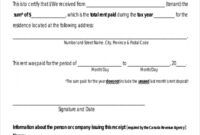

Canadian charitable tax receipt template, All business owners are aware of the vital importance of this receipting process to keep payments created up-to-date. There’s nothing more frustrating for a customer than to have to return to a company with evidence of a payment that has not yet been deducted from his or her accounts.

Ordinarily this acknowledgement receipt is prepared by some of the next like business owner, landlord, moneylender, sales manager or sales associate individuals. Basically you may use this document if you want to provide a written proof that you have received cash from a person or organization and you may use this receipt if you want to obtain proof for somebody’s which you’ve given money to an individual or organization. Below are some basic components of the receipt for example going for payment receipt, provide the information of the individual receiving the payment, the information of the plaintiff, the announcement of the received payment, additional related info, total amount and signature.

An acknowledgment of payment receipt is a written admiration the cash, property or anything of value has been obtained as well as this receipt additionally generates a record and proof of the transaction. These documents also play an essential part to avoid any disputes or misconception concerning the detail of the transaction. Generally this record can be used for any type of payment that’s received from the clients, suppliers, customers and business partners. These receipts are also very crucial once the market analysts prepare a business program that intends to boost the earnings in addition to profit.

Basically these receipts help the business owner to keep tabs on the business transactions together with clients or customers details. Therefore it’s an easier way for any business account to conduct their audit of the business profits, losses and other essential info. Here are a few essential steps that will guide you how to compose an acknowledgement reception effectively in addition to professionally such as first use your business letterhead to convey a professional, identify the fundamental objective of this document, address the document to the appropriate person or organization, be sincere, timely acknowledgement, be polite, proofreading, be succinct and choose an official closing for your document.

If you handle a relatively small number of receipts, storing them in paper form by month may be sufficient. It is possible to store them with your hanging reference documents, or perhaps a larger accordion file that is split by month. Information from a lesser quantity of receipts may fairly easily be entered into your financial management program, and locating a receipt should be quick if it is filed appropriately. If you handle a relatively large number of receipts, then you can reduce energy and time by automating your own storage, recovery and input of receipt info.