Charitable contribution receipt templat, The Federal Trade Commission is proposing new rules for business opportunities sellers and inside this fresh set of proposed rules among the new stipulations will be that company opportunities sellers must present their customer or a receipt. What’s the Federal Trade Commission requiring this? Well, there have been instances of fraud where the buyer never got receipt and therefore could not prove that dated been ripped off. Meanwhile, there wasn’t any record of this trade in any way, no copy of these signed agreements in several cases and no method to get the purchaser’s money back. Sounds pretty shady to be. And that’s why or rather this is one of the reasons why the FTC can be one of a number of other new suggested changes requiring that business opportunities sellers provide receipts to their customers.

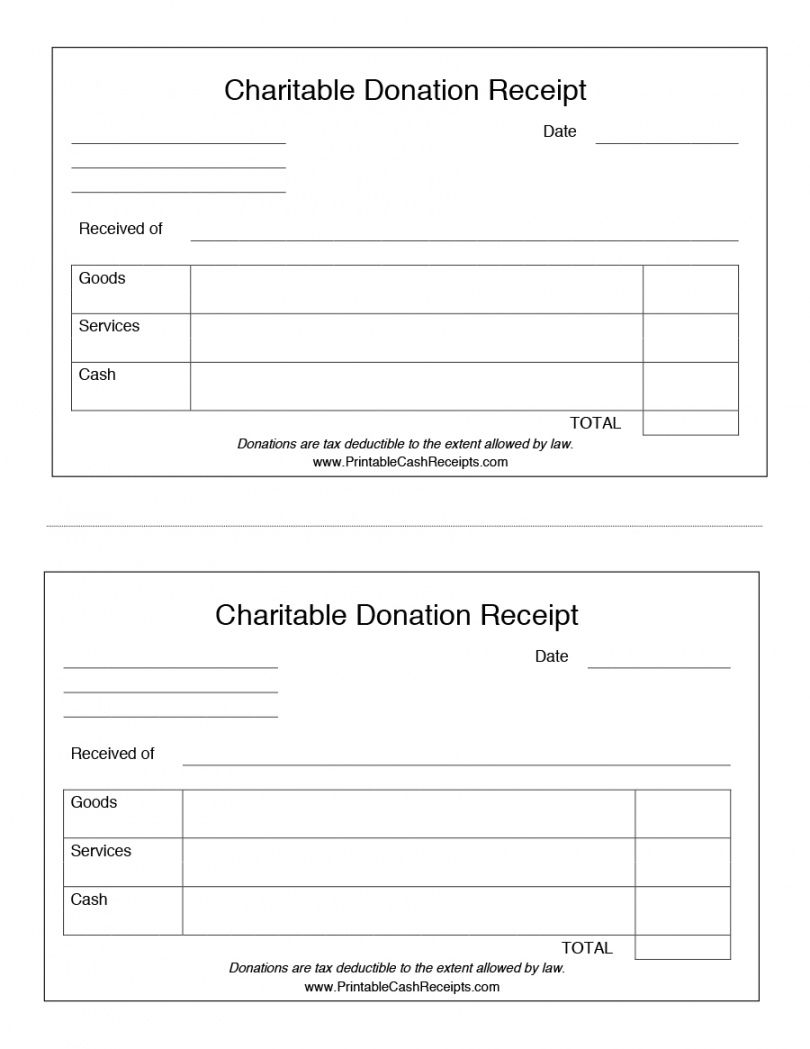

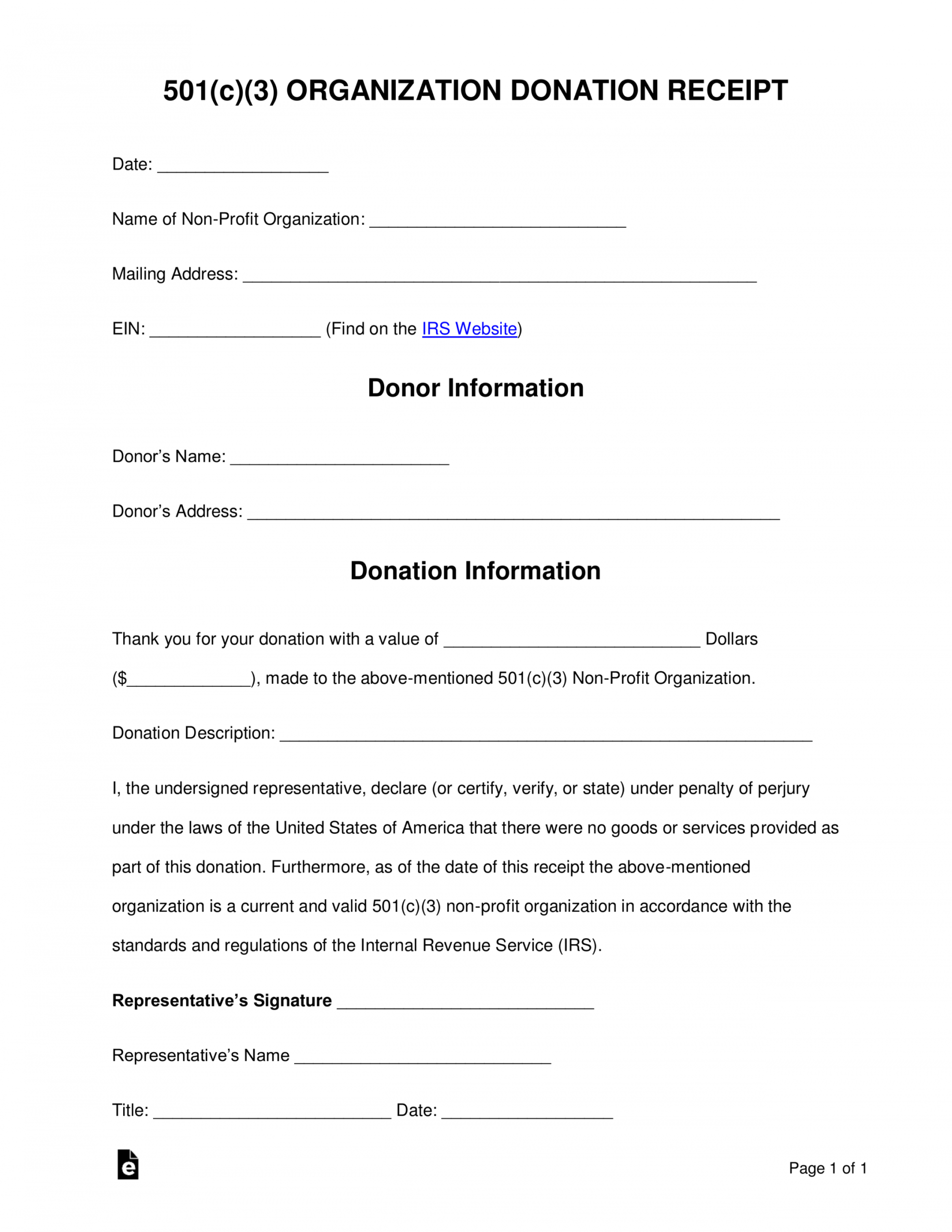

Ordinarily this acknowledgement receipt is prepared by some of the following like business operator, landlord, moneylender, sales manager or sales associate people. Basically you can use this record if you would like to supply a written evidence that you have received cash from an individual or business and you can use this receipt if you want to attain proof for somebody’s which you have given money to an individual or company. Below are a few fundamental components of this receipt for example going for payment receipt, supply the information of the person receiving the payment, and the information of this plaintiff, the statement of the received payment, and other related information, amount and signature.

An acknowledgment of payment receipt is a written admiration that the cash, property or anything of worth has been received in addition to this receipt additionally generates a record and evidence of the transaction. These documents also play an essential part to avoid any disputes or misunderstanding about the detail of this transaction. Generally this record can be used for any kind of payment that is received from the clients, suppliers, clients and business partners. These receipts are also very crucial once the market analysts prepare a business program that aims to enhance the earnings in addition to profit.

If your business is audited, you will again, have to get a copy of your receipts. You should keep the receipts in a safe place and make sure they’re organized so that you can in fact refer back to preceding transactions! Plus, how will you adjust your company habits or make a profit if you don’t know where your money is about, or that you are making? If you are new to the business world, you may not Understand That there are many Distinct Kinds of receipts.

These receipts can function as a tricky evidence of a payment which in turn deprive the possibility of the company owner to make valid claims concerning nonpayment. This document also enables the consumer in case if they want a refund for damaged goods. These documents spell out all necessary information and communicate them into brief yet thorough paragraph in addition to ensure that all your thoughts are conveyed perfectly. Some basic advantages of maintaining these receipts such as they convey information in a professional manner, expand markets, and maintain the secrecy, building in a good will, help in maintain records, lowest cost, stop from conflicts and conclude transactions in an organized way.