Receiving a call or letter from a collection agency can feel incredibly overwhelming, often causing stress and anxiety. It’s a situation many people find themselves in, sometimes for debts they genuinely owe, and other times for amounts that are incorrect, already paid, or even entirely fraudulent. The immediate reaction might be to ignore it, but that’s rarely the best course of action. Taking proactive steps to address the situation is crucial for protecting your financial health and credit standing.

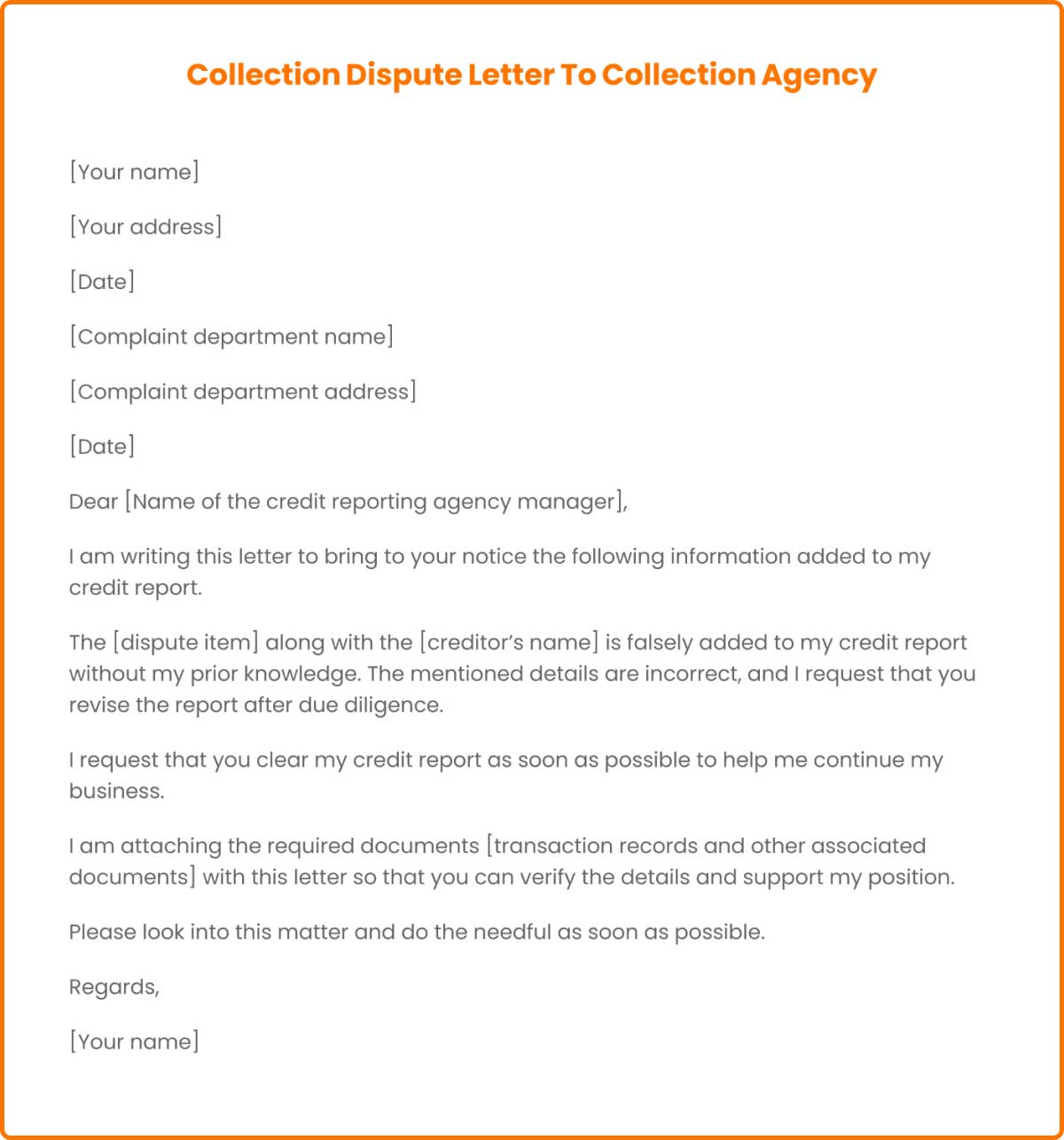

One of the most powerful tools at your disposal in these challenging circumstances is a well-crafted dispute letter. This isn’t just about telling them you disagree; it’s about formally asserting your consumer rights and initiating a process that can lead to resolution, validation, or even the removal of an inaccurate debt from your record. Understanding how to utilize a collection agency dispute letter template effectively can make all the difference in navigating these waters with confidence.

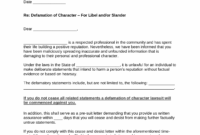

Why Sending a Dispute Letter is Your First Line of Defense

When a collection agency first contacts you about a debt, whether by mail or phone, the clock starts ticking on your rights. Under the Fair Debt Collection Practices Act (FDCPA), you have specific protections, and one of the most important is the right to dispute the debt. Within 30 days of receiving the initial communication, you can send a written dispute, which legally requires the collection agency to pause their collection efforts until they can provide validation of the debt. This isn’t just a suggestion; it’s a powerful legal right that can provide you with much-needed breathing room.

Disputing a debt verbally over the phone, while sometimes convenient, is often less effective and harder to prove later on. A written dispute, on the other hand, creates a clear, undeniable record of your communication. It demonstrates that you are serious about protecting your rights and that you expect them to adhere to legal guidelines. This paper trail can be invaluable if further action is needed, such as filing a complaint with a consumer protection agency or if the issue escalates.

By sending a dispute letter, you’re not admitting ownership of the debt. Instead, you’re simply asking the collection agency to prove that the debt is legitimate, that you owe it, and that they have the legal right to collect it. This process, known as debt validation, forces the agency to produce evidence like the original creditor’s name, the amount owed, and sometimes even copies of original agreements. If they cannot provide this validation within a reasonable timeframe, they are legally required to cease collection activities and remove the debt from your credit report.

This initial step is absolutely critical, as it can prevent an inaccurate debt from damaging your credit score. A properly sent dispute letter can stop reporting to credit bureaus temporarily, giving you the time to investigate and resolve the issue without immediate negative impact. It’s about being informed, being assertive, and ensuring that any financial obligation attributed to you is genuinely yours and accurately represented.

Key Elements Your Dispute Letter Must Include

- Your full name, address, and the account number (if provided by the collection agency).

- A clear statement that you dispute the debt. It’s often best to use phrases like “I dispute this debt” or “I am writing to dispute the validity of this debt.”

- A demand for debt validation, asking for specific information like the name of the original creditor, the amount of the debt, and proof that they have the right to collect it.

- A request that they cease all collection activities and communications until the debt has been fully validated.

- The current date and your physical signature.

- Always send your letter via certified mail with a return receipt requested. This provides irrefutable proof that the letter was sent and received.

Crafting Your Effective Collection Agency Dispute Letter Template

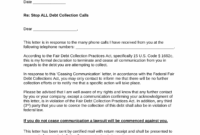

When preparing your dispute letter, the tone and clarity are just as important as the content. While you might feel frustrated or angry, keep your letter professional, concise, and factual. Avoid emotional language, admissions of guilt, or unnecessary details. The goal is to formally dispute the debt and request validation, not to engage in a lengthy explanation or argument. A well-structured collection agency dispute letter template will guide you to include all the necessary information without oversharing.

It’s also important to recognize that not all debt disputes are the same. You might be disputing the accuracy of the amount, claiming the debt isn’t yours due to identity theft, or asserting that the statute of limitations has expired. While the core request for validation remains consistent, you can briefly (and factually) mention the specific reason for your dispute if it helps clarify your position. However, always prioritize the request for validation above all else in your initial letter.

Once you’ve sent your dispute letter, the collection agency is legally bound to stop contacting you about that specific debt until they provide the requested validation. This period gives you time to gather your own records, review your credit report, and potentially seek legal advice if needed. If they fail to provide validation, or if the validation is insufficient, they must cease all collection efforts and cannot legally report the debt to credit bureaus. If they do provide validation, you then have the information needed to decide your next steps, whether that’s negotiating a settlement, paying the debt, or continuing to dispute it with stronger evidence.

Remember, organization is your ally in this process. Keep meticulous records of everything: a copy of the letter you sent, the certified mail receipt, any responses you receive from the collection agency, and notes from any phone conversations (though written communication is always preferred). This paper trail is your best defense and will be invaluable if you need to escalate your complaint to regulatory bodies or consult with an attorney.

- Do not admit that the debt is yours or make any promises to pay. Stick strictly to disputing the debt and requesting validation.

- Avoid providing sensitive personal information beyond what is necessary to identify the account.

- Aim to send your dispute letter within 30 days of the collection agency’s initial contact. This window grants you maximum legal protection under the FDCPA.

Taking charge of your financial situation by knowing your rights and how to act upon them is empowering. Utilizing a proper dispute letter is a crucial step in ensuring fair treatment and accuracy in debt collection. It allows you to pause the process, demand accountability, and protect your credit from potentially erroneous claims.

By understanding the importance of this initial written communication and diligently following through, you are not just reacting to a collection attempt, but actively shaping the outcome. This proactive approach helps safeguard your financial well-being and ensures that only legitimate and accurate debts impact your future.