Getting into a car accident can be a truly jarring and stressful experience. Beyond the initial shock and dealing with immediate injuries or vehicle damage, navigating the aftermath, especially when it comes to compensation, can feel overwhelming. Many people find themselves in a position where they need to formally communicate their demand for damages to an insurance company, and this is where understanding a car accident settlement letter template becomes incredibly useful.

This letter isn’t just a formality; it’s a critical document that outlines your case, details your losses, and states your desired settlement amount. Crafting an effective settlement letter is a pivotal step in the negotiation process, ensuring your voice is heard and your claims are clearly understood by the insurance adjuster. It sets the stage for a fair resolution and helps you move forward from the incident with the compensation you deserve.

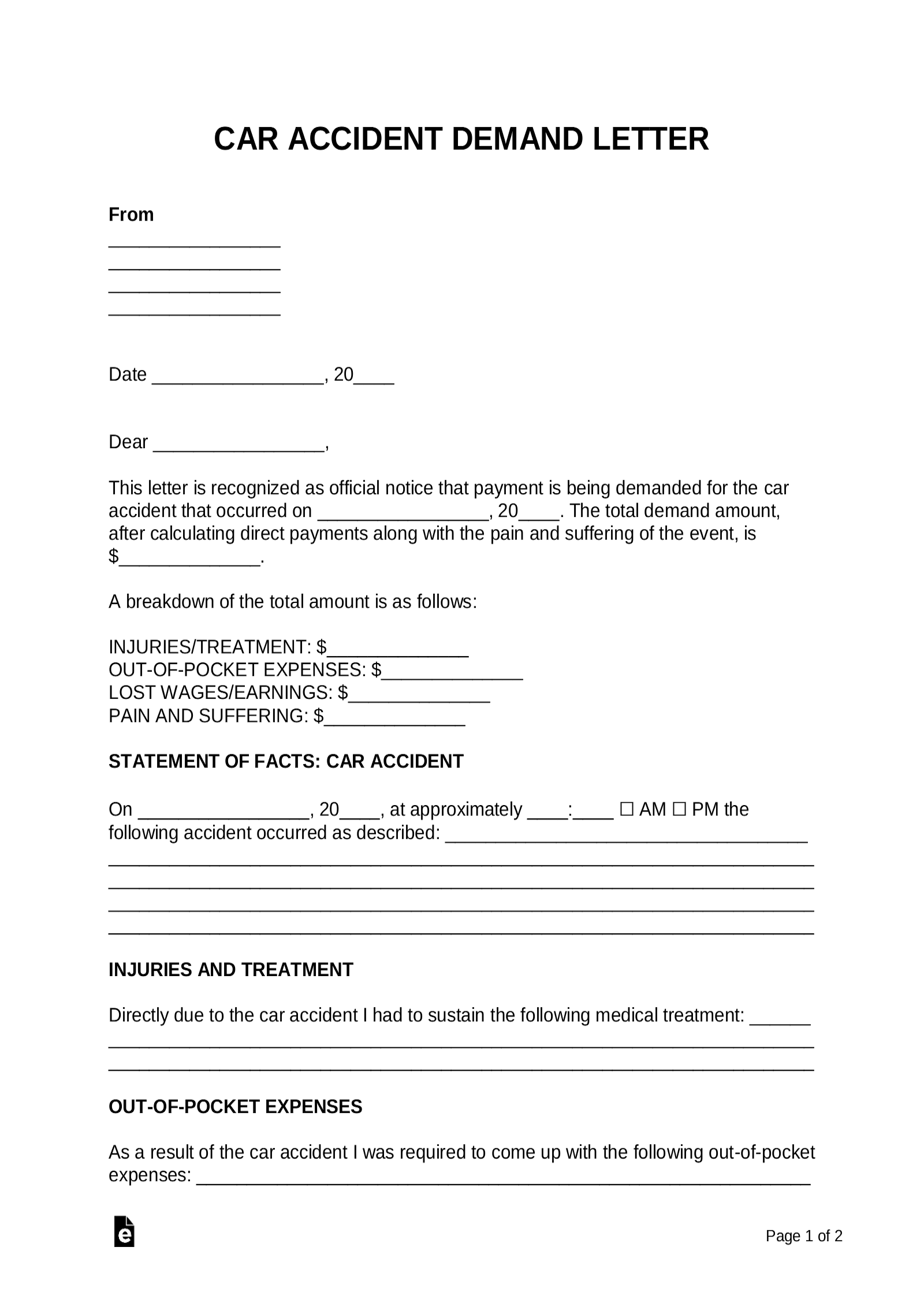

Crafting Your Settlement Letter: What to Include

When you’re ready to write your settlement letter, think of it as your opportunity to present a clear, concise, and compelling summary of your accident and its consequences. The goal is to provide the insurance company with all the necessary information they need to evaluate your claim thoroughly. Starting with a professional tone is key; even though you’ve been through a difficult experience, maintaining a business-like approach helps in demonstrating the seriousness and validity of your demands.

Begin with the essentials: your contact information, the date, and the insurance company’s contact details, including the adjuster’s name if you have it. Always reference your claim number clearly. This ensures your letter is easily matched to your specific case. Then, provide a brief, factual description of the accident itself, including the date, time, and location, and a summary of how the other party was at fault. Avoid overly emotional language and stick to verifiable facts from the police report or witness statements.

Detailing Your Damages

This is arguably the most crucial section of your letter. You need to meticulously list every loss you’ve incurred due to the accident. This includes both tangible economic damages and non-economic damages. For medical expenses, gather all bills from hospitals, doctors, therapists, and pharmacies. Don’t forget to account for future medical needs if your injury requires ongoing treatment. Pain and suffering, though harder to quantify, are also a significant part of your claim and should be addressed here.

Property damage is another key component. Include estimates or actual invoices for vehicle repairs, detailing the damage and the cost to fix it. If your vehicle was totaled, include information about its fair market value before the accident. Also, consider “diminished value,” which is the loss in your car’s resale value even after repairs, simply because it was involved in an accident. Providing clear documentation for all these items is paramount.

- Lost Wages: Include documentation from your employer confirming missed workdays and the income lost as a direct result of your injuries.

- Out-of-Pocket Expenses: This covers anything you paid for directly related to the accident, such as prescription co-pays, mileage to medical appointments, crutches, or rental car fees.

- Emotional Distress and Loss of Enjoyment of Life: While challenging to put a price on, these non-economic damages are valid and can be supported by doctor’s notes, therapy records, or a personal journal detailing your struggles.

Tips for a Powerful and Persuasive Letter

Beyond simply listing your damages, the way you present your case in your settlement letter significantly impacts its effectiveness. A powerful letter isn’t just about what you say, but how you say it, and what evidence you provide to back up your assertions. Always ensure that every claim you make is supported by documentation; this is what lends credibility and strength to your demands. Think of your letter as a comprehensive package of evidence and a clear statement of your losses.

Gathering all supporting documents beforehand is a crucial step. This includes the official police report, photographs of the accident scene and vehicle damage, medical records, doctor’s notes, prognoses, therapy bills, receipts for any related expenses, and letters from your employer detailing lost wages. Organizing these documents and referring to them within your letter shows the adjuster that you are thorough and serious about your claim. It streamlines their review process and leaves little room for doubt.

When stating your final demand, be clear and specific. While you want to be firm, it’s often wise to leave a little room for negotiation. Remember, the initial demand is a starting point. It’s a common practice to ask for a slightly higher amount than your absolute minimum acceptable settlement, as insurance companies typically offer a lower figure initially. However, ensure your demand is reasonable and justifiable based on the evidence you’ve presented.

After you send your car accident settlement letter template, the process doesn’t end there. Be prepared for a response, which might be an offer, a request for more information, or even a denial. If you receive an offer, carefully evaluate it against your documented losses and your initial demand. If it’s too low, you’ll need to be prepared to negotiate. This might involve sending a counter-offer or providing additional arguments. Sometimes, seeking legal advice from a personal injury attorney can be invaluable, especially if negotiations become complex or if you’re unsure about the fairness of an offer.

Taking the time to meticulously prepare and send a well-crafted settlement letter can significantly influence the outcome of your claim. It demonstrates your diligence and your understanding of the process, often leading to a more favorable resolution. Remember, you are your best advocate, and this letter is a powerful tool in that advocacy.

Even with the best intentions and a perfectly written letter, navigating the legal and insurance landscape can be complex. Don’t hesitate to consult with legal professionals if you feel out of your depth or if the insurance company’s response is unsatisfactory. Their expertise can provide invaluable guidance and ensure that your rights are fully protected throughout the settlement process, helping you achieve the justice and compensation you rightfully deserve.