Navigating the world of professional relationships, especially when it comes to services like insurance, real estate, or financial advising, often involves significant paperwork. One crucial document that frequently comes into play when you decide to change or officially appoint a new representative is the Broker of Record letter. This isn’t just a formality; it’s a powerful tool that puts you, the client, in control, ensuring a smooth transition and clear communication between all parties involved.

Understanding what a Broker of Record letter is, why it’s necessary, and what vital information it should contain can save you time, prevent misunderstandings, and ensure your service needs are met without interruption. Whether you’re a business owner looking to switch insurance providers or an individual appointing a new agent, having a solid broker of record letter template at your fingertips is incredibly valuable for asserting your choices and simplifying the process.

What Exactly Is a Broker of Record Letter and Why Do You Need One?

At its core, a Broker of Record (BOR) letter is an official document from a client to a service provider (like an insurance carrier or a managing agency) authorizing a specific broker or agent to represent their interests. It essentially states, "This is the person or company I want to handle my affairs with you." This letter is pivotal because it formally grants the new broker the authority to access information, negotiate on your behalf, and manage your accounts. Without it, the new broker might not be able to act for you, and the existing relationship with the previous broker could remain in effect, leading to confusion or delays.

The necessity of a BOR letter stems from the need for clear authorization and accountability. Service providers need to know exactly who is allowed to represent you to protect your privacy and ensure compliance. It serves as a legal directive, establishing the relationship with your chosen broker and, by extension, often terminating or modifying the relationship with any previous broker regarding specific policies or accounts. It’s a foundational step in establishing trust and professional boundaries.

Think of it as a formal hand-off, sanctioned by you. The letter notifies all relevant parties that a change is occurring or that a new representation is being established. This transparency is crucial for ensuring that your service continues uninterrupted and that your new broker can start working for you immediately and effectively, without getting caught in bureaucratic red tape. It’s a standard practice across many industries, underscoring its importance in professional dealings.

For businesses, especially, a BOR letter can be instrumental in managing complex insurance portfolios or large real estate transactions. It ensures that your company’s interests are consistently represented by the broker you trust most to understand your unique needs and advocate on your behalf. It simplifies the administrative burden by clearly defining who has the authority to act, preventing potential disputes or miscommunications down the line.

Key Scenarios Where a BOR Letter is Essential

- Switching insurance brokers to find better rates, improved service, or specialized expertise.

- Appointing a new real estate agent for property management or a specific transaction.

- Consolidating multiple insurance policies or financial accounts under a single, new broker.

- Formally establishing a new client-broker relationship from the outset, especially for significant engagements.

- When a previous broker relationship has ended, and you need to ensure the new broker has full authority.

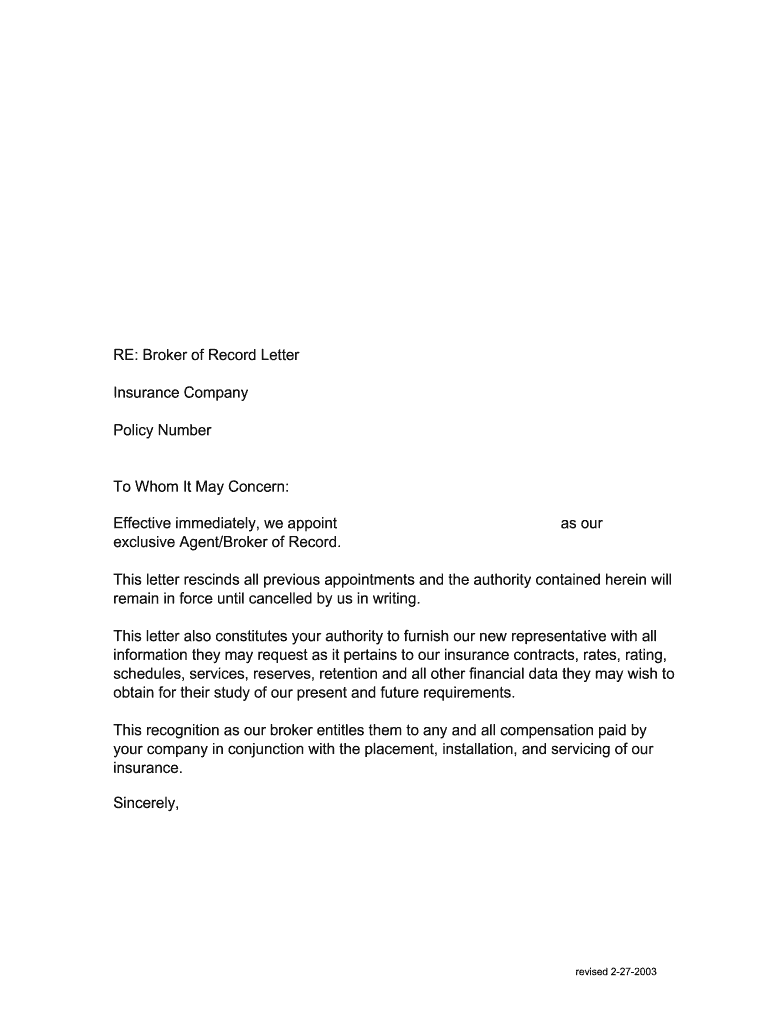

Crafting Your Own Broker of Record Letter Template: What to Include

When you’re ready to create your own broker of record letter template, precision and clarity are your best friends. A well-structured template will ensure that every critical piece of information is included, leaving no room for ambiguity. This isn’t a document where you want to cut corners or be vague, as its purpose is to grant specific authority and potentially revoke existing authority. Starting with your full legal name or the full legal name of your organization at the top, along with your complete contact information, sets a professional tone from the get-go.

Next, you’ll need to clearly address the letter to the relevant service provider, such as the insurance carrier or the managing real estate agency. Include their full name and address. Following this, the effective date of the broker change or appointment is absolutely vital. This date clarifies when the new broker’s authority begins, and it’s essential for ensuring a seamless transition and preventing any gaps in representation. Without a clear effective date, there could be confusion about who is responsible for what, and when.

The core of the letter will be a clear and unequivocal statement authorizing your new broker. This statement should explicitly name the new broker, including their agency’s full legal name, contact information, and any relevant license numbers. Simultaneously, if you are replacing a previous broker, the letter should also explicitly state that the authority of the previous broker is being revoked for the specified accounts or policies. This dual function of appointing new authority and revoking old authority is crucial for a clean break and a clear mandate.

Finally, you must list the specific accounts, policies, or properties that the new broker will be responsible for. This could include policy numbers, property addresses, or types of coverage. Being as specific as possible here helps avoid any misunderstandings about the scope of the new broker’s authority. The letter must conclude with your signature (or the signature of an authorized representative if it’s for an organization), your printed name, and the date signed. This provides the necessary legal backing and confirms your consent.

Consider including the following essential elements:

- Client’s Full Legal Name and Contact Information: Your complete address, phone number, and email.

- Recipient’s Full Legal Name and Address: The name and address of the insurance carrier, agency, or relevant party.

- Effective Date: The precise date when the new broker’s authority begins.

- Previous Broker’s Name (if applicable): Clearly state the name of the broker whose authority is being revoked.

- New Broker’s Full Legal Name and Contact Information: Include agency name, address, phone number, and perhaps a license number.

- Clear Statement of Authorization: A concise sentence granting authority to the new broker.

- Specific Accounts/Policies/Properties: List all relevant policy numbers, account IDs, or property details.

- Client’s Signature and Date: Your handwritten signature and the date you signed the letter.

- Printed Name of Signatory: Your name typed or clearly printed below your signature.

A well-crafted Broker of Record letter empowers you to manage your professional relationships with clarity and confidence. It ensures that your interests are always represented by the professionals you trust most. By using a comprehensive template, you can streamline this process, maintain accurate records, and focus on the services you need without unnecessary administrative hurdles.