Finding yourself in a situation where someone owes you money can be frustrating, to say the least. Whether it’s an unpaid invoice for services rendered, an overdue personal loan, or a business debt that has gone ignored, pursuing what you are rightfully owed often requires a structured approach. You might have tried verbal reminders or informal emails, but when those avenues fail, it’s time to elevate your efforts.

This is where a formal demand for payment letter comes into play. It’s a professional and serious step before considering legal action, clearly outlining the debt and your expectation for its repayment. Instead of starting from scratch and potentially missing crucial details, leveraging a demand for payment letter template can make all the difference, providing a clear roadmap to ensure your communication is effective and legally sound.

What is a Demand for Payment Letter and Why Do You Need One?

A demand for payment letter is a formal written request sent to an individual or entity that owes you money, outlining the debt, the amount owed, and the deadline for payment. Think of it as a formal heads-up, a final courtesy before you consider taking more drastic measures like litigation or involving collections agencies. Its primary purpose is to clearly state your claim, provide details of the outstanding amount, and demand a specific action from the debtor.

The benefits of sending such a letter are numerous. Firstly, it adds a layer of professionalism and seriousness that informal communications often lack. It clearly establishes a paper trail, which is incredibly useful should the matter escalate to court. It demonstrates that you have made a good faith effort to resolve the dispute amicably, strengthening your position in any potential legal proceedings. Furthermore, it often serves as a powerful psychological trigger, prompting the debtor to take your claim seriously and prioritize your payment.

This letter is typically sent after initial reminders have been ignored and before you engage legal counsel. It acts as a formal declaration of your intent to collect the debt and often includes a warning about the consequences of non-payment. By sending this, you are not only giving the debtor a final chance to settle but also building a solid foundation for any future actions you might need to take.

Ultimately, a well-crafted demand for payment letter can often resolve disputes without the need for costly and time-consuming legal battles. It clarifies the situation for all parties involved and provides a final opportunity for the debtor to fulfill their obligation.

Key Elements to Include

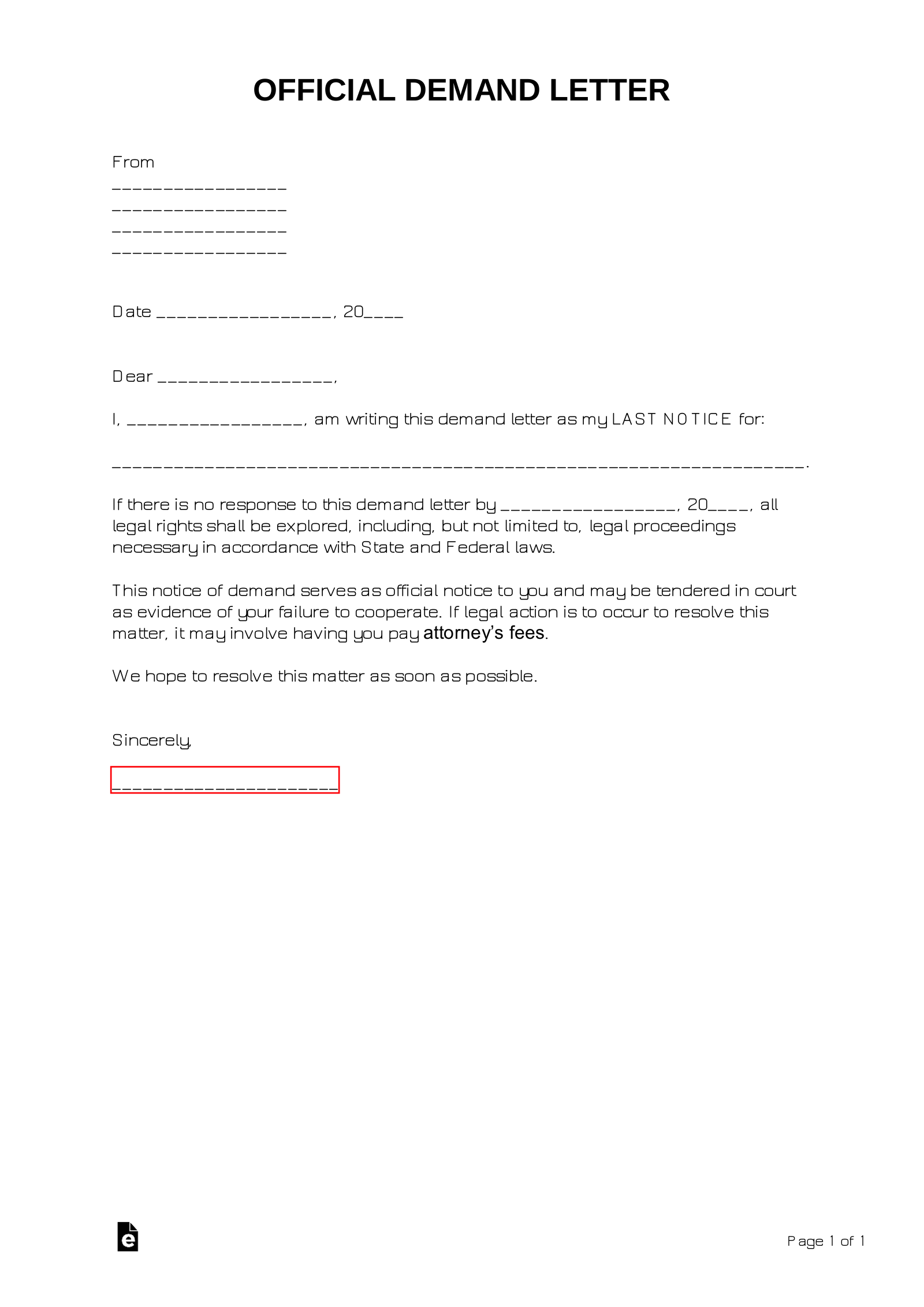

To ensure your demand for payment letter is effective, it must contain specific information. Missing even one detail could weaken your claim or create ambiguity. Here’s what you should always include:

- Sender and Recipient Information: Clearly state who you are and who the letter is addressed to, including full names and addresses.

- Date of Letter: Essential for documenting when the formal demand was made.

- Clear Statement of Debt: Explicitly state the purpose of the letter and that it is a demand for payment.

- Original Invoice Details: Reference the original invoice number, contract, or agreement that generated the debt.

- Amount Owed: State the exact amount of money owed, breaking it down if there are multiple charges or late fees.

- Due Date for Payment: Provide a reasonable deadline by which the payment must be received, typically 7 to 14 days from the letter’s date.

- Consequences of Non-Payment: Clearly outline what steps you will take if the payment is not received by the deadline, such as legal action or reporting to credit bureaus.

- Payment Options: Provide clear instructions on how the debtor can make the payment.

- Professional Closing: Sign off professionally, reiterating your expectation for prompt payment.

Crafting an Effective Demand for Payment Letter

When you sit down to write your letter, remember that tone and clarity are paramount. While you are demanding payment, the language should remain firm but professional, avoiding any aggressive or emotional rhetoric. The goal is to elicit payment, not to alienate the debtor further. A calm, factual presentation of the situation is far more effective than an angry one. Ensure every sentence is clear, concise, and unambiguous, leaving no room for misinterpretation regarding the debt or the expected action.

Specificity is key. This isn’t the place for vague statements. You must detail the exact amount owed, the date the payment was originally due, and precisely what the payment is for. Include references to any contracts, agreements, or original invoices. The more specific you are, the harder it is for the debtor to claim ignorance or dispute the validity of the debt. If possible, attach copies of these supporting documents to the letter itself, reinforcing your claim with irrefutable evidence.

The method of delivery for your demand for payment letter also holds significant importance. For critical communications like this, simply dropping it in the mail is often not enough. Consider sending it via certified mail with a return receipt requested. This provides undeniable proof that the letter was sent and received by the debtor, which is invaluable if you end up pursuing legal action. Alternatively, an email with a read receipt can also serve as proof, but certified mail is generally considered the more formal and legally robust option.

Finally, always maintain a detailed record of all correspondence. This includes copies of the letter itself, any enclosures, proof of mailing, and any subsequent communications, whether by email or phone. This comprehensive record will be your best asset if the situation does not resolve and you need to take further steps. It showcases your due diligence and provides a clear timeline of your efforts to collect the debt.

A carefully prepared demand for payment letter can often be the turning point in recovering overdue funds. It clearly communicates your intent and the seriousness of the situation, often prompting debtors to act before further escalation. By following a structured approach and ensuring all essential details are included, you increase your chances of a successful resolution without the need for court intervention. Utilizing a reliable demand for payment letter template can be an invaluable asset in this process, guiding you through the necessary steps and ensuring your communication is both professional and effective.