It is an all too common and frustrating situation to find yourself owed money by an individual or a business. Whether it is for services rendered, goods sold, or a personal loan that has gone unpaid, chasing down overdue payments can be stressful and time consuming. Before resorting to more drastic or costly measures, a formal approach often proves to be the most effective first step in resolving such disputes.

This is where a well-crafted demand letter comes into play. It serves as a clear, written request for payment and outlines your intent to pursue further action if the debt remains unpaid. Understanding how to construct such a document properly can significantly increase your chances of recovering your money. This article will guide you through the process, offering insights into what makes an effective demand letter template for money owed.

Why Send a Demand Letter Understanding Its Importance

Sending a demand letter is much more than just a polite reminder; it is a serious and formal communication that indicates you are prepared to take further action to recover what is rightfully yours. It demonstrates to the debtor that you are organized and serious about the matter, often prompting them to take your request more seriously than informal phone calls or emails. This initial formal step can often resolve disputes without the need for expensive and lengthy legal proceedings.

Furthermore, a demand letter serves as crucial documentation. Should the matter escalate to small claims court or other legal action, having a clear record of your attempt to collect the debt and the specific terms of your demand will be invaluable. It establishes a timeline and clearly states the amount owed, the reason for the debt, and the deadline for payment, leaving little room for ambiguity or misunderstanding on the part of the debtor.

From a psychological perspective, receiving a formal letter on letterhead can often prompt a debtor to prioritize your payment over others. It signals that you are not going to simply let the debt go, and that you understand the process for escalating the matter. This can create a sense of urgency for them to settle the outstanding amount before potential legal consequences or damage to their credit standing occurs.

Finally, a demand letter forces you to organize all the details surrounding the debt. You must clearly articulate the amount, the original agreement, any relevant dates, and the specific terms you are demanding. This process ensures that your case is solid and well documented, preparing you for any objections or defenses the debtor might raise. It clarifies your position and strengthens your ability to advocate for yourself.

Key Advantages of a Demand Letter

Crafting Your Effective Demand Letter Template For Money Owed

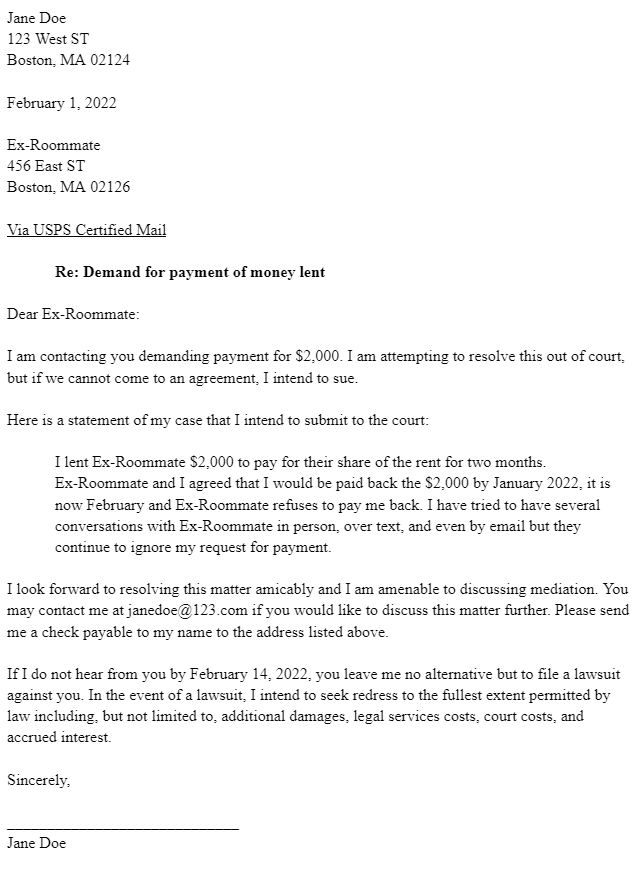

When preparing your demand letter, clarity, professionalism, and conciseness are your best allies. The goal is to present your case in a way that is easy to understand, leaves no room for misinterpretation, and clearly states what you expect from the debtor. Avoid emotional language or threats; stick to the facts and the legal implications. A well-structured letter will be more impactful and more likely to achieve the desired outcome.

Start with your contact information and the current date, followed by the debtor’s complete contact information. A clear subject line is essential, such as “Demand for Payment for Outstanding Balance” or “Formal Demand for Money Owed.” This immediately informs the recipient of the letter’s purpose and its serious nature, ensuring it is not overlooked or dismissed as casual correspondence.

The body of the letter must meticulously detail the debt. Clearly state the exact amount of money owed and provide a comprehensive explanation of how this debt was incurred. Include all relevant dates, such as the date the services were rendered, goods were delivered, or the loan was made. Refer to any specific agreements, invoices, contracts, or prior communications that support your claim. Attaching copies of these supporting documents is highly recommended to substantiate your demand.

Next, explicitly state your demand for payment. Specify the exact amount you are seeking and provide a clear deadline for payment, typically between seven and fourteen days from the date of the letter. Outline the acceptable methods of payment. It is crucial to inform the debtor of the consequences should they fail to meet this deadline. This might include taking legal action, pursuing the debt through a collection agency, or reporting the debt to credit bureaus, depending on the nature of the debt and your jurisdiction.

Conclude the letter with a professional closing, your signature, and your typed name. Always keep a copy of the demand letter and any enclosed documents for your records. Sending the letter via certified mail with a return receipt requested provides proof that the letter was sent and received, which can be invaluable evidence if further legal action becomes necessary. A good demand letter template for money owed considers all these details.

Essential Elements to Include

Taking the time to draft a precise and professional demand letter can significantly improve your chances of recovering money owed without the hassle and expense of court. It serves as a powerful initial step in asserting your rights and formally requesting what is due to you, establishing a clear path for resolution.

By following these guidelines and utilizing a well-structured approach, you empower yourself to address financial disputes effectively. Being proactive and organized in your communication not only increases your likelihood of success but also demonstrates your commitment to fairness and accountability in financial dealings.