Understanding your credit report is a crucial step in maintaining financial health. Sometimes, despite our best efforts, inaccuracies can appear on these reports, potentially harming your credit score and affecting your ability to secure loans, housing, or even certain jobs. It is a common misconception that these errors are permanent or difficult to fix, but taking action is often simpler than you might think.

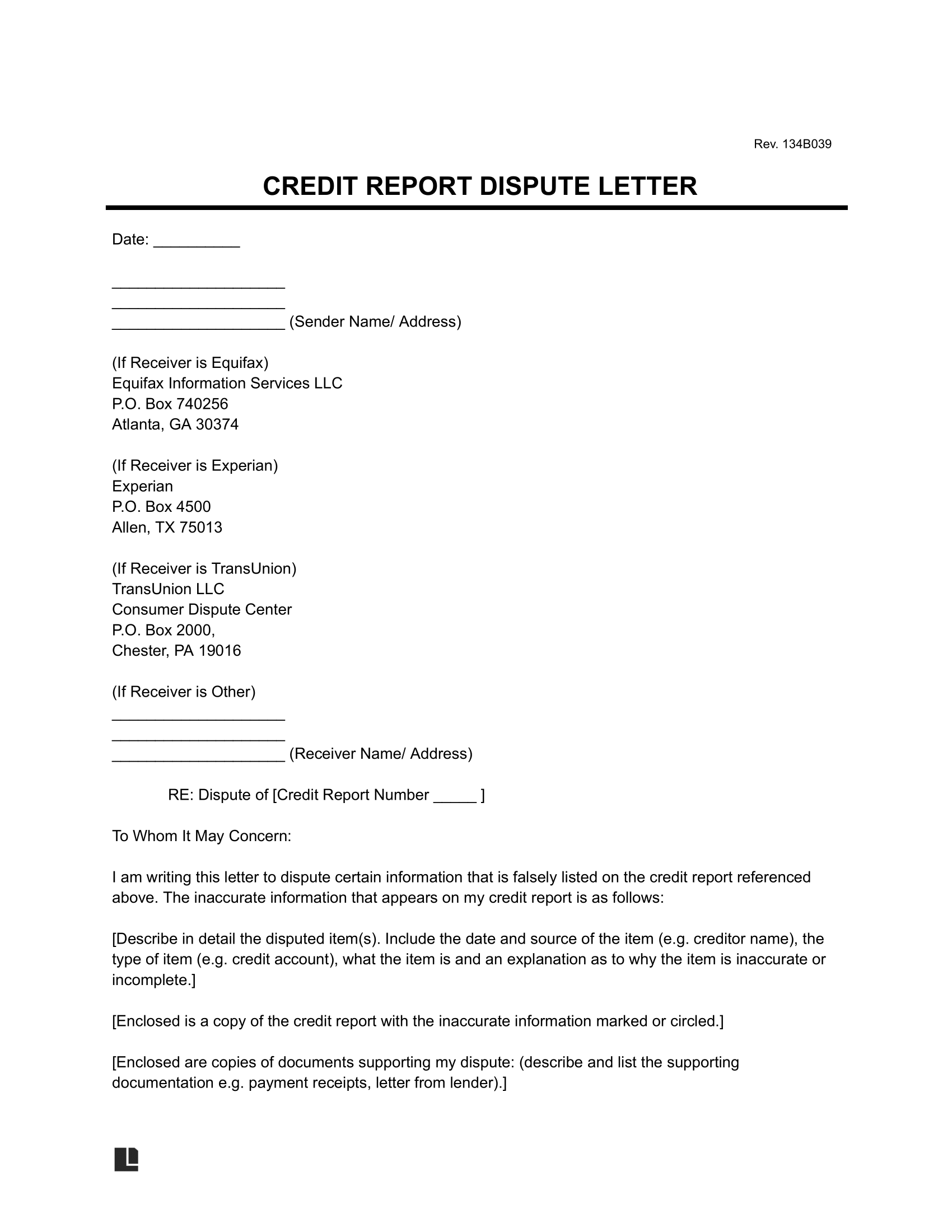

The good news is that federal law grants you the right to dispute any information on your credit report that you believe to be inaccurate or incomplete. The most effective way to initiate this process is by sending a formal letter to the credit reporting agencies. Having a reliable credit agency dispute letter template can save you time and ensure you include all the necessary information to get your dispute handled properly.

What to Include in Your Dispute Letter

When you decide to challenge an item on your credit report, your dispute letter serves as your formal communication with the credit bureaus. It is essential that this letter is clear, concise, and includes all relevant details to help the agency identify the error and begin their investigation. Think of it as presenting your case in a professional manner.

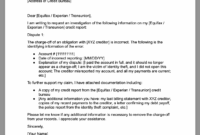

Your letter should always start with your personal identifying information. This helps the credit agency locate your file without any confusion. Make sure to use the exact name, address, and social security number that appear on your credit report. Any discrepancy could delay the process or even lead to your dispute being ignored.

Next, you need to clearly state what information you are disputing. Be specific. Do not just say “this account is wrong”; instead, provide the account name, account number, and the specific item within that account that you believe is incorrect. For example, if it is a late payment that you know you made on time, state the date of the alleged late payment.

Finally, explain why you believe the information is inaccurate and what action you want the credit agency to take, such as removing the item or correcting the date. Always include copies of any documents that support your claim, like payment receipts, bank statements, or court documents. Never send original documents; always keep them for your records. The right credit agency dispute letter template will prompt you for all these critical details.

Key Elements to Ensure Your Letter is Effective

Remember to keep a copy of the letter for your own records, along with copies of any enclosed documents. It is also wise to send your letter via certified mail with a return receipt requested. This provides proof that the credit agency received your dispute, which can be very important if you need to follow up later.

The Dispute Process Explained

Once you have sent your meticulously crafted dispute letter, the ball is then in the credit reporting agency’s court. Federal law mandates that they investigate your claim within a certain timeframe. This usually involves contacting the original creditor who reported the information to verify its accuracy. During this period, the disputed item may be temporarily removed from your credit report while the investigation is ongoing.

The credit agency typically has 30 days, or in some cases 45 days, from the date they receive your dispute to investigate and respond. They must forward all relevant information you provided to the original creditor, who is then required to investigate and report back to the credit bureau. It is during this back and forth that many errors are often identified and corrected.

After their investigation, the credit agency will send you the results in writing. If the information is found to be inaccurate or unverifiable, it must be removed from your report. If the information is verified as accurate, it will remain on your report. You also have the right to request a free copy of your updated credit report if any changes were made.

What happens if the dispute is not resolved in your favor, and you still believe the information is wrong? You are not out of options. You have the right to add a “statement of dispute” to your credit report, which explains your side of the story regarding the item. While this does not remove the item, it does provide context for anyone reviewing your report. You can also file a complaint with the Consumer Financial Protection Bureau CFPB if you feel your rights were violated.

Persistence is key when dealing with credit report disputes. It can sometimes feel like a daunting process, but with a clear understanding of your rights and the steps involved, you can effectively challenge inaccuracies and protect your financial standing.

Taking charge of your credit report is a powerful step towards financial stability and peace of mind. By actively monitoring your reports and knowing how to effectively dispute errors, you empower yourself to maintain an accurate reflection of your financial responsibility. This proactive approach not only helps your credit score but also builds a foundation for a healthier financial future.

Remember, your credit report is a dynamic document that should reflect your financial history accurately. Do not hesitate to use the tools and rights available to you to ensure it does. Regular review and timely action on any discrepancies will serve you well in the long run.