Finding an unexpected or incorrect charge on your credit card statement can be quite frustrating and even a little alarming. Whether it is a subscription you thought you canceled, a duplicate charge for a single purchase, or a transaction you simply do not recognize, swift action is often necessary to protect your finances and credit score. It is a common situation many consumers face, and understanding the right steps to take can make all the difference in resolving the issue smoothly.

While a phone call to your credit card company might seem like the quickest solution, a formal written dispute carries significant weight. It creates an official record of your complaint, ensuring your concerns are properly documented and processed according to consumer protection laws. This article will guide you through the importance of this formal communication and help you understand how to effectively address these financial discrepancies.

Understanding Why a Dispute Letter is Crucial

When you discover an error on your statement, your immediate thought might be to pick up the phone. While this can be a good first step for initial clarification, it often falls short for a formal dispute. A written letter transforms a casual complaint into an official notification, triggering specific protections under federal law, particularly the Fair Credit Billing Act (FCBA). This act provides consumers with the right to dispute billing errors and requires creditors to investigate these claims promptly. Without a written record, it can be challenging to prove when and how you initiated your dispute, potentially weakening your case if further action is needed.

Think of your dispute letter as a formal declaration of your position. It clearly outlines the problem, provides all necessary details, and formally requests an investigation and resolution. This paper trail is invaluable should the issue escalate or if you need to refer back to your original complaint. It demonstrates to your credit card issuer that you are serious about resolving the matter and have followed the proper procedures. It also holds them accountable for responding within specific timeframes as mandated by law.

Beyond legal protections, a well-crafted letter ensures clarity. Verbal communications can sometimes lead to misunderstandings or misinterpretations. With a written letter, every detail is laid out precisely, leaving little room for ambiguity. This precision helps your credit card company investigate more efficiently, as they have all the facts at their fingertips, reducing the back and forth that often characterizes phone conversations.

Moreover, sending a formal letter can also protect your credit rating. Under the FCBA, once you send a written dispute, your creditor cannot report the disputed amount as delinquent to credit bureaus while they are investigating. This prevents potential damage to your credit score during the resolution process, which is a significant relief for anyone concerned about their financial standing.

Key Information Your Letter Must Include

- Your full name and account number clearly stated at the top.

- The specific transaction date and amount of the disputed charge.

- A clear and concise explanation of why you are disputing the charge.

- Any supporting evidence you have, such as receipts, emails, or cancellation confirmations.

- The desired resolution, whether it is a credit, a refund, or removal of the charge.

- Your contact information for follow-up communication.

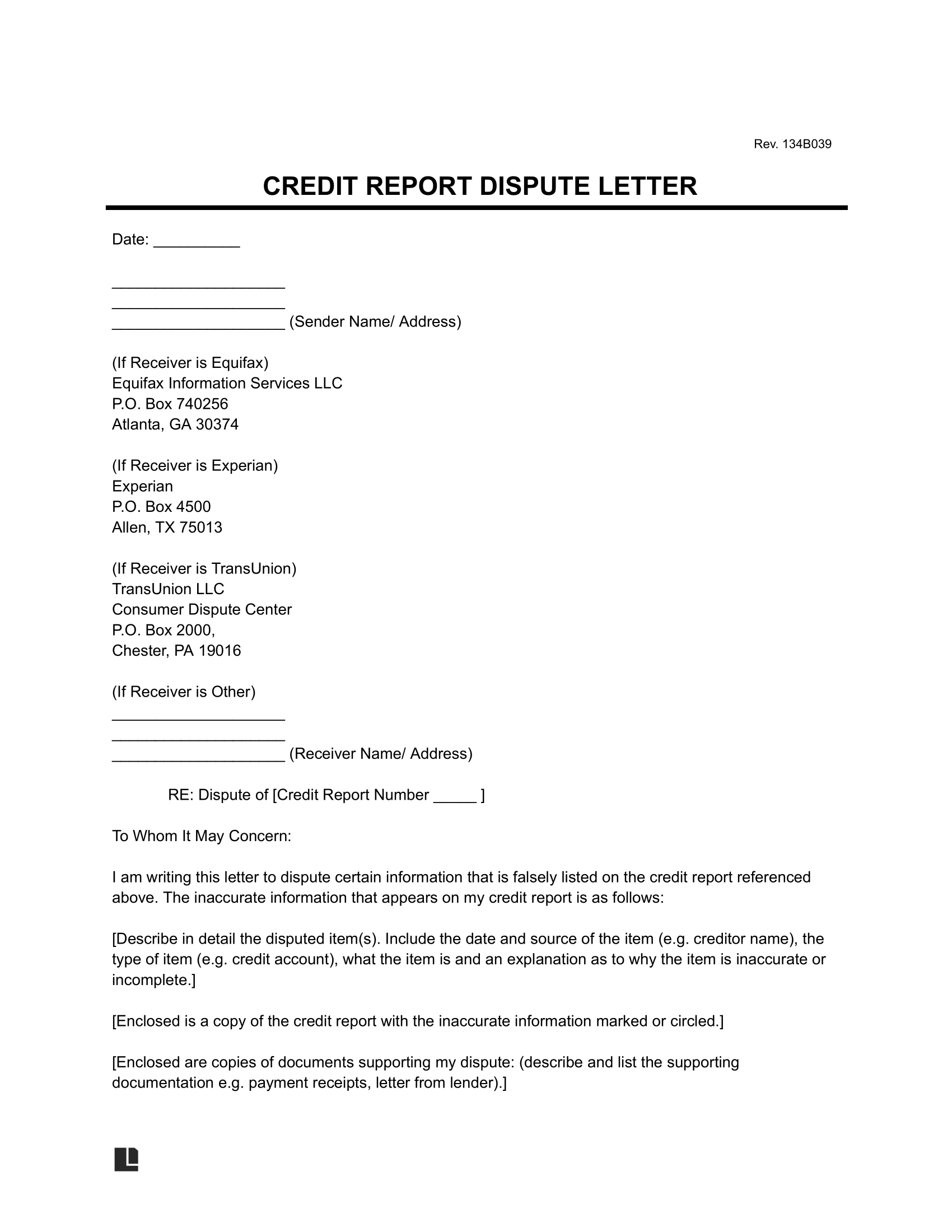

Crafting Your Credit Card Dispute Letter Template

Developing an effective credit card dispute letter template involves more than just listing the facts; it is about presenting them in a clear, professional, and persuasive manner. The letter should be addressed directly to the billing inquiries department of your credit card company, not necessarily the merchant. Your credit card issuer is the entity legally responsible for handling your billing error disputes under the FCBA, and directing your communication to them ensures it is processed correctly. It is important to maintain a respectful but firm tone, focusing on the facts of the situation rather than emotional appeals.

Begin your letter by clearly stating your purpose: you are disputing a charge on your account. Provide your account number immediately to help the issuer identify your file quickly. Then, meticulously detail the transaction in question. Include the date of the charge, the merchant’s name, the amount, and any transaction or reference numbers you might have. This level of detail is critical for your credit card company to locate the specific charge in their records and begin their investigation promptly.

The core of your letter will be the explanation of why you believe the charge is erroneous. Be specific. Did you cancel a service but were still billed? Was the amount charged different from what you authorized? Did you never receive the goods or services you paid for? Or perhaps it is a fraudulent charge you did not authorize at all. Back up your claim with any documentation you possess. This could include copies of receipts, order confirmations, communication with the merchant, proof of cancellation, or bank statements showing duplicate charges. The more evidence you provide, the stronger your case.

Finally, clearly state what action you expect your credit card company to take. This usually involves removing the charge from your account and issuing a credit. Also, request that they investigate the matter thoroughly and provide you with an update on their findings within the legally stipulated timeframe. Remember to keep a copy of everything you send, including the letter and all supporting documents, for your own records. This comprehensive approach, guided by a well-structured credit card dispute letter template, significantly increases your chances of a successful resolution.

When faced with an incorrect charge, taking the proactive step of drafting a detailed dispute letter empowers you to assert your consumer rights effectively. This formal communication acts as a robust foundation for resolving the issue, providing a clear record and triggering the protections designed to safeguard your financial interests. By understanding the elements of a strong dispute and carefully preparing your case, you put yourself in the best possible position to achieve a fair outcome.