide validation, you can then review the information to determine your next steps.

A good template will guide you through all the essential components of a powerful dispute letter, from the initial contact information to the closing statements. It ensures you cite your rights under the FDCPA, specifically demanding that the collection agency provide substantiation for the debt they claim you owe. This structured approach helps you stand firm in protecting your consumer rights and financial standing against potentially erroneous or unfair collection attempts.

A comprehensive dispute letter should generally include the following elements:

- The current date.

- Your full name and contact information.

- The collection agency’s name and address.

- A formal salutation addressed to the collection agency.

- A clear subject line identifying the account in question.

- A body paragraph stating that you dispute the debt, referencing your rights under the FDCPA.

- A request for specific validation documents.

- A closing statement that reiterates your dispute and the expectation of validation.

- Your signature above your typed name.

Navigating the landscape of debt collection can be daunting, but with the right tools and knowledge, you can effectively challenge inaccurate or unverified debts. Taking proactive steps by sending a formal dispute letter is a powerful way to assert your consumer rights and ensure that only legitimate debts appear on your record. It is about taking control of your financial narrative rather than passively accepting claims that might be incorrect.

Empowering yourself with a solid dispute letter is a crucial step towards maintaining a healthy credit profile and peace of mind. By demanding validation and exercising your rights, you are not only addressing a specific collection notice but also building good habits for financial advocacy. Remember, you have a right to know who you owe, why you owe it, and that the amount is correct.