Dealing with collection agencies can be an incredibly stressful and confusing experience. Receiving calls or letters demanding payment for a debt, especially one you might not recognize or believe is accurate, can leave anyone feeling overwhelmed and unsure of what steps to take next. It is a common situation, and knowing your rights and how to respond effectively is your strongest defense against potential inaccuracies and unfair practices.

Fortunately, you don’t have to navigate these waters alone. Equipping yourself with the right tools and information can make a significant difference in how you manage these interactions and protect your financial standing. This guide aims to empower you by providing clear insights and, crucially, a solid foundation for a dispute letter template collection agency that will help you address these challenges head-on.

Understanding Your Rights When a Collection Agency Calls

When a collection agency contacts you, it is important to remember that you have specific rights designed to protect consumers. A collection agency is typically a third-party business that buys old debts from original creditors for a fraction of their value, or is hired by creditors to collect on overdue accounts. Their primary goal is to recover as much of that debt as possible, which can sometimes lead to aggressive or misleading tactics if you are not informed.

One of the most important pieces of legislation protecting you is the Fair Debt Collection Practices Act, often referred to as the FDCPA. This federal law sets strict rules for how collection agencies can interact with consumers. It prohibits them from engaging in harassment, using abusive language, making false statements, or threatening legal action they do not intend to pursue. Understanding the FDCPA is your first step in regaining control of the situation.

Key Protections Under the FDCPA

- Prohibition of harassment, which includes repeated phone calls or threats of violence.

- Restrictions on calling times, typically only between 8:00 AM and 9:00 PM in your local time.

- Requirement to provide a debt validation notice within five days of initial contact, detailing the debt amount, the original creditor, and your right to dispute the debt.

- Prohibition of false or misleading statements about the debt or the consequences of not paying.

Crucially, the FDCPA grants you the right to dispute the debt and request validation. This means the collection agency must provide verifiable proof that you owe the debt and that they are legally entitled to collect it. They must show you evidence, not just make claims. Failing to dispute a debt you believe is inaccurate can lead to it appearing on your credit report, potentially harming your credit score and future financial opportunities. Taking action through a formal dispute is an essential part of protecting yourself.

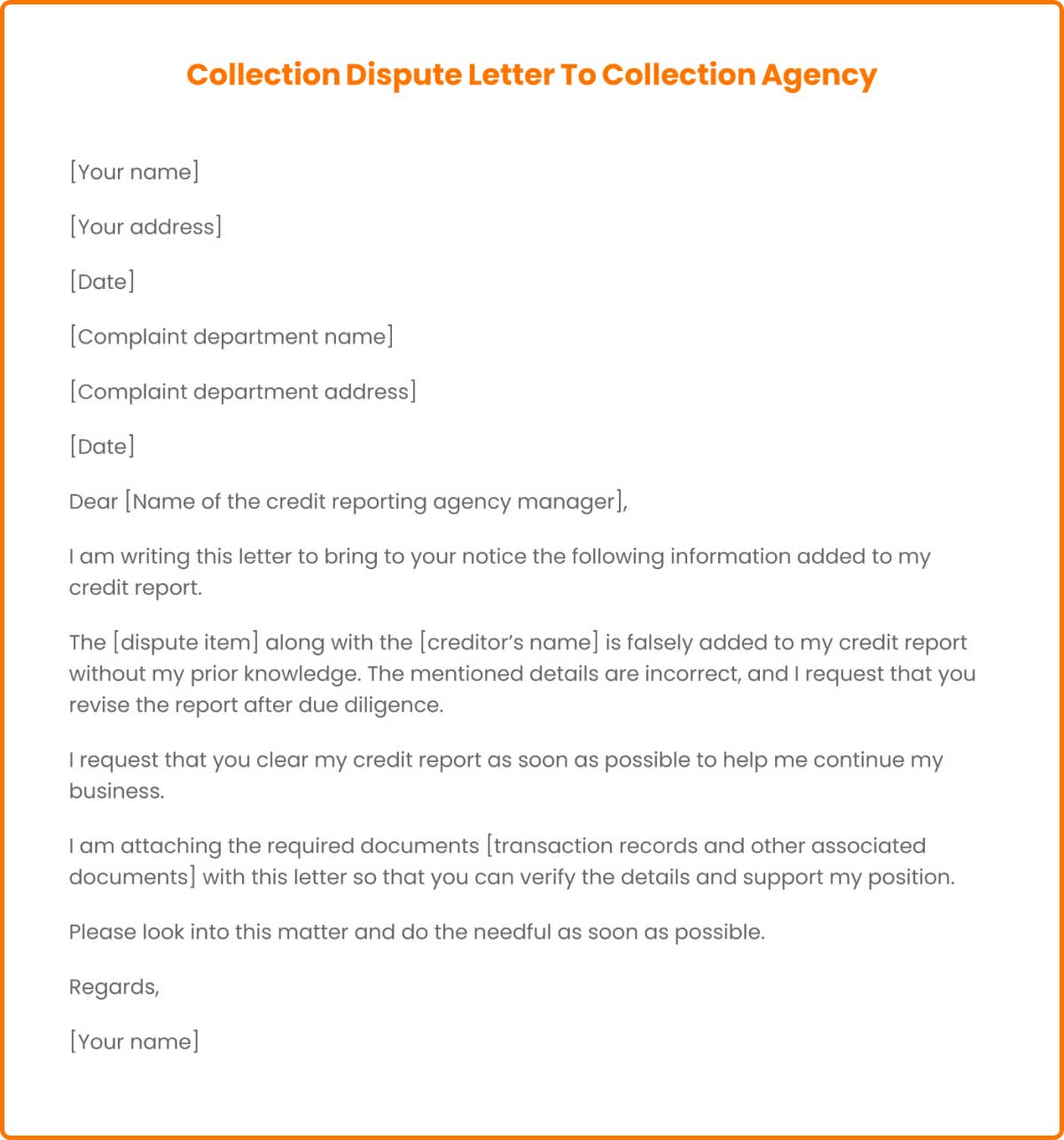

Crafting Your Effective Dispute Letter Template Collection Agency

Once you understand your rights, the next step is to put them into action, and the most effective way to do this is through a written dispute letter. While a phone call might seem quicker, written communication creates a clear, undeniable paper trail that can be invaluable if the situation escalates. It documents your actions, the agency’s response, and ensures there is no misunderstanding about your position.

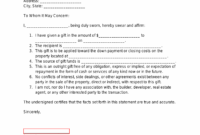

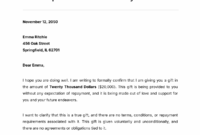

Your dispute letter does not need to be overly complicated, but it must be clear and contain specific information. Begin by including your contact details and the collection agency’s information. Clearly state that you are disputing the debt and demand validation. Request details such as the original creditor, the exact amount owed, and proof that the agency has the legal right to collect. It is also wise to include a statement that sending the letter is not an admission that you owe the debt.

When composing your dispute letter template collection agency, consider the following essential elements:

- Your full name and current address.

- The collection agency’s name and address.

- The account number the agency provided (if any).

- A clear statement: “I am disputing this debt.”

- A request for debt validation, asking for specific documentation.

- A request for the agency to cease all collection activities until validation is provided.

- The date and your signature.

Sending your letter via certified mail with a return receipt requested is paramount. This provides official proof that you sent the letter and that the collection agency received it. Once they receive your dispute letter, the agency is legally required to cease collection activities until they provide the requested validation. You typically have 30 days from their initial contact to send this dispute letter, so acting promptly is in your best interest. If they fail to provide validation or continue collection attempts after receiving your letter, you have stronger grounds to report them to regulatory bodies or seek legal counsel.

Navigating the complexities of debt collection can feel daunting, but by understanding your rights and utilizing effective tools like a well-crafted dispute letter, you can assert control over the situation. This proactive approach helps protect your credit report from inaccuracies and ensures that collection agencies adhere to legal standards.

Taking the time to prepare and send a formal dispute letter can save you significant headaches and financial distress in the long run. Empowering yourself with knowledge and the right communication strategy is key to safeguarding your financial well-being and resolving debt collection issues fairly and accurately.