Navigating the complexities of your credit report can often feel like deciphering a secret code, especially when an unexpected late payment shows up and impacts your financial standing. A single missed payment, even if it was an oversight or due to unforeseen circumstances, can unfortunately linger on your report for years, potentially lowering your credit score and making it harder to secure loans, mortgages, or even certain jobs. It is a frustrating situation, but one that is not always without a remedy.

The good news is that you don’t have to accept every negative mark on your credit report as final. There are proactive steps you can take to address inaccuracies or negotiate for the removal of certain blemishes. One of the most effective tools in your arsenal for tackling these issues is a carefully crafted letter, specifically a late payment removal letter template. This approach allows you to formally communicate with creditors and credit bureaus, providing a structured way to present your case and request a reevaluation of your payment history.

Understanding How Late Payments Impact Your Financial Health

A late payment on your credit report can have a surprisingly significant and lasting effect on your financial well-being. When you miss a payment deadline, usually by more than 30 days, your creditor will typically report this to the major credit bureaus. This negative mark then becomes part of your credit history, signaling to potential lenders that you might be a higher risk borrower. Even if it was an isolated incident and you have an otherwise stellar payment history, the presence of a late payment can cause your credit score to drop, sometimes by many points.

This drop in your credit score isn’t just about bragging rights; it has tangible consequences. A lower score can lead to higher interest rates on loans, making borrowing money more expensive in the long run. It might also influence a landlord’s decision when you apply for a rental, or an insurance company’s premium calculations. In some cases, employers even review credit reports as part of their background checks, making a clean credit history valuable in more ways than one. Understanding this impact is the first step towards realizing the importance of actively working to remove these negative entries.

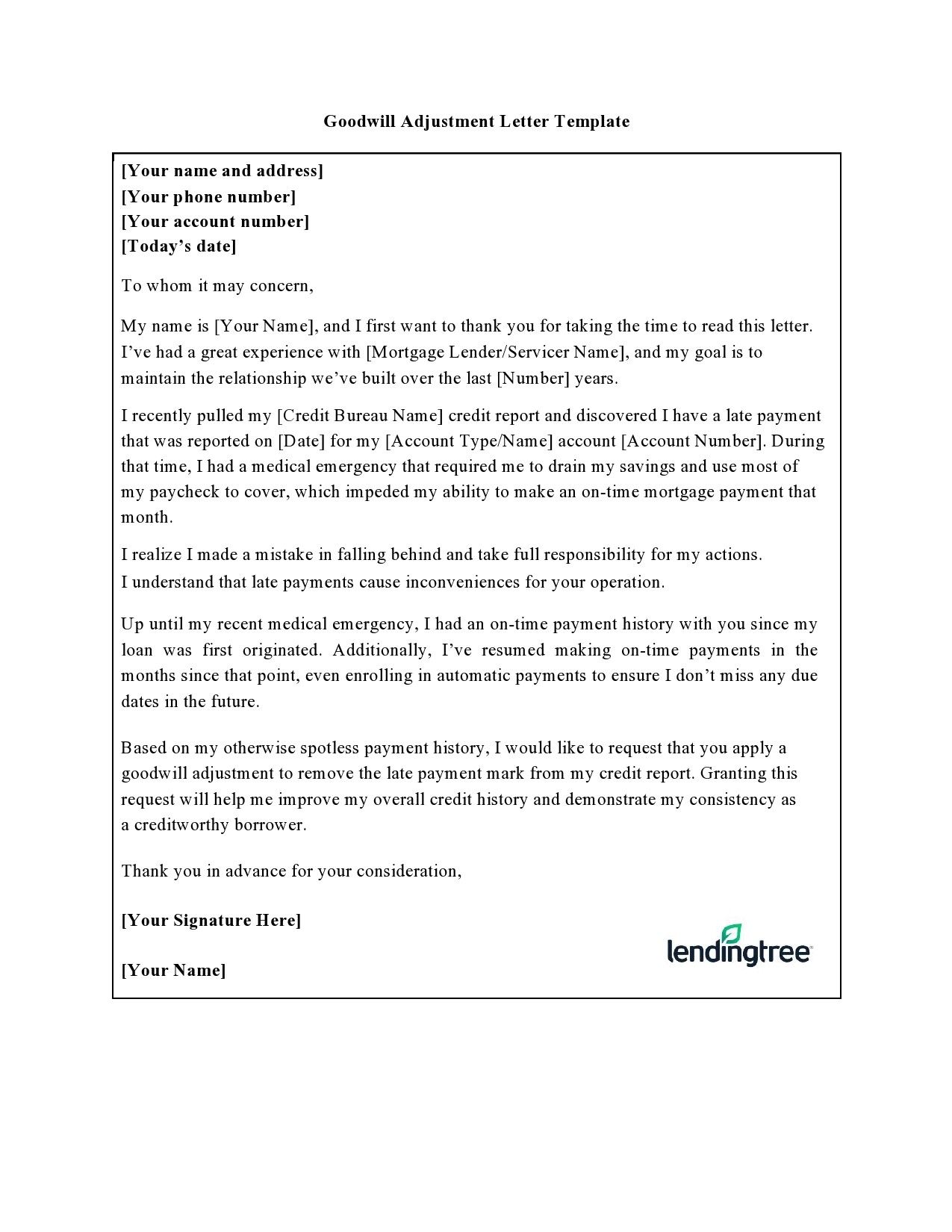

Fortunately, not all late payments are set in stone. There are various scenarios where a late payment might be disputable or eligible for removal, especially if you act promptly and professionally. Perhaps the payment was incorrectly reported, or there was a technical glitch. In other situations, you might have experienced an extenuating circumstance that led to the delay, or you could simply be requesting a “goodwill” adjustment from a creditor you’ve had a long and positive relationship with.

Addressing these issues directly with a well-composed letter demonstrates your commitment to financial responsibility and often garners a more favorable response than a quick phone call. It provides a written record of your communication and ensures all relevant details are clearly presented, setting the stage for a potential positive outcome.

When You Might Need a Late Payment Removal Letter

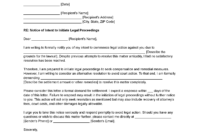

- You believe the late payment was reported in error or is inaccurate.

- You can provide proof that your payment was actually made on time but not recorded.

- This is your very first late payment, and you have an excellent payment history otherwise.

- You experienced a significant life event or financial hardship that directly led to the late payment.

- You are requesting a “goodwill” removal from a long-standing creditor with whom you have a good relationship.

Crafting Your Effective Late Payment Removal Letter

When it comes to requesting the removal of a late payment, the quality and tone of your letter can make all the difference. This isn’t just about complaining; it’s about presenting a clear, concise, and compelling case. Your letter should always be professional and polite, even if you feel frustrated by the situation. Remember, you are asking for a favor or correcting an error, and a respectful approach is much more likely to yield positive results than an aggressive one.

Start by clearly identifying yourself and the account in question. Include your full name, address, account number, and any other relevant identification that helps the creditor quickly locate your records. State the specific late payment you are referring to, including the date it occurred and the amount. Be factual and avoid emotional language, as sticking to the details makes your case stronger and easier to process.

Next, explain the reason for your request. If it’s an error, clearly state what the error is and provide any supporting documentation you might have. For instance, if you have bank statements or cancelled checks showing the payment was made on time, include copies. If you are seeking a goodwill adjustment due to an oversight or a hardship, briefly and honestly explain the circumstances. If you have a history of on-time payments, politely emphasize this point as it showcases your reliability.

Finally, clearly state what you are requesting: the removal of the late payment from your credit report. Remember to keep a copy of the letter for your records and consider sending it via certified mail with a return receipt requested. This provides proof that your letter was sent and received, which can be invaluable if further follow-up is needed. A well-constructed late payment removal letter template can streamline this process, ensuring you include all necessary information and maintain a professional tone.

Making sure your credit report accurately reflects your financial habits is a continuous process, and sometimes it requires direct action. By using a well-structured letter, you are actively participating in maintaining the health of your credit score, rather than passively waiting for issues to resolve themselves. This proactive approach can lead to successful outcomes, ultimately helping you preserve your financial reputation.

Taking the initiative to address negative items on your credit report is a smart move for anyone serious about their financial health. A clear, polite, and factual letter can often persuade creditors to reconsider a late payment entry, especially when you have a strong history or compelling circumstances. Staying vigilant about your credit report and being prepared to communicate effectively are key steps toward a healthier financial future.