Deciding to close a bank account can happen for many reasons. Perhaps you’ve found a better deal with another financial institution, you’re relocating to a new city or country, or maybe you simply no longer need the account. Whatever your motivation, the process requires a formal approach to ensure everything is handled smoothly and without any lingering issues. It’s not just about emptying the funds; it’s about officially severing ties with your bank for that specific account.

While it might seem daunting to draft such a formal communication, having a reliable bank account closure letter template at your fingertips can make the entire procedure much simpler. It helps you articulate your request clearly, provides all necessary information to the bank, and creates a clear record of your intentions. This ensures that both you and your bank are on the same page, minimizing potential misunderstandings or delays in the closure process.

Why a Formal Letter is Crucial and What to Include

Sending a formal letter to close your bank account is more than just a courtesy; it is often a requirement and always a wise step. This official communication serves as a written record of your request, which can be invaluable should any disputes or questions arise later. It ensures that your bank processes your request according to their protocols and gives you peace of mind that your financial affairs are being handled meticulously. Without a clear written instruction, the bank might not proceed, or the process could be subject to delays.

A well-crafted letter leaves no room for ambiguity. It clearly states your intention to close the account, provides all the necessary details for the bank to identify and process your request, and outlines any specific instructions you may have, such as where to transfer the remaining balance. This level of detail protects both you and the financial institution, creating a transparent and accountable closure process. It also helps in preventing unauthorized transactions or lingering charges after you believe the account is closed.

Preparing your letter thoroughly is key to a smooth closure. It is beneficial to ensure that every piece of information the bank needs is right there, preventing them from having to contact you for clarification. This proactive approach speeds up the process and reduces the chances of errors. Think of it as providing a comprehensive instruction manual for your bank to follow.

Key Elements of Your Letter

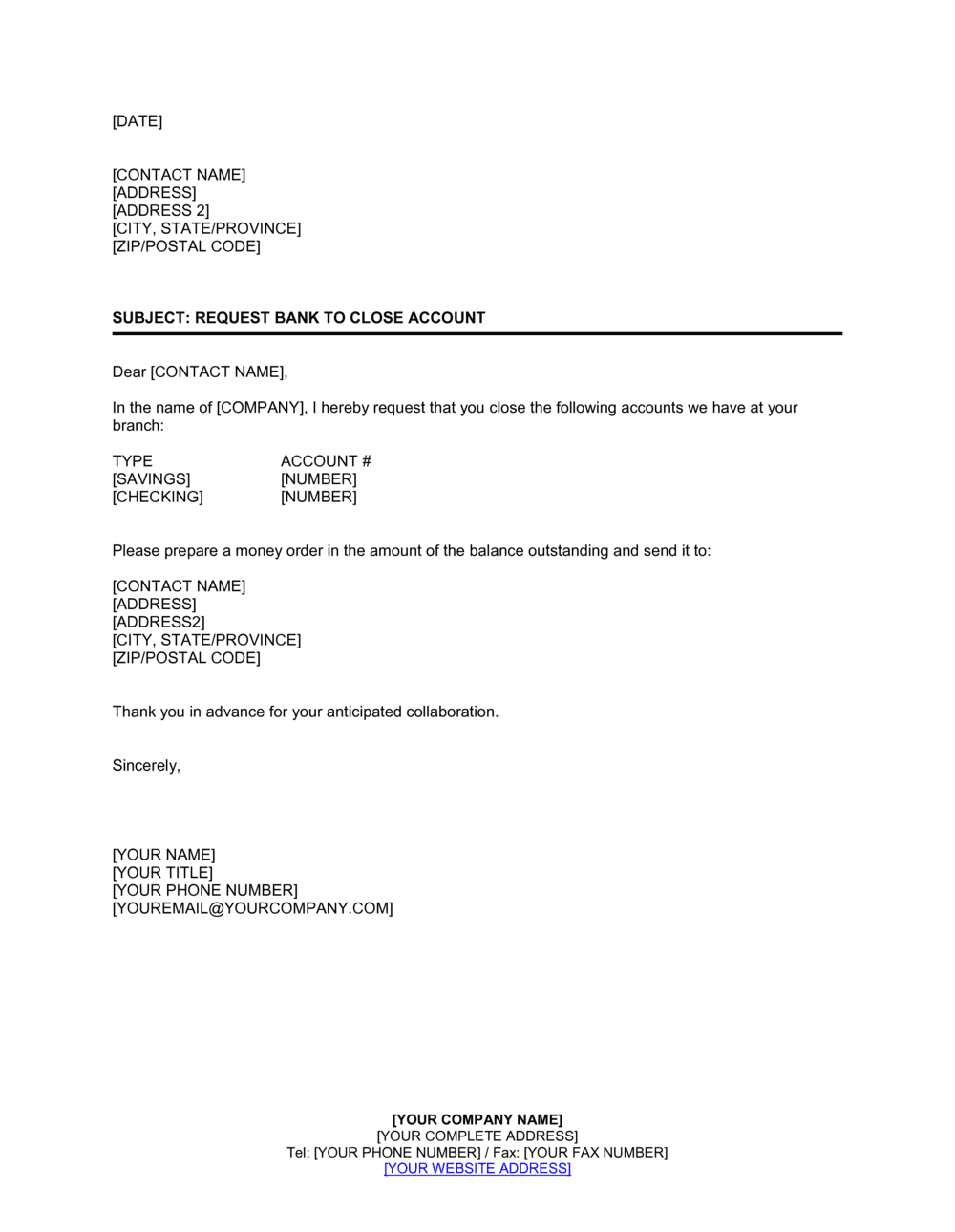

When you’re putting together your bank account closure letter template, there are several essential pieces of information that absolutely must be included. These details ensure that your bank can correctly identify your account and process your request without any hiccups. Missing even one crucial piece of information could lead to delays or the letter being rejected.

- Your Full Name and Current Address: This helps the bank identify you as the account holder.

- Bank Name and Branch Address: Specify which branch handles your account, if applicable.

- Account Number: This is critical for the bank to locate the exact account you wish to close.

- Account Type: State whether it is a checking, savings, or other type of account.

- Effective Closure Date: Specify when you want the account to be closed.

- Instructions for Remaining Balance: Clearly state where any leftover funds should be transferred (e.g., another account number and bank).

- Your Signature: A handwritten signature authenticates your request.

- Date of the Letter: Important for record-keeping and tracking.

By including these elements, you provide your bank with a complete and actionable request, allowing them to proceed efficiently. Remember, clarity and completeness are your best tools when dealing with financial matters like account closure.

Steps to Take Before Sending Your Closure Request

Before you drop that bank account closure letter template in the mail, there are a few important preparatory steps you should take to ensure a seamless transition and avoid any unexpected issues. Rushing into the closure without proper groundwork can lead to complications, such as missed payments, overdraft fees, or difficulty accessing funds. A little planning now can save you a lot of hassle down the line.

Firstly, identify and transfer all recurring payments, direct debits, and standing orders linked to the account you wish to close. This is incredibly important as you do not want essential bills like utilities, rent, or loan repayments to be missed due to an inactive account. Make a comprehensive list of all these transactions and update them with your new account details well in advance. This might involve contacting various service providers or logging into their online portals.

Secondly, ensure there are no outstanding checks or pending transactions on the account. Wait until all checks you’ve written have cleared and any expected deposits have been received. Closing an account with pending transactions can lead to bounced checks, fees, and inconvenience for all parties involved. It is always best to let the account settle completely before initiating the closure process.

Finally, decide what to do with any remaining balance in the account. Most people opt to transfer these funds to another existing account, either with the same bank or a different institution. Make sure the new account is fully operational and ready to receive the funds. If you’re transferring a substantial amount, confirm any daily transfer limits or procedures with both banks. This ensures your money moves safely and efficiently.

- Check for any associated fees: Some banks charge a fee for closing an account, especially if it’s new or falls below a certain balance.

- Update all automatic payments: Ensure everything from your gym membership to your mortgage payment is linked to your new account.

- Confirm your final balance: Make sure you know exactly how much money is left and where it is going.

- Keep copies of all correspondence: Maintain a record of the letter you send and any replies from the bank.

Taking these proactive measures will help prevent any financial disruptions and ensure that your account closure is a smooth and stress-free experience. It’s all about meticulous preparation for a clean break.

Closing a bank account doesn’t have to be a complicated ordeal. By utilizing a clear bank account closure letter template and following a few simple preparatory steps, you can ensure a smooth and efficient process. This organized approach provides you with the confidence that your financial affairs are handled professionally and leaves no room for error.

Taking the time to prepare your letter and address all the necessary pre-closure tasks will save you from potential headaches and unexpected charges. It’s about being in control of your financial journey and making transitions as seamless as possible, giving you complete peace of mind.