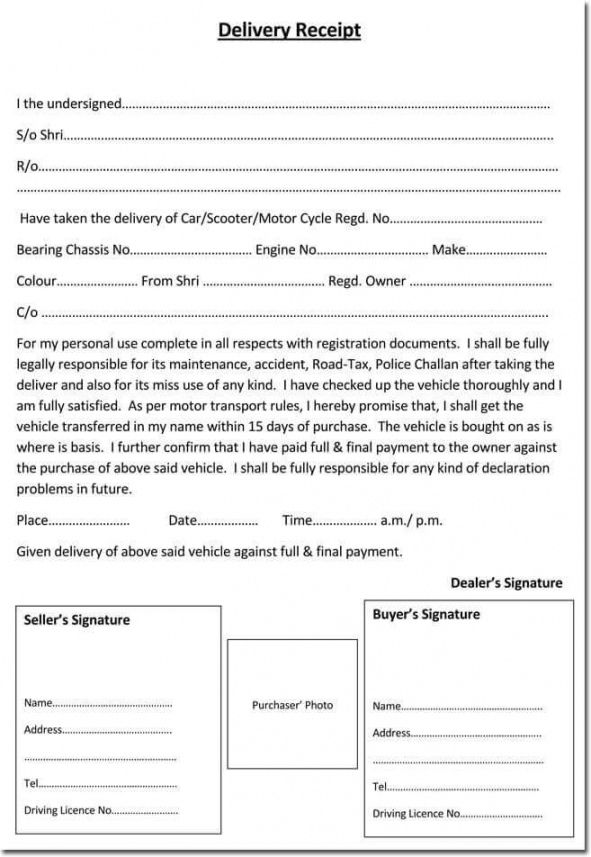

Cash receipt for partial payment template, All business owners are conscious of the vital importance of this receipting process to maintain payments made up-to-date. There is nothing more frustrating for a client than to have to return to a company with evidence of a payment which hasn’t yet been deducted from their account.

Though most receipts include the identical info, it’d be best to review quite a few receipt sample resources prior to presenting your format of choice. It is important that you shop around. If you are going to get a free template from the Internet, you have the ability to add your business name, emblem and the reception number to each receipt generated electronically. Many customers choose to manage their payments, online. Your office staff therefore must keep current with all these transfers. Bank statements will need to be assessed daily and obligations made deducted from the customers’ accounts.

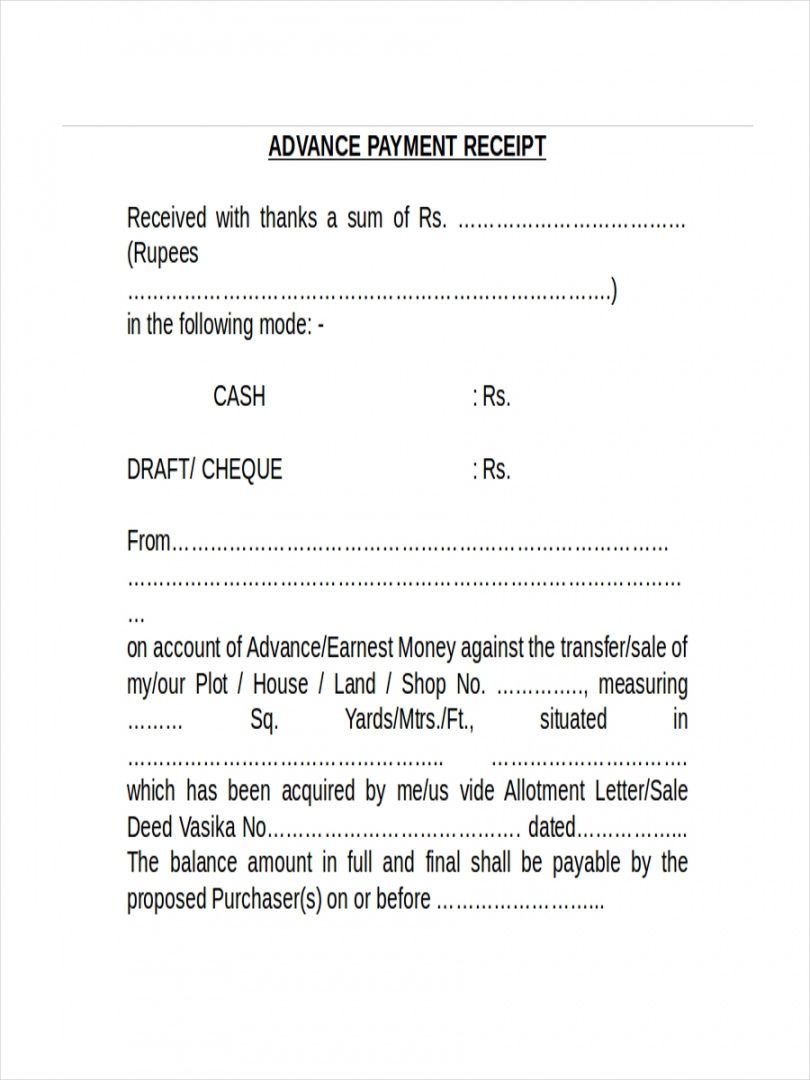

An acknowledgment of payment receipt is a written admiration that the cash, property or anything of value was received in addition to this receipt additionally creates a record and evidence of this transaction. These records also play an essential role to prevent any disputes or misconception about the detail of the transaction. Generally this document can be used for any kind of payment that is obtained from the customers, providers, clients and business partners. These receipts are also quite crucial when the market analysts prepare a business program that intends to enhance the earnings in addition to profit.

If your business is audited, you will again, need to have a copy of your receipts. You should keep the receipts in a safe place and be sure they are organized so that you can in fact refer back to previous transactions! Plus, how are you going to adjust your business habits or earn a profit if you don’t know where your money is about, or that much you are making? If you are new to the business world, you might not Understand That there are many different types of receipts.

If you handle a relatively few of receipts, keeping them in paper form by month could be adequate. You can store them with your hanging reference documents, or perhaps a larger accordion file that’s divided by month. Information from a lesser quantity of receipts may fairly easily be input into a financial management application, and finding a receipt ought to be quick if it’s filed appropriately. If you manage a relatively high number of receipts, you can decrease energy and time by automating your own storage, retrieval and enter of receipt info.