Receiving a denial for an insurance claim can be incredibly frustrating and disheartening. You’ve paid your premiums, you’ve sought necessary medical care, and then you’re told that your claim won’t be covered. It’s easy to feel defeated, but it’s crucial to remember that a denial isn’t always the final word. Many initial denials can be overturned through a well-structured appeal process.

This is where a powerful appeal letter comes into play. Crafting a compelling argument requires clarity, evidence, and an understanding of what insurance companies look for. Having a solid reconsideration insurance appeal letter template at your disposal can simplify this often daunting task, guiding you to present your case effectively and significantly improve your chances of a successful outcome.

Understanding the Importance of Your Appeal Letter

Your appeal letter is much more than just a formal complaint; it is your official voice in challenging an insurance denial. It provides you with the opportunity to present new information, clarify misunderstandings, or highlight policy clauses that support your claim. Think of it as your most direct line of communication with the insurance provider, allowing you to articulate precisely why their initial decision was incorrect or needs to be re-evaluated.

Insurance claims are denied for various reasons. Perhaps the insurer deemed a service “not medically necessary,” or they lacked sufficient documentation, or maybe the treatment was considered “out-of-network.” Whatever the reason, your appeal letter is your chance to directly address these points, providing the specific facts and evidence that counter their original decision. A strong letter can transform a confusing denial into a clear path toward approval.

Key Elements Your Appeal Letter Must Include

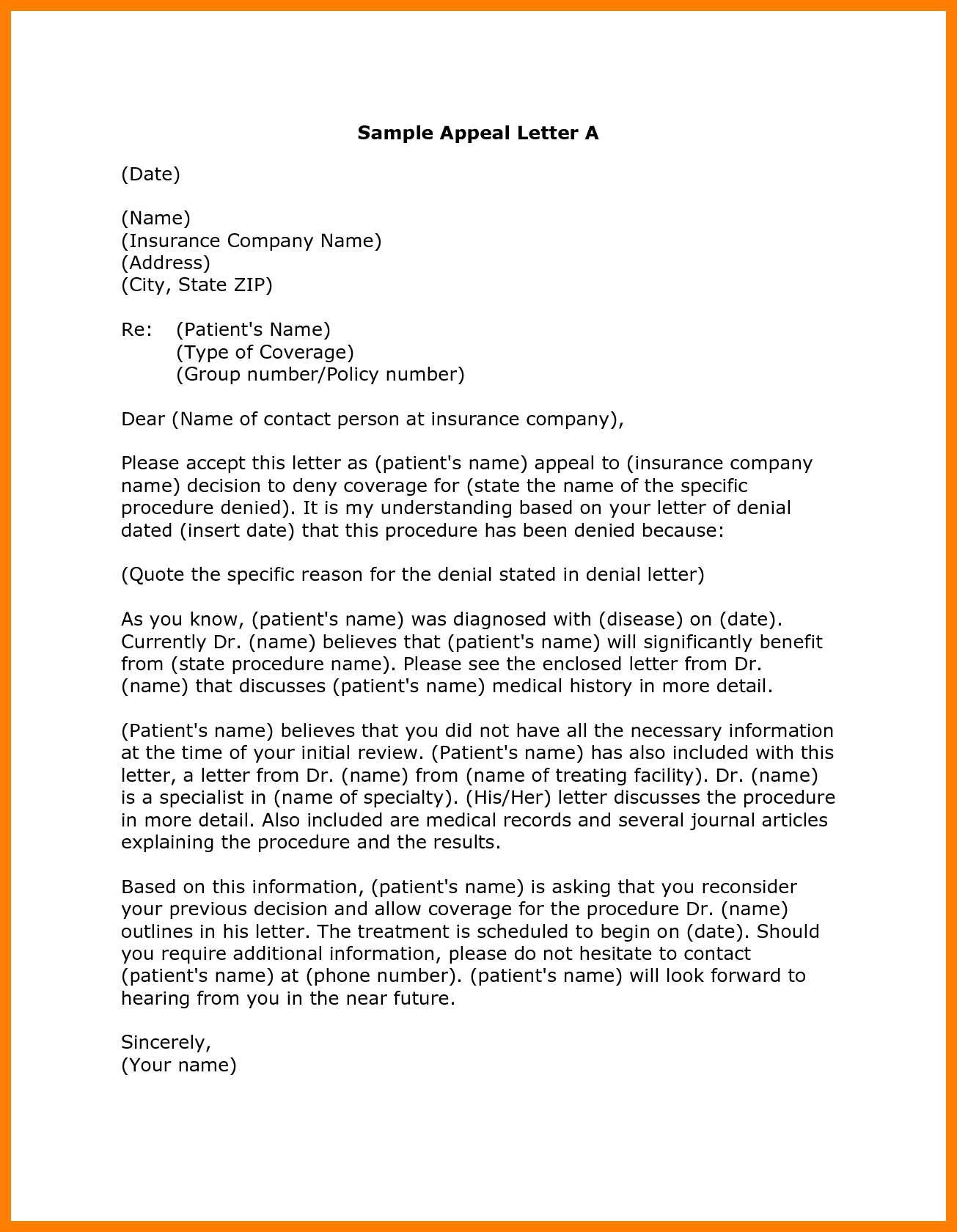

To ensure your appeal letter is as effective as possible, it must contain several critical pieces of information. This isn’t just about being polite; it’s about providing the insurance company with everything they need to process your appeal efficiently and understand your position thoroughly. Missing even one key detail could delay the reconsideration process.

Here are the essential components you should always include in your appeal letter:

- Your full name, address, and contact information.

- Your insurance policy number and the specific claim number related to the denial.

- The exact date of the denial letter you received.

- A clear and concise statement requesting a full reconsideration of the denied claim.

- Detailed, factual reasons why you believe the original decision should be reversed. This is where you present your counter-arguments.

- A list of all supporting documentation you are including (e.g., medical records, doctor’s letters, test results, policy excerpts).

- A professional closing, thanking them for their time and consideration.

Remember, the more organized, clear, and evidence-based your letter is, the stronger your case will be. Providing specific dates, names, and references to your policy can make a significant difference in how your appeal is perceived and processed.

Crafting Your Reconsideration Insurance Appeal Letter: A Step-by-Step Guide

Writing an appeal letter might seem overwhelming, but by breaking it down into manageable steps, you can create a powerful document. The first step involves thorough preparation: gathering all necessary documents, understanding the specific reasons for your denial, and familiarizing yourself with your insurance policy. This foundational work will ensure your arguments are well-informed and backed by facts.

Next, carefully review your original denial letter. What specific language did the insurance company use? Did they cite a particular policy exclusion? Understanding the exact rationale for their decision is paramount because it allows you to directly address their points in your appeal. Identify the contact person or department for appeals, and note any deadlines you need to meet. Time is often of the essence in these situations.

When you start writing the body of your letter, maintain a professional and objective tone. While frustration is understandable, emotional language can detract from the credibility of your arguments. Clearly state the service or treatment that was denied, the date of service, and why you believe it should be covered. If your doctor can provide a letter of medical necessity, this is invaluable and should be included.

To guide you in constructing your letter, consider these practical steps:

- Gather all relevant documents: This includes your original claim, the denial letter, your insurance policy, all pertinent medical records, doctor’s letters, and any prior correspondence with your insurer.

- Reference your policy: If your policy explicitly covers the denied service, cite the specific sections and page numbers.

- Explain the medical necessity: If your denial was based on a lack of medical necessity, have your healthcare provider write a detailed letter explaining why the treatment was essential for your health.

- Be concise and factual: Stick to the facts. Avoid jargon where possible, or explain it simply. Your goal is to be understood clearly and efficiently.

- Proofread meticulously: Typos or grammatical errors can unfortunately detract from your credibility. Have someone else read it over if possible.

- Keep copies: Always send your letter via certified mail with a return receipt requested. This provides proof that your letter was sent and received. Keep a complete copy of everything you send for your personal records.

By following these steps, you’re not just sending a letter; you’re building a comprehensive case. A well-constructed reconsideration insurance appeal letter template empowers you to advocate for your healthcare rights effectively, ensuring every detail supports your argument for coverage.

Navigating insurance denials can be a challenging process, but it’s important to remember that you have the right to appeal. By meticulously preparing your case, gathering all supporting documentation, and articulating your arguments clearly and professionally, you significantly enhance your chances of overturning an unfavorable decision. Don’t let an initial denial be the final word on your claim.

Your persistence and attention to detail in crafting a compelling appeal letter can make all the difference. Take the time to understand the reasons for the denial, organize your evidence, and present your case with confidence. Advocating for your healthcare coverage is a vital step in ensuring you receive the benefits you are entitled to.