Receiving calls and letters from debt collectors can be an incredibly stressful and confusing experience. It’s a situation many people find themselves in, often unexpectedly, and it can feel overwhelming trying to navigate the complex world of debt collection agencies. You might be unsure if the debt is even yours, if the amount is correct, or if the collector is legitimate. Taking the right steps to address these issues is not just smart; it’s essential for protecting your financial health and peace of mind.

One of the most powerful tools at your disposal in such a scenario is a formal dispute letter. This isn’t just a casual email or phone call; it’s a legally recognized way to formally challenge a debt and demand verification. A well-crafted debt collection dispute letter template can provide you with the structure and content you need to clearly communicate your concerns, assert your rights, and ensure that your dispute is taken seriously by the collection agency, setting the stage for a fair resolution.

Why Sending a Debt Collection Dispute Letter is Crucial

When a debt collector contacts you, whether by phone or mail, it’s natural to feel a rush of anxiety. However, before you pay anything or even acknowledge the debt, it’s absolutely crucial to verify its legitimacy. Sending a debt collection dispute letter is your first and most important step in this process. This letter formally challenges the debt and requires the collector to provide proof that you owe the money, and that they have the legal right to collect it. Without this verification, they cannot continue collection activities.

The Fair Debt Collection Practices Act, or FDCPA, is a federal law designed to protect consumers from abusive, unfair, or deceptive debt collection practices. Under this act, you have specific rights, including the right to dispute a debt. When you send a dispute letter, the collection agency must cease all collection efforts until they provide you with documentation verifying the debt. This crucial pause gives you time to investigate, gather your own records, and prevent potential damage to your credit report based on an unverified claim.

Think of your dispute letter as putting the ball back in their court, but with a clear set of rules. It shifts the burden of proof from you to the collection agency. They must show you things like the original creditor’s name, the amount of the debt, and how they acquired the debt. Without this, their claims are just that – claims. This formal communication also creates a paper trail, which is incredibly important if the dispute escalates or if you ever need to demonstrate that you took action to address the alleged debt.

Sending a dispute letter also helps to clarify the situation, especially if the debt is old, inaccurate, or simply not yours. Cases of mistaken identity, identity theft, or incorrect amounts are surprisingly common. By using a robust debt collection dispute letter template, you’re not only exercising your rights but also actively working to prevent negative information from appearing on your credit report or remaining there if it already has. It’s your official way of saying, “Prove it!”

What Your Dispute Letter Should Ask For

- The original creditor’s name and address.

- The exact amount of the debt.

- Documentation showing how the debt was calculated.

- Proof that you are the person who owes the debt.

- Proof that the collection agency is legally entitled to collect this specific debt.

- Copies of any judgment if the debt has been litigated.

Crafting Your Effective Debt Collection Dispute Letter

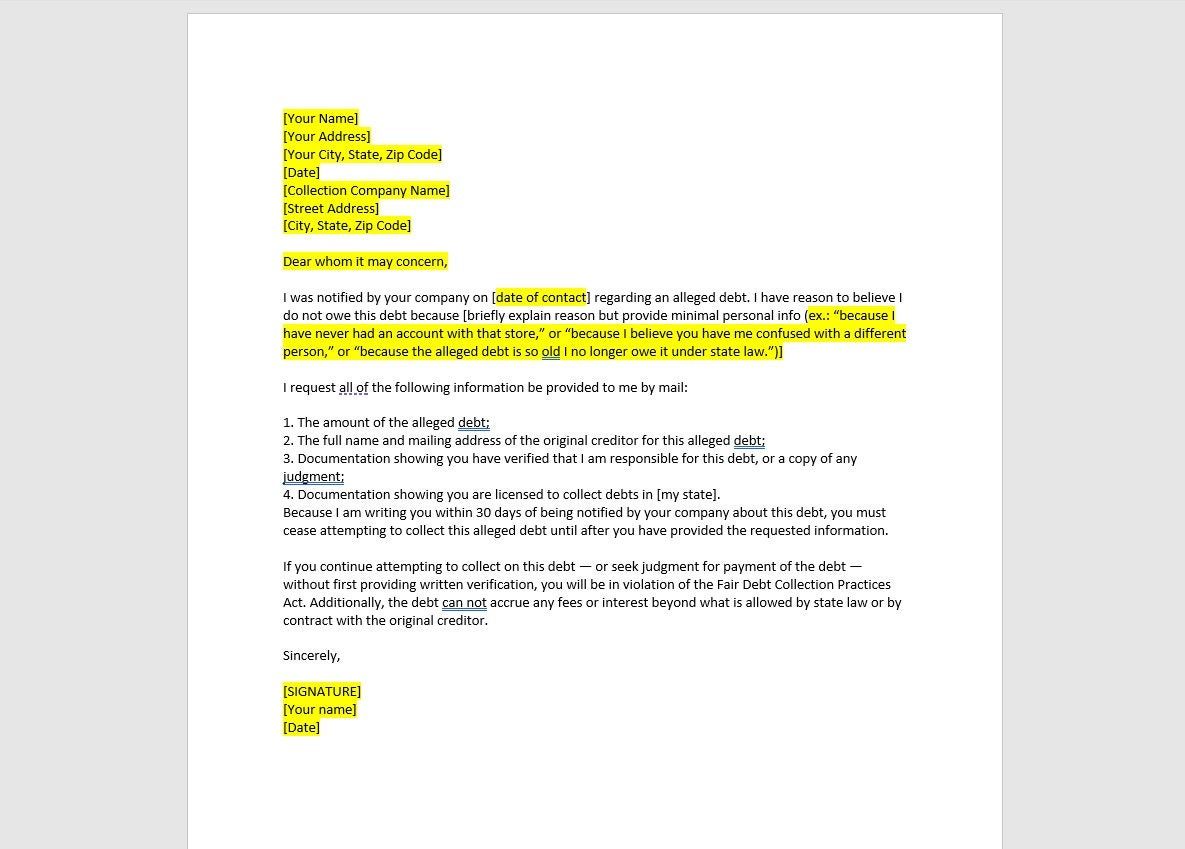

When it comes to writing your debt collection dispute letter, clarity, conciseness, and professionalism are key. While it might be tempting to express frustration, keeping a calm and objective tone will serve you best. Remember, this letter is a legal document, and its primary purpose is to demand verification, not to engage in an emotional argument. A well-structured letter ensures that your request is clear and leaves no room for misinterpretation by the collection agency.

Your letter should always include your full name, current address, and the account number (if one was provided by the collector). Make sure to state unequivocally that you are disputing the debt and requesting verification. It’s also wise to include a specific deadline for their response, usually 30 days, which aligns with FDCPA guidelines for initial disputes. This timeline is critical, as it dictates how long they have to provide the requested information before they must cease collection activities.

Be careful not to admit that the debt is yours or to make any partial payments, as this could be interpreted as an acknowledgment of the debt, which might waive some of your rights to dispute it later. Instead, focus solely on requesting verification. If you have any specific reasons for disputing the debt – for example, you believe it’s past the statute of limitations, it’s not your debt, or the amount is incorrect – you can briefly mention these without going into extensive detail or providing your own evidence at this stage.

Finally, how you send the letter is just as important as what’s inside it. Always send your debt collection dispute letter via certified mail with a return receipt requested. This provides you with undeniable proof that the letter was sent and received, along with the date of delivery. Keep a copy of the letter for your own records, along with the mailing receipt. This paper trail is invaluable if you need to demonstrate your actions in the future, should the dispute not be resolved to your satisfaction or if the collection agency violates your rights.

You are taking a proactive step to protect your rights and ensure fair treatment under the law. By formally disputing any alleged debt, you’re not only giving yourself time to investigate but also compelling the collection agency to prove their claims. This crucial initial action can save you from paying a debt you don’t owe, protect your credit score, and bring you closer to resolving the situation responsibly.

Remember, you have rights, and by understanding them and using the proper tools, you can navigate these challenging situations effectively. Taking control of the narrative with a clear, documented dispute is an empowering move towards maintaining your financial integrity.