Dealing with a charge-off on your credit report can feel like a punch to the gut. It’s a serious negative mark that can significantly impact your ability to get loans, credit cards, or even rent an apartment for years to come. Many people feel helpless when they see this kind of entry, believing there’s nothing they can do to challenge it.

However, that’s not always the case. You have rights, and there are situations where you can, and absolutely should, dispute a charge-off. Understanding how to properly challenge inaccurate or unfair reporting is crucial, and that’s where a well-crafted charge off dispute letter template becomes an invaluable tool in your credit repair arsenal.

Understanding Charge-Offs and Why You Should Dispute Them

A charge-off occurs when a creditor, after a period of non-payment, decides that they are unlikely to collect the debt. They then remove the debt from their active accounts and classify it as a loss. It’s important to understand that a charge-off is an internal accounting procedure for the creditor; it does not mean the debt has been forgiven or that you no longer owe the money. It simply signifies that the original creditor has given up on collecting it themselves and may sell the debt to a collection agency.

The immediate and most significant consequence of a charge-off is its severe impact on your credit score. This negative entry can remain on your credit report for up to seven years from the date of the first delinquency, making it extremely difficult to obtain new lines of credit, secure favorable interest rates, or even pass background checks for employment or housing. It’s a persistent hurdle that can hinder your financial progress.

Many consumers believe that once an account is charged off, their hands are tied. However, you absolutely have the right to dispute any information on your credit report that you believe is inaccurate, incomplete, or unverifiable. This includes charge-offs. There are several compelling reasons why you might challenge such an entry, ranging from factual errors to identity theft.

Credit bureaus and creditors are legally obligated to investigate your dispute and verify the accuracy of the information they are reporting. If they cannot verify the charge-off, or if it is found to be incorrect, they must remove it from your credit report. This process can be challenging, but with persistence and the right approach, it’s a battle you can win.

Key Reasons to Challenge a Charge-Off

- Errors in reporting, such as incorrect dates, amounts, or account numbers.

- Identity theft where the account was opened fraudulently in your name.

- The debt is not yours, or you were never responsible for it.

- You have proof of payment or a different settlement agreement with the creditor.

- The charge-off violates state or federal consumer protection laws.

- The statute of limitations for collecting the debt has expired.

Crafting Your Effective Charge Off Dispute Letter Template

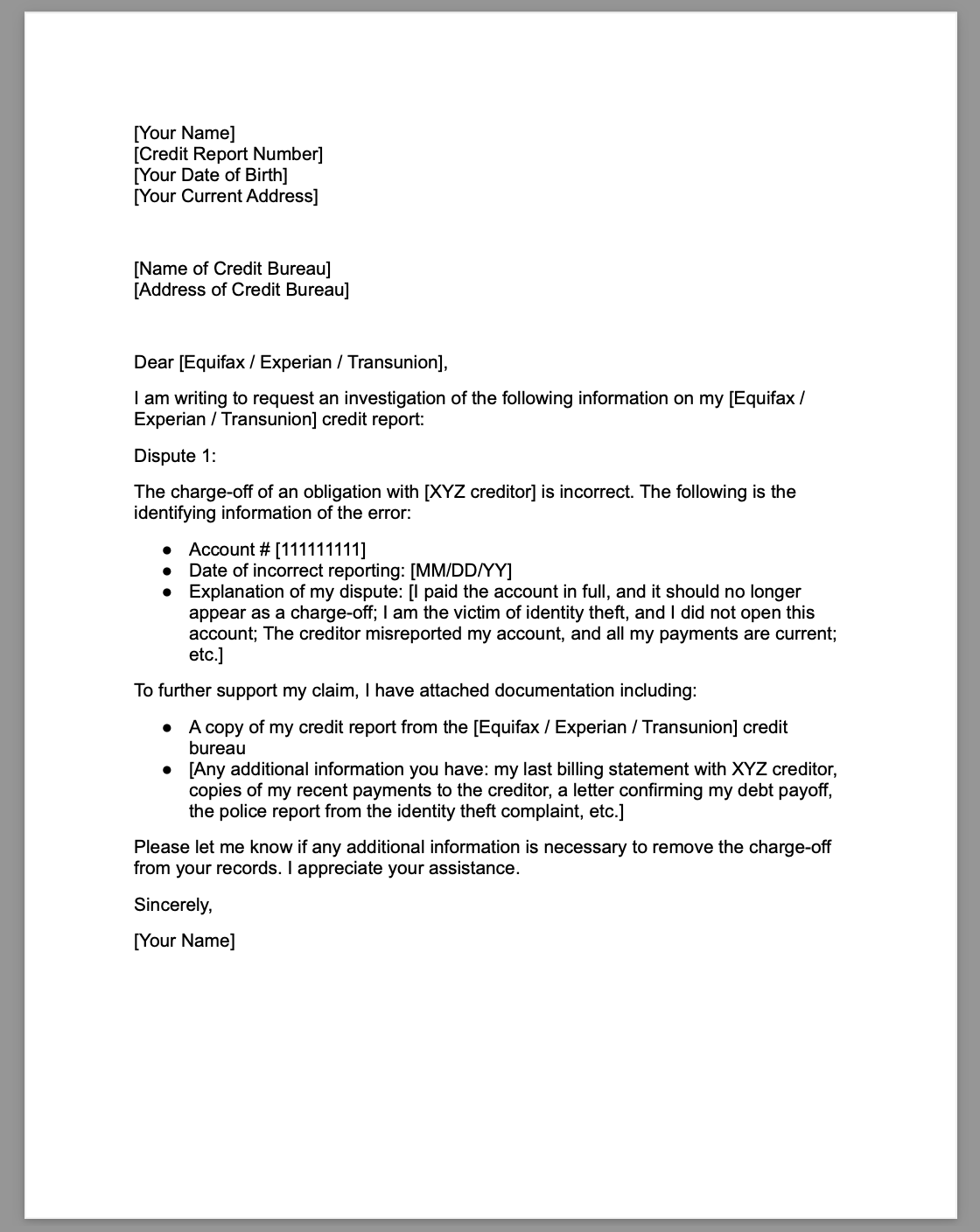

When you decide to dispute a charge-off, the effectiveness of your efforts often hinges on the quality of your dispute letter. This isn’t just a casual note; it’s a formal communication that initiates a legal process. A strong charge off dispute letter template will be clear, concise, and provide all necessary information, laying the groundwork for a successful challenge to the derogatory mark on your credit report.

Your letter should include your full name, current address, and any relevant previous addresses to help the credit bureaus and creditors identify your file accurately. Crucially, you need to state the specific account number of the charged-off debt, the name of the original creditor, and the reason you are disputing the entry. Be precise in your explanation, whether it’s an incorrect date of last payment, an amount you don’t recognize, or a claim of identity theft.

It’s incredibly important to back up your claims with supporting documentation. This could include bank statements showing payments, copies of correspondence with the creditor, police reports if it’s an identity theft issue, or any other paperwork that validates your position. Remember to send *copies* of these documents, never the originals, as you might not get them back. The more evidence you can provide, the stronger your dispute.

Once your letter is prepared, send it via certified mail with a return receipt requested. This provides you with proof that the letter was sent and received, which is vital if there are any future issues. You should send separate letters to each of the major credit bureaus (Experian, Equifax, TransUnion) that are reporting the charge-off, and it’s also a good idea to send a copy to the original creditor or the debt collection agency that currently owns the debt. By law, they have 30 days to investigate your dispute and respond.

Using a reliable charge off dispute letter template can empower you to take control of your financial narrative. It provides a structured approach to challenging inaccuracies, giving you a clear path forward. Remember to always keep detailed records of all correspondence, including dates, names, and what was discussed, as this paper trail will be invaluable throughout the dispute process.

Taking proactive steps to address issues on your credit report is one of the most powerful things you can do for your financial well-being. Don’t let a charge-off sit unchallenged if you have reason to believe it’s inaccurate or unfair. Your credit health is too important to leave to chance.