Receiving constant calls and letters from debt collectors can be incredibly stressful and disruptive to your daily life. It often feels like an endless cycle of interruption, making it hard to focus on anything else. You might be feeling overwhelmed and unsure of how to get these persistent communications to stop, especially when you are trying to manage your financial situation.

Thankfully, there’s a powerful tool available to you that can legally put an end to this harassment: a cease and desist letter. This isn’t just any letter; it’s a formal request backed by federal law, specifically designed to instruct debt collectors to stop contacting you. Understanding how to use a cease and desist collection letter template can provide you with much-needed peace of mind and control over your personal space.

Understanding the Power of a Cease and Desist Letter

When you’re dealing with aggressive debt collectors, it’s easy to feel like you have no control. However, the Fair Debt Collection Practices Act (FDCPA) is a federal law designed to protect you from abusive debt collection practices. One of its most powerful provisions allows you to stop all communication from a debt collector simply by sending them a written notice. This notice is precisely what a cease and desist letter aims to be. It’s a formal way of telling a collector that you no longer wish for them to contact you by phone, mail, or any other method.

It’s important to understand what a cease and desist letter does and does not do. While it effectively stops communication, it does not erase the debt itself. The debt still exists, and the collector may still pursue legal action to collect it. However, the FDCPA strictly limits how they can proceed once they receive your letter. They can only contact you once more to confirm receipt of your letter and to inform you if they plan to take specific legal action, like filing a lawsuit. This brings a tremendous amount of relief by eliminating the daily badgering.

Sending this type of letter can significantly reduce your stress levels and give you breathing room to assess your financial situation without constant pressure. It forces debt collectors to respect your boundaries, ensuring your rights under the FDCPA are upheld. Knowing that you have this legal recourse can be incredibly empowering when facing what feels like an insurmountable problem.

Key Scenarios for Sending a Cease and Desist Letter

This letter is particularly useful in several situations:

- When you are being contacted excessively and feel harassed.

- If you believe the debt is not yours or is inaccurate and you need time to investigate.

- When you have already sent a debt validation letter and the collector continues to contact you without providing validation.

- You are represented by an attorney for the debt.

- You simply want the calls and letters to stop, regardless of your intention to pay or dispute the debt.

Remember, taking this step is about asserting your consumer rights and regaining control over your communications.

Crafting Your Own Cease And Desist Collection Letter Template

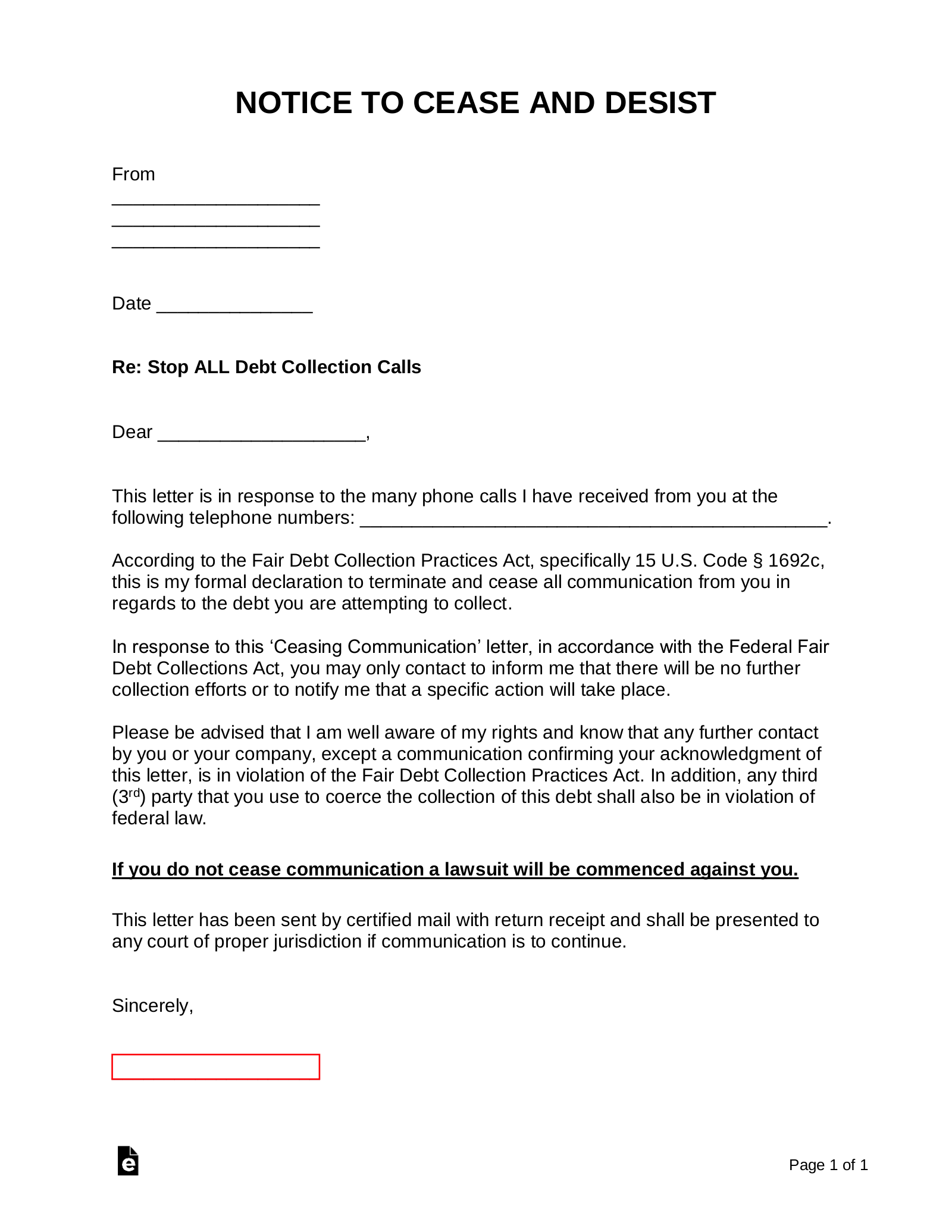

While the thought of writing a legal letter might seem daunting, creating a cease and desist collection letter template is quite straightforward once you understand the key components. The most crucial aspect is to be clear, concise, and to include all necessary identifying information so there’s no ambiguity about which debt and which collector you are addressing. Your letter should unmistakably state your demand for them to cease all contact. Using a template ensures you don’t miss any vital details that could undermine your request.

Start by including your full name, current address, and the date. Then, list the debt collector’s full name and address. Crucially, you must reference the specific account number associated with the debt they are attempting to collect. This eliminates any confusion and ensures your request is tied to the correct account. State clearly and unequivocally that you demand they cease all communication with you regarding this debt, as per your rights under the FDCPA. You can specify methods of communication you wish to stop, but generally, requesting “all communication” is the most effective.

Once your letter is drafted, the method of sending it is almost as important as the content itself. Always send your cease and desist letter via certified mail with a return receipt requested. This provides you with proof that the letter was sent and, more importantly, proof that it was received by the debt collector. This documentation is invaluable if the collector continues to contact you after receiving your letter, as it provides evidence for further legal action. Keep a copy of the letter for your records, along with the certified mail receipt.

After sending the letter, pay close attention to any further communications. The debt collector is legally permitted to send you one final letter, usually to confirm they have received your cease and desist request or to inform you of their intent to pursue legal remedies. Beyond that, any further contact, apart from a lawsuit, is a violation of the FDCPA, for which you may have legal recourse. This step empowers you to enforce your rights and ensures you are no longer subjected to unwanted collection attempts.

Taking control of your interactions with debt collectors is a significant step toward managing your financial well-being. By utilizing the legal protections available to you, you can stop unwanted communications and create the space you need to address your debts on your own terms. Remember, you have rights, and using a cease and desist letter is a powerful way to exercise them effectively.