Have you ever noticed an unexpected hard inquiry on your credit report and wondered where it came from? It can be quite a frustrating experience to see something negatively impacting your credit score, especially when you didn’t authorize it. Many people find themselves in this exact situation, often feeling confused about how to address such an issue and protect their financial well-being.

The good news is that you don’t have to just accept unauthorized inquiries. You have the right to dispute them, and a well-crafted letter is your most powerful tool in this process. Understanding how to effectively challenge these entries can make a significant difference in maintaining a healthy credit profile. This guide will walk you through the essential steps and help you build your own effective communication strategy.

Understanding Credit Inquiries and Their Impact

Before diving into how to dispute an inquiry, it’s crucial to understand what credit inquiries are and the different types you might encounter. Essentially, a credit inquiry is a request for your credit report information. These requests are logged by credit bureaus (Equifax, Experian, and TransUnion) and can be initiated by various entities, including yourself or potential lenders. The key distinction lies between “soft” and “hard” inquiries.

Soft inquiries usually happen when you check your own credit report, or when a potential lender pre-approves you for an offer without you explicitly applying. These types of inquiries do not affect your credit score and are not visible to other lenders. They are harmless checks that provide a general overview without implying a new credit application.

On the other hand, hard inquiries, also known as “hard pulls,” occur when a lender legitimately checks your credit history because you have applied for new credit, such as a loan, credit card, mortgage, or even some rental applications. Each hard inquiry can cause a small, temporary dip in your credit score, typically lasting for about 12 months, although it remains on your report for two years. A cluster of hard inquiries in a short period can signal to lenders that you might be a higher risk, as it suggests you’re seeking a lot of new credit.

Types of Credit Inquiries

- Soft Inquiries: These do not impact your credit score. They often occur when you review your own credit report, or when a lender conducts a pre-screen for a credit offer. Other examples include background checks for employment or insurance purposes.

- Hard Inquiries: These can temporarily lower your credit score by a few points. They are typically generated when you formally apply for new credit, such as a credit card, car loan, mortgage, or personal loan. Lenders use these to assess your creditworthiness.

It is the hard inquiries that typically cause concern and are the focus when discussing disputes. An unauthorized hard inquiry might appear due to identity theft, a clerical error, or if a company pulled your credit without your explicit permission for a credit application. Identifying and acting on these discrepancies is vital for protecting your financial standing.

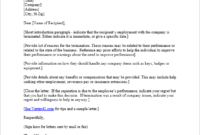

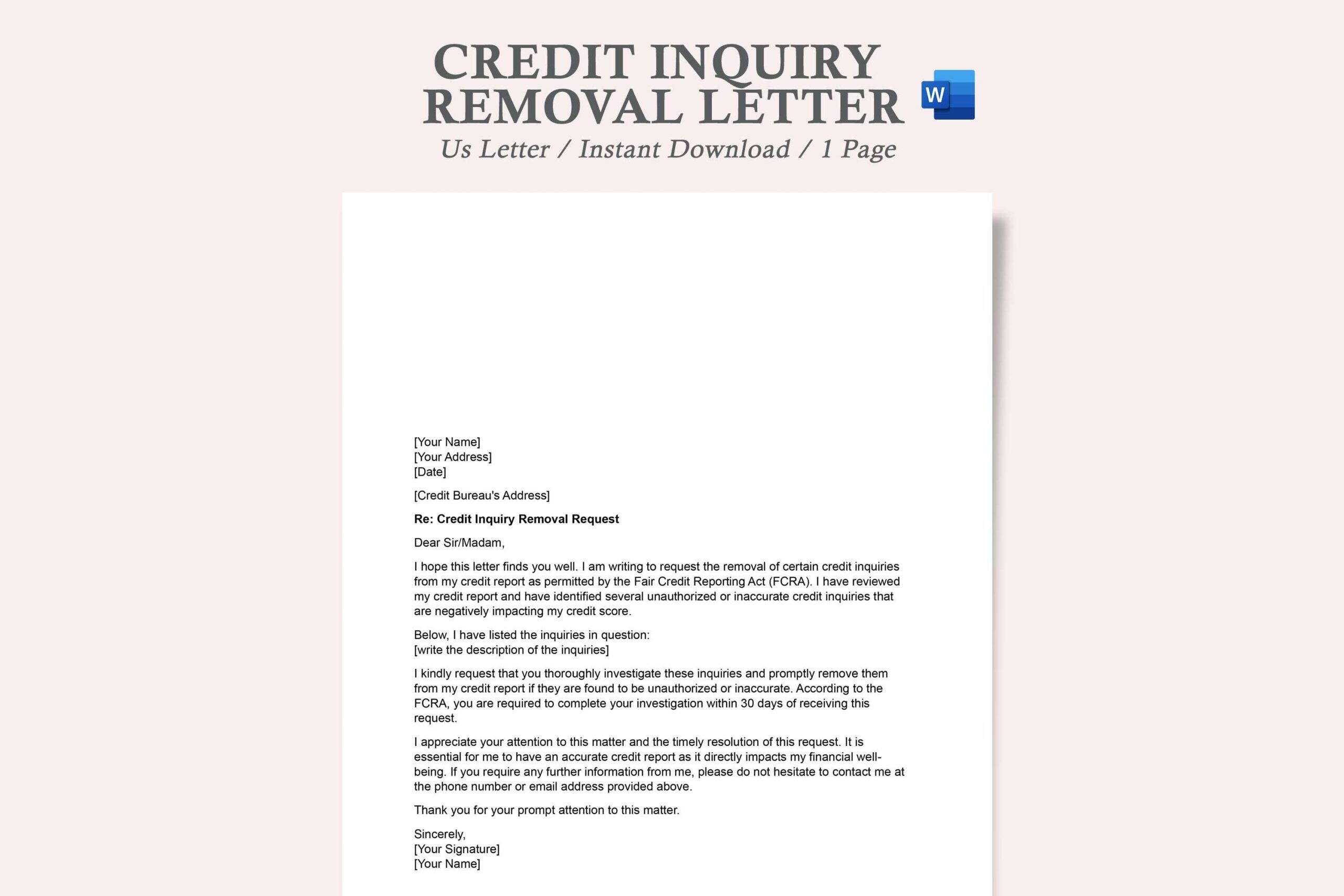

Crafting Your Dispute Credit Inquiry Removal Letter Template

When you discover an unauthorized hard inquiry on your credit report, taking swift and decisive action is key. A carefully written letter is your primary tool for communicating with the credit bureaus and the original creditor to request the removal of such an inquiry. This process can seem daunting, but by understanding the core components of an effective dispute, you can create a powerful document.

Your dispute credit inquiry removal letter template should be clear, concise, and professional. It needs to articulate precisely why you believe the inquiry is unauthorized and what action you expect the recipient to take. Remember, you are providing them with information to investigate and rectify an error that is impacting your financial health. Ensure you focus on facts and avoid emotional language.

Essential Components of Your Dispute Letter

- Your Full Name and Contact Information: Include your current address, phone number, and email.

- Credit Bureau’s Full Name and Address: Address the letter to the specific credit bureau (Equifax, Experian, or TransUnion) that shows the unauthorized inquiry.

- Date: The date you are sending the letter.

- Subject Line: Clearly state the purpose, for example: “Dispute of Unauthorized Credit Inquiry – [Your Name] – Account Number [Your Account Number if applicable].”

- Statement of Dispute: Clearly state that you are disputing an unauthorized hard inquiry. Provide the exact date of the inquiry, the name of the creditor who made the inquiry, and the account number associated with it (if any).

- Reason for Dispute: Explain why you believe the inquiry is unauthorized. This could be due to identity theft, a misunderstanding, or simply no application being made.

- Request for Removal: Politely but firmly request the complete removal of the inquiry from your credit report.

- Supporting Documents: Mention any documents you are enclosing to support your claim (e.g., police report for identity theft, fraud affidavit).

- Your Signature: Sign the letter.

Once your dispute credit inquiry removal letter template is complete, it’s recommended to send it via certified mail with a return receipt requested. This provides you with proof that the letter was sent and received, which is invaluable if further action is required. Always keep a copy of the letter and all supporting documents for your own records. The credit bureaus are legally required to investigate your dispute within a certain timeframe, typically 30 days, and notify you of the outcome. Following these steps diligently empowers you to correct inaccuracies and maintain a healthy credit profile.

Taking charge of your credit report is an important aspect of financial literacy and personal empowerment. By understanding how to identify and dispute unauthorized entries, you are actively protecting your financial future. Regularly monitoring your credit reports for any suspicious activity is a habit that will serve you well in the long run.

Having the knowledge and the tools, like a well-structured dispute letter, can give you peace of mind. It allows you to confidently address discrepancies and ensure your credit history accurately reflects your financial behavior. Remember, your credit report is a dynamic document, and you play a crucial role in its accuracy and health.