Finding an unauthorized or incorrect charge on your credit card statement can be a truly frustrating experience. It’s a moment that often sparks a mix of confusion and indignation, leaving you wondering how best to address the situation without losing valuable time or money. While calling your bank might be your first instinct, sometimes putting things in writing offers a more formal and trackable approach, especially when dealing with complex issues.

This is where a well-structured letter becomes your best friend. A clear, concise, and well-documented communication can significantly strengthen your case and ensure your concerns are taken seriously by your credit card issuer. It serves as an official record of your attempt to resolve the matter and outlines all the necessary details for a swift investigation.

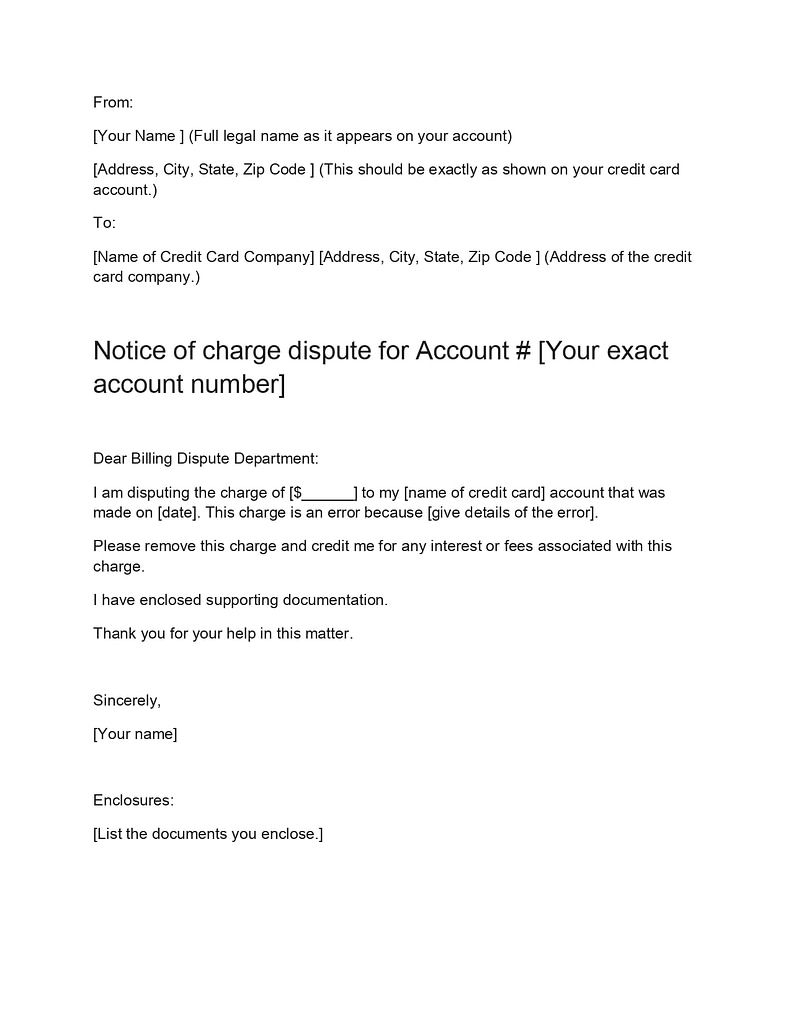

Crafting Your Effective Dispute Letter

When you’re faced with an unexpected or incorrect charge on your credit card, acting quickly and methodically is key. While many card companies allow you to initiate a dispute online or by phone, a formal written letter provides a tangible record of your communication and details, which can be invaluable as the dispute process unfolds. This method ensures all parties have a clear understanding of the issue and your desired resolution.

Your letter isn’t just a complaint; it’s a formal request for your credit card issuer to investigate a specific transaction. It needs to be professional, factual, and include all the pertinent information to help them understand the problem without any ambiguity. Think of it as presenting your case, backed by evidence, to ensure a fair review. The goal is to provide enough detail so that the issuer can easily identify the charge and begin their internal process.

A strong dispute credit card charge letter template will guide you in including every piece of information your bank or credit card company needs to process your request efficiently. It helps you stay organized and articulate your reasons clearly, minimizing back-and-forth communication and potential delays. Remember, clear communication from the start can make a big difference in the speed and success of your dispute.

Essential Sections of Your Letter

- Your Account Information: Full name, address, phone number, and credit card account number.

- Credit Card Issuer’s Information: The full name and address of your credit card company’s dispute department.

- Transaction Details: The exact date of the transaction, the amount charged, and the name of the merchant.

- Clear Explanation of the Dispute: A concise statement explaining why you are disputing the charge (e.g., unauthorized transaction, duplicate charge, services not rendered, merchandise not received).

- Supporting Documentation: Mention any evidence you are enclosing, such as receipts, order confirmations, communication with the merchant, or statements.

- Desired Resolution: Clearly state what you want to happen (e.g., credit my account for the disputed amount).

- Your Signature and Date: Always sign and date your letter.

For instance, if you’re disputing a charge because you never received the item you paid for, your letter would clearly state the item, the order date, and that despite attempts to contact the merchant, the goods have not arrived. Including copies of your order confirmation and any email correspondence with the merchant will significantly bolster your claim, providing the credit card company with a comprehensive overview of the situation. This structured approach, built around a solid dispute credit card charge letter template, ensures no critical details are overlooked.

Tips for a Successful Dispute and Follow-Up

Once your dispute letter is prepared, sending it off is just the first step. To maximize your chances of a successful resolution, there are several crucial practices you should adopt. Firstly, timing is incredibly important. Most credit card companies have a limited window, often 60 days from the statement date on which the charge appeared, for you to formally dispute a charge. Acting promptly not only adheres to these timelines but also ensures the details are fresh in your mind and makes it easier to gather any necessary evidence. Don’t procrastinate; the sooner you act, the better.

Secondly, always keep meticulous records of everything related to your dispute. This includes copies of your dispute letter, any supporting documents you send, notes from phone calls with your credit card company or the merchant (including dates, times, and names of people you spoke with), and any correspondence you receive back. Sending your letter via certified mail with a return receipt requested is highly recommended, as it provides undeniable proof that your letter was sent and received, along with the date of delivery. This paper trail is your best friend if the dispute becomes complicated or takes longer than expected.

Thirdly, while your formal letter goes to the credit card issuer, it’s often a good idea to try and resolve the issue directly with the merchant first, if possible. Sometimes, a simple error or misunderstanding can be quickly fixed with a phone call or email. Document these attempts, too, as they show your credit card company that you’ve made a good faith effort to resolve the problem before escalating it. If the merchant is unresponsive or unhelpful, then your formal dispute through the credit card company becomes even more justified.

Finally, stay vigilant and follow up. After sending your letter, monitor your credit card statements carefully. The disputed amount might appear as a temporary credit while the investigation is ongoing. If you don’t hear back within a reasonable timeframe (which your credit card company should be able to tell you), don’t hesitate to follow up. Refer to your previous correspondence and proof of mailing to inquire about the status of your dispute. Persistence, coupled with organized records, is a powerful tool in ensuring your issue is ultimately resolved in your favor.

Navigating the process of disputing a credit card charge can feel daunting, but with the right tools and a clear understanding of the steps involved, it becomes much more manageable. Taking proactive measures and maintaining a structured approach ensures that you protect your financial interests effectively.