Embarking on the journey to homeownership is an exciting milestone, often filled with dreams of picket fences, cozy evenings, and building a future. For many, this dream becomes a reality with a little help from loved ones, especially when it comes to the significant financial investment of a down payment or closing costs. Receiving a monetary gift from family or friends can be a game-changer, but when you’re applying for a mortgage, there’s a specific step you can’t skip: providing a gift letter.

A gift letter is a crucial document that formally declares money received for your home purchase is indeed a gift, with no expectation of repayment. It’s a standard requirement from lenders to ensure transparency and prevent any hidden debts that could affect your ability to repay your loan. Understanding what goes into this letter and why it’s so important will save you stress and potential delays in securing your dream home.

Why Your Lender Needs a Gift Letter for Mortgage

When you’re applying for a mortgage, lenders are primarily concerned with your financial stability and your ability to repay the loan. Every dollar accounted for in your financial profile is scrutinized, especially large sums of money that suddenly appear in your bank account. If a significant deposit shows up without clear documentation, a lender might view it as an undisclosed loan, which could impact your debt-to-income ratio and, consequently, your loan eligibility. This is where a gift letter steps in, providing the necessary clarity and assurance.

The primary purpose of a gift letter is to verify that the funds are a true gift, not a loan in disguise. Lenders need to be certain that you won’t have to pay back this money, as any repayment obligation would directly affect your monthly budget and your capacity to manage mortgage payments. Without this assurance, the lender might factor a hypothetical “repayment” into their calculations, potentially denying your loan or offering less favorable terms.

Furthermore, the letter helps prevent situations where the gift giver might later claim an ownership interest in the property because they contributed financially. By clearly stating the funds are a gift with no strings attached, the letter protects both the borrower and the lender from future legal complications or disputes over the property’s ownership.

Providing a comprehensive and well-prepared gift letter streamlines the underwriting process, demonstrating to your lender that you are organized and transparent about your finances. This can help prevent unnecessary delays, making your path to homeownership much smoother. Think of it as a vital piece of the puzzle that confirms the financial support you’re receiving is genuinely helpful, not a hidden liability. To ensure your letter meets all requirements, it’s essential to include several key pieces of information.

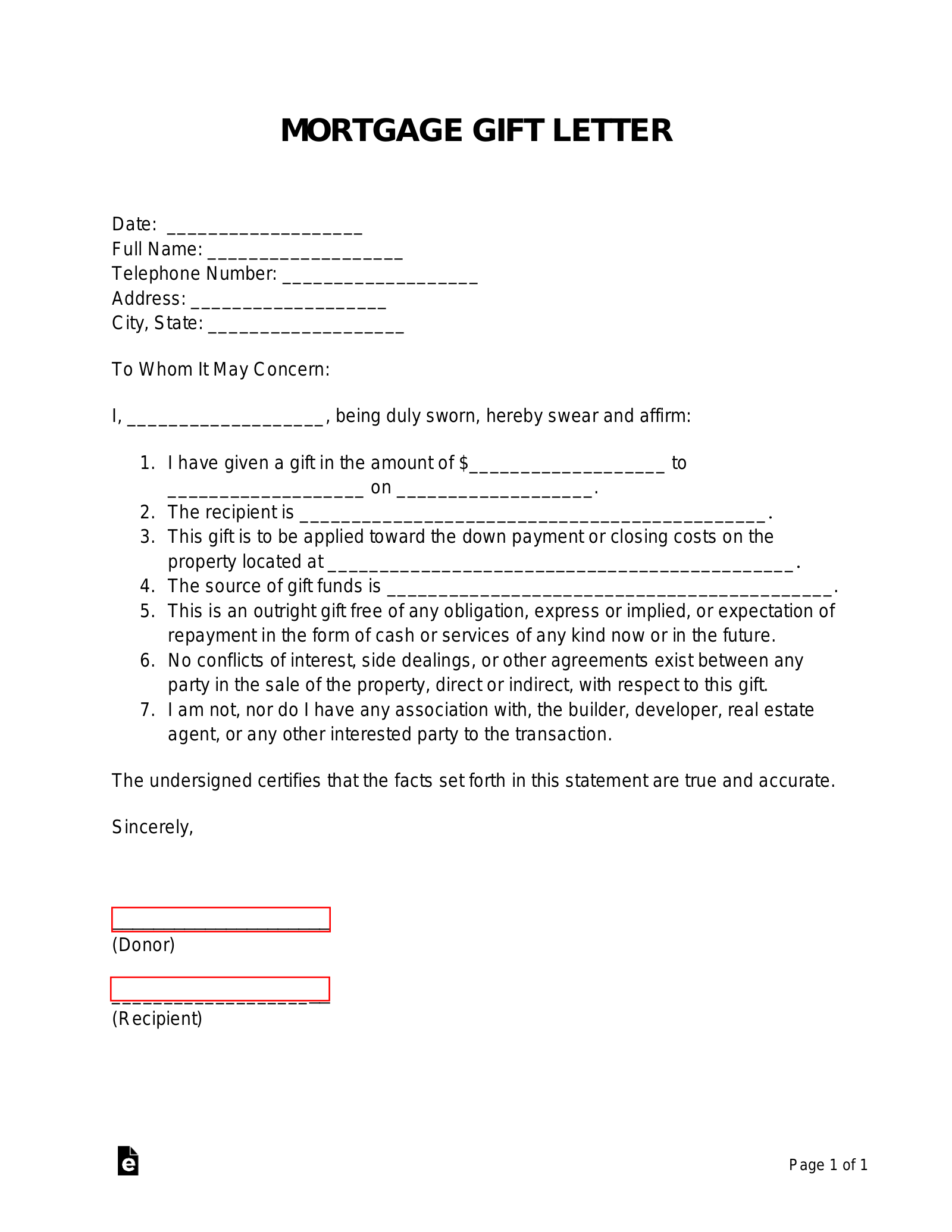

Key Elements of an Effective Gift Letter

- The full name, address, and contact information of the donor(s).

- The full name, address, and contact information of the borrower(s) receiving the gift.

- The exact monetary amount of the gift.

- A clear statement confirming that the funds are a gift and no repayment is expected or required.

- A statement confirming that the funds are not sourced from a loan that requires repayment by the donor.

- The relationship between the donor and the borrower (e.g., parent, grandparent, sibling).

- The address of the property being purchased with the gift funds.

- The date the gift was provided.

- Signatures of all donors involved.

Crafting Your Own Gift Letter: What to Include and How to Send It

While the idea of a formal letter might seem daunting, creating a gift letter for mortgage purposes is quite straightforward when you know what information your lender expects. Think of it as a template that you fill in with your specific details. Most lenders will provide a sample or guidance on what they require, but having a clear understanding of the components will help you prepare proactively.

Once you have gathered all the necessary details, it’s crucial that the gift letter is signed by the donor(s). Some lenders may also require the letter to be notarized, adding an extra layer of legal verification. Always check with your loan officer or mortgage broker about their specific requirements for notarization, as failing to do so could lead to last-minute scrambling or delays in your loan approval.

Beyond the letter itself, lenders often require documentation to verify the source of the gift funds. This typically involves recent bank statements from the donor’s account, showing that the funds were available to them before the gift was made. They might also ask for proof that the funds have been transferred to your account. This process, often referred to as “seasoning,” helps the lender track the money’s origin and ensure it wasn’t recently borrowed by the donor.

Submitting your gift letter and all supporting documentation promptly is essential. The earlier you provide these details in the mortgage application process, the smoother the underwriting will be. Open communication with your loan officer throughout this process is key; they can guide you through any specific requirements or questions that may arise. Remember, while a good gift letter template for mortgage can guide you, the details and context around your specific situation are what truly matter.

- Always confirm specific requirements with your mortgage lender.

- Ensure all names, addresses, and amounts are accurate and complete.

- Obtain all necessary signatures from the gift donor(s).

- Be prepared to provide bank statements from the donor, showing the origin of funds.

- Submit the gift letter and all supporting documents as early as possible.

Having a properly prepared gift letter simplifies what could otherwise be a complicated aspect of your mortgage application. It ensures that the generous support from your loved ones is recognized by your lender without creating any financial red flags. This small but mighty document paves the way for a smooth approval process, allowing you to focus on the exciting prospect of moving into your new home.

Ultimately, a clear and comprehensive gift letter is a testament to transparency and preparedness. It’s an essential step in leveraging family support to achieve your homeownership goals, turning what could be a complex financial transaction into a straightforward and celebrated milestone. With this document in hand, you’re one step closer to unlocking the door to your very own home.