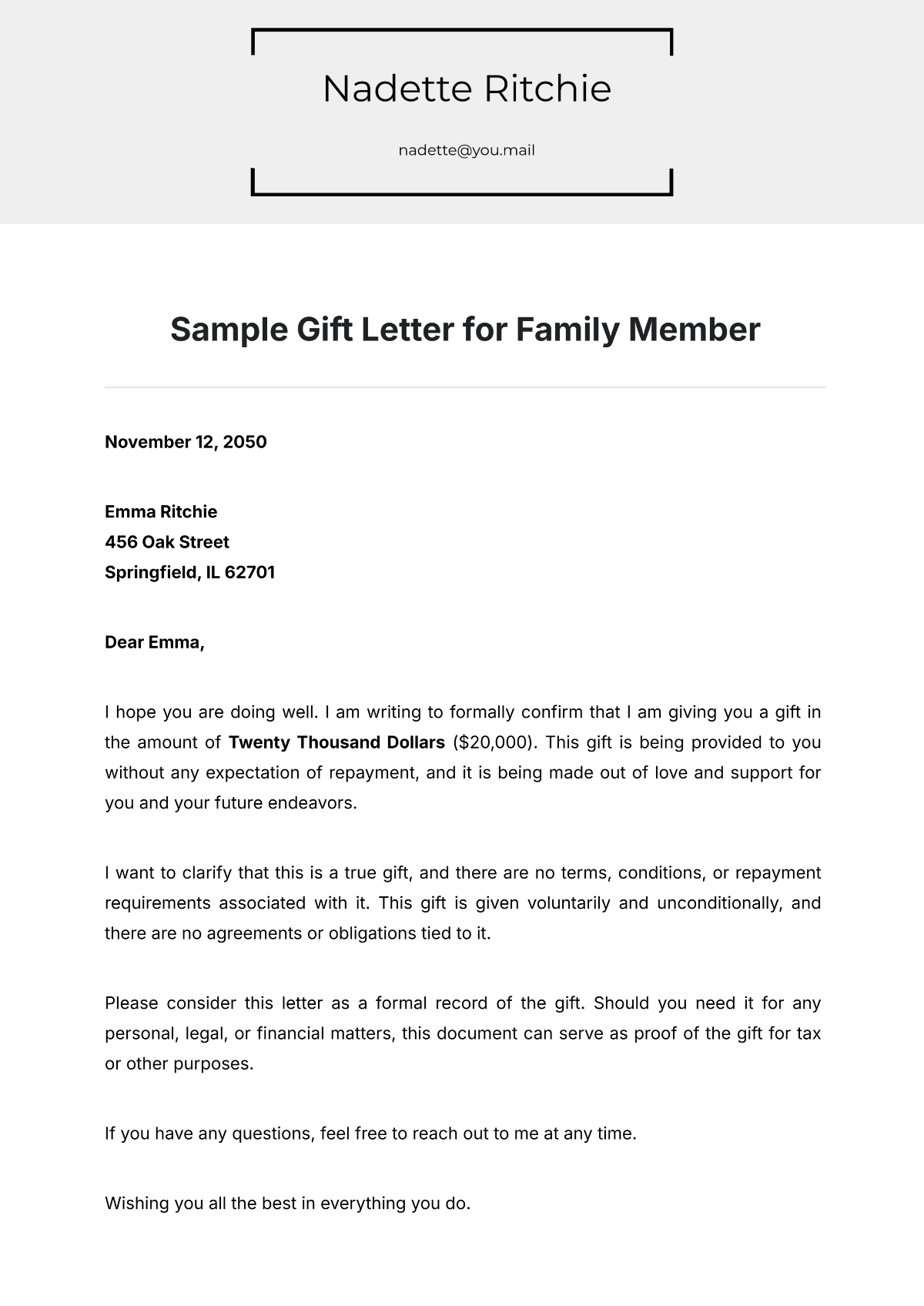

Giving a financial gift to a loved one is a truly generous act, often driven by a desire to help them achieve a significant life goal, like buying a home, paying for education, or navigating a new chapter. While the sentiment is pure and heartfelt, sometimes these wonderful gestures need a little formal touch to ensure everything goes smoothly, especially when financial institutions, government agencies, or even tax implications are involved. That’s where a gift letter comes in – it’s your way of clearly documenting your kindness.

Navigating the nuances of financial gifting can feel a bit daunting. You want to provide support without inadvertently creating future complications for your family member. This is why having a clear, concise document that outlines the nature of the gift is so important. It helps prevent misunderstandings, provides necessary documentation for various official processes, and brings a sense of security to both the giver and the recipient. Think of a reliable family member gift letter template as your straightforward guide to formalizing these thoughtful exchanges.

Why a Gift Letter is More Than Just a Nice Gesture

When you give a substantial financial gift, especially one intended for a major purchase or an official application, it’s about more than just handing over money. Without proper documentation, what you intend as a gift could be misconstrued as a loan by external parties, or even lead to confusion within the family down the road. A gift letter explicitly states your intention, safeguarding everyone involved and ensuring your generosity serves its intended purpose without any unexpected hitches.

Consider scenarios like applying for a mortgage. Lenders scrutinize every penny that goes into a down payment. If a significant portion comes from a family member, they will almost certainly require a gift letter to verify that these funds are indeed a gift and not a loan that could impact the borrower’s debt-to-income ratio. This isn’t just a formality; it’s a critical piece of the puzzle that allows your family member to secure the financing they need.

The distinction between a gift and a loan is also vital for tax purposes. While most gifts between family members fall within annual exclusion limits and don’t trigger immediate tax implications for the recipient, documenting it as a gift prevents any future questions from tax authorities. It provides a clear audit trail, offering peace of mind to both the giver and the recipient that all financial transactions are transparent and accounted for correctly.

Ultimately, a gift letter is a powerful tool for clarity and peace of mind. It removes ambiguity, provides legal and financial assurance, and ensures that your act of generosity is fully understood and correctly processed by all relevant parties. It’s a small step that brings significant benefits in protecting your family’s financial well-being and ensuring your gift is recognized for what it truly is: an unconditional contribution.

Key Elements to Include in Your Gift Letter

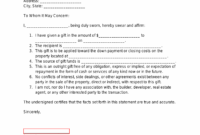

- Giver’s full legal name, current address, and contact information.

- Recipient’s full legal name, current address, and contact information.

- A clear, unequivocal statement that the funds are an unconditional gift and no repayment is expected or implied.

- The exact amount of the gift, stated in both numerical and written form (e.g., “$10,000.00 – Ten Thousand Dollars and Zero Cents”).

- The specific purpose of the gift, if applicable (e.g., “for the down payment on a property located at [Property Address]”).

- A statement confirming that the gift is not a loan and there is no expectation of repayment, either now or in the future.

- The date the letter is written and signed.

- The signatures of all gift givers and recipients, often along with printed names for clarity.

- In some cases, especially for real estate transactions, a statement from the giver confirming the source of funds and solvency.

Common Scenarios Where a Gift Letter Shines

One of the most frequent reasons a gift letter becomes indispensable is during the home-buying process. Many first-time homebuyers rely on financial assistance from family members for their down payment or closing costs. Mortgage lenders strictly require a gift letter in these situations to confirm that the funds are not a disguised loan. This documentation assures them that the borrower’s ability to repay their mortgage will not be encumbered by additional debt to a family member, making the loan application process much smoother.

Beyond real estate, gift letters play a crucial role in immigration. If an individual is applying for a visa or green card and needs to demonstrate financial support, a gift letter from a family member can serve as official proof of available funds. This shows immigration authorities that the applicant has the necessary financial backing to support themselves or their family, preventing them from becoming a public charge. The letter makes it clear that the funds are a non-repayable contribution.

Educational expenses are another area where a gift letter can be incredibly useful. While not always legally mandated by institutions, providing a gift letter for a substantial contribution towards tuition or living expenses can help clarify the source of funds, especially if the recipient is applying for financial aid or scholarships. It distinguishes the money from earned income or a loan, ensuring proper classification and potentially affecting eligibility for other forms of assistance.

Even for smaller, but still significant, family gifts, like helping with a car purchase or medical bills, a gift letter can provide invaluable clarity. It serves as a clear record for everyone involved, preventing any future misunderstandings about whether the money was a gift or a loan to be repaid. This proactive step helps maintain harmony and transparency within family finances, reinforcing the generous spirit of the contribution.

Understanding the importance of formally documenting financial gifts to family members is a crucial step in ensuring that generosity brings only positive outcomes. Whether it’s for a down payment, educational costs, or simply to provide a safety net, a well-crafted gift letter protects both the giver and the recipient. It simplifies complex processes, avoids legal ambiguities, and maintains crystal-clear communication about financial intentions.

Embracing the use of a reliable family member gift letter template isn’t about being overly formal or mistrusting, but about being responsible and thoughtful. It’s about protecting your loved ones and your generous gesture from potential headaches down the line, ensuring that the act of giving remains a joyful and beneficial experience for all involved. This small effort upfront can prevent significant complications and provide lasting peace of mind.