Buying a home is often one of the most exciting and significant milestones in life. As you envision new beginnings and personal spaces, the hurdle of the down payment can sometimes feel daunting. Many aspiring homeowners are fortunate enough to receive financial assistance from family or close friends, helping them bridge the gap and make their dream home a reality.

While a generous gift is a wonderful boost, lenders require proper documentation to ensure transparency and compliance. This is where a down payment gift letter becomes essential – it’s a formal declaration that the funds are indeed a gift and not a loan that needs to be repaid, which would impact your debt-to-income ratio.

Why You Need a Down Payment Gift Letter

Lenders have strict guidelines when it comes to the source of funds for your down payment. They need to verify that all the money you’re using is legitimate and doesn’t create any undisclosed liabilities. A gift letter serves several crucial purposes: it helps prevent money laundering, confirms the gift is not a hidden loan, and ensures that the lender has a clear understanding of your financial standing before approving your mortgage. Without this documentation, even a well-intentioned gift could delay or even jeopardize your loan approval.

The implications for both the borrower and the lender are significant. For you, the borrower, it means clearly demonstrating that a portion of your down payment comes without a repayment obligation, thus not adding to your monthly debt. For the lender, it’s about mitigating risk and adhering to regulatory standards, ensuring that their investment is sound and that you are genuinely capable of repaying the mortgage based on the disclosed financial information.

Generally, gifts for a down payment can come from close relatives, such as parents, grandparents, siblings, or spouses. Sometimes, depending on the loan program, even a domestic partner or a fiancé/fiancée might be an acceptable donor. However, it’s rare for a lender to accept a gift from someone with no familial connection, as this raises more questions about the nature of the transaction. Always confirm with your loan officer who is an eligible gift donor for your specific loan type.

Different loan programs also have varying rules regarding gift funds. For instance, FHA loans are quite flexible, allowing gifts from approved sources for the entire down payment. Conventional loans, on the other hand, often require a portion of the down payment to come from the borrower’s own funds, though the exact percentage can vary. VA loans and USDA loans typically don’t require a down payment at all, making gift letters less common but still relevant if additional funds are gifted for closing costs. It’s vital to discuss these specifics with your mortgage lender early in the process.

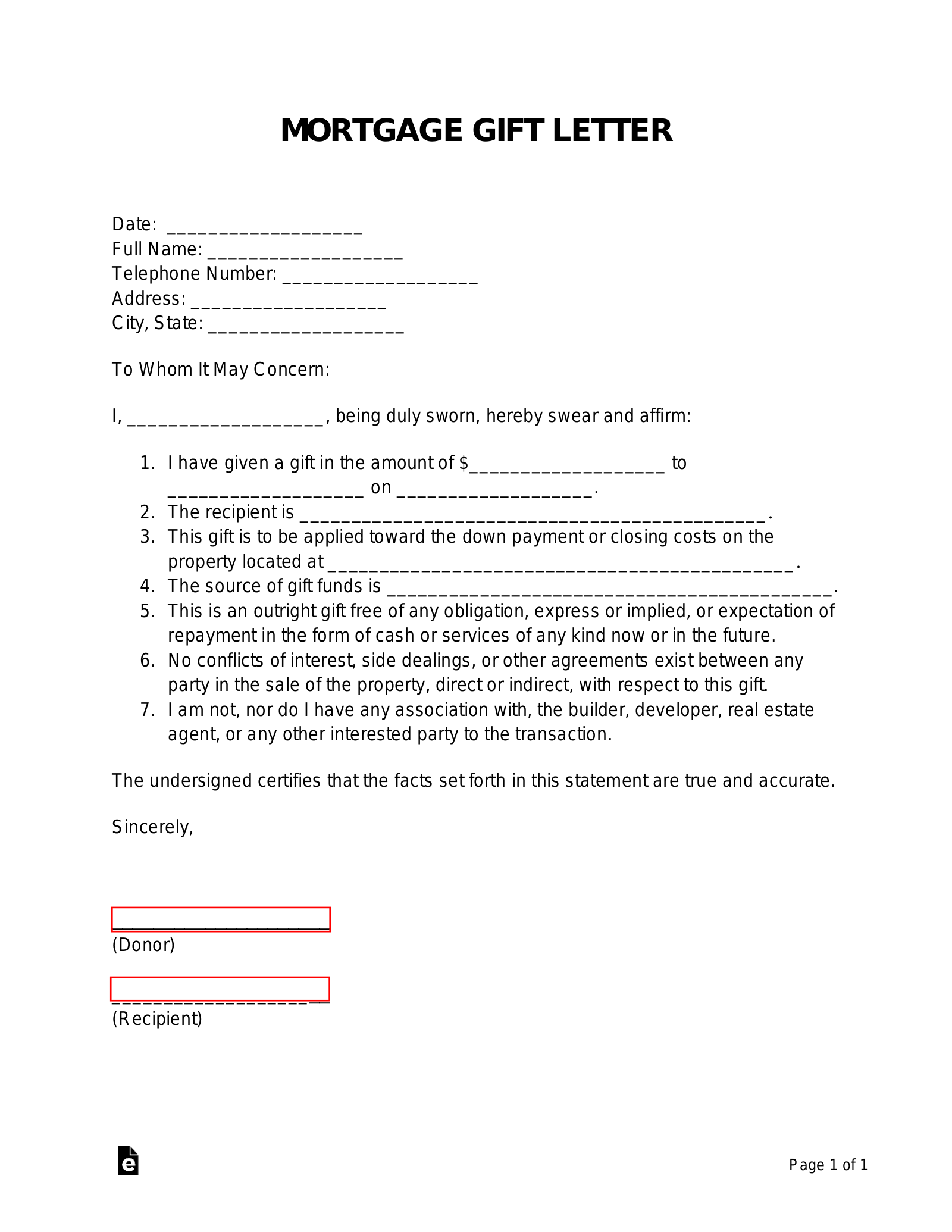

Key Information to Include in Your Gift Letter

- Donor’s full name, address, and contact information.

- Recipient’s full name, address, and contact information.

- The exact monetary amount of the gift.

- A clear statement affirming that the funds are a gift and no repayment is expected or implied.

- The relationship between the donor and the recipient (e.g., “Parent of the borrower”).

- The property address where the gifted funds will be used for the down payment.

- The date the letter is written.

- Signatures of both the donor(s) and the recipient(s).

- Sometimes, lenders may also require bank statements from the donor to show proof of funds and that the money has been seasoned (in their account for a certain period).

Tips for a Smooth Gift Letter Process

Creating a clear and comprehensive down payment gift letter is crucial for a seamless mortgage application. Starting with a reliable down payment gift letter template can save you a lot of time and ensure you include all the necessary details required by lenders. This template acts as a foundational guide, helping both the donor and recipient understand what information is expected and how to present it formally. The key is to be precise and avoid any ambiguities that could raise questions later.

Timing is another critical aspect. It’s always best to prepare and submit your gift letter as early in the mortgage process as possible. This gives your lender ample time to review the document, ask any follow-up questions, and integrate it into your overall loan application without causing delays. Waiting until the last minute can create unnecessary stress and potentially push back your closing date, so proactive communication with your loan officer is highly recommended.

Beyond the letter itself, lenders often require documentation to verify the transfer of funds. This typically includes bank statements from the donor, showing that they possessed the gifted amount prior to the transfer, and then a record of the actual transfer to the recipient’s account. This paper trail is essential for the lender to confirm the legality and legitimate source of the funds, ensuring there are no hidden loans or suspicious transactions involved.

Be mindful of gift tax implications, though this is primarily the donor’s responsibility. While the gift letter itself doesn’t directly deal with taxes, understanding that there are annual and lifetime gift tax exclusions can be important. Large gifts exceeding the annual exclusion amount may need to be reported to the IRS by the donor. It’s always wise for the donor to consult with a tax professional if they have concerns about the tax implications of their generous contribution.

When embarking on the journey to homeownership with the help of a gift, a well-executed down payment gift letter is more than just a formality; it’s a vital piece of the puzzle. By using a solid down payment gift letter template and following these guidelines, you can ensure a smooth process for both you and your generous gift-giver. It helps clarify the intent of the funds, satisfies lender requirements, and ultimately moves you closer to getting those keys in your hand.

With proper documentation and clear communication, the process of using gifted funds for your down payment can be straightforward and stress-free. This careful preparation is a small but important step toward achieving your dream of owning a home, laying a solid foundation for your financial future and ensuring your mortgage application proceeds without a hitch.